Involve White Paper 2021 looks into the full-year trend and performance of our Advertisers and Partners.

We break down into key sections based on clicks, sales and conversions – product categories based on audiences’ online purchasing behaviour, double-date sales, and top-performing Partners – based on the strategies we have implemented in 2021.

With strategies implemented in 2021, Involve made it easier for new Partners to sign up and start promoting and also localised the platform in multiple countries.

Early & Express Withdrawal allowed Partners to get a portion of their paid conversions within 15 days from the day of conversion before they are validated by Advertisers.

Our data shows that specific categories and campaigns, including double-date sales, contributed over 2 Billion clicks & 20 Million conversions and drove more than USD7.4 Billion in total sales in Malaysia, Indonesia, the Philippines, Thailand, Singapore and other countries.

Home & Living, Health & Beauty, Groceries & Pets, Women’s Fashion and Electronics were the top 5 categories that drove the most sales and conversions during off-peak sales and peak double-digit sales in 2021.

Double-digit sales during Q3 & Q4 2021 boosted high performance in terms of clicks, sales and Partners’ participation.

Ad networks, content creators, influencers and loyalty networks increased the total of conversions and sales in 2021. They actively promoted Marketplace (Home & Living, Health & Beauty, Groceries & Pets and Electronics), Fashion, Health & Beauty, and Services brands.

Click on the following drop-down bars to view more in each section of this report.

Introduction

COVID-19 pandemic put us in isolation at home and affected brick-and-mortar stores’ businesses. Some people were working from home while others have lost their jobs due to unprecedented times.

However, these events provided pivotal opportunities for both businesses and individuals as they turned to technology that breaks down barriers and connects with people in digital space.

Since 2020, we saw a build-up in the affiliate marketing industry in Southeast Asia – Advertisers (such as brands and marketplaces) focus on e-commerce and digital platforms to drive sales while Partners (including content creators and KOLs) earn money online via affiliate marketing as their source of side income.

Here’s what we learned throughout 2021:

The Rise of Micro-Influencers

Micro-influencers continued to craft great quality niche content, inspired by their specialised industry knowledge, that garnered audience traffic and engagement in blogs, websites and social media platforms.

- An influencer marketing firm, r3, shared that the influencer marketing industry was worth $638 million. They foresee that, by 2024, the value was increased 4x to almost $2.59 billion.

- In 2020, 482 million Southeast Asians were using social media. Influencers were the most frequent social media users to share their content and communicate with their audience.

Engaging content that benefited audiences’ needs persuaded them to click on their affiliate links and make purchases at Advertisers’ designated e-commerce landing pages, leading to high conversion rates and boosting brands’ awareness and sales growth.

Micro-influencers were making full use of the new features that are popping up on social media platforms (such as Instagram Reels). It helped them to discover trending topics and popular brands that inspire them to craft their next engaging content. They also repurposed their content on different social media platforms to expand their reach and drive engagement.

Long-term Trust & Loyalty

Partners’ audiences came back to their social media platforms and websites because they provided their authentic voice in thoughts and experiences with products and services.

The continuous engagement with Partners’ content built a strong rapport that audiences could rely on when they were looking for beneficial solutions.

Sharing affiliate links on their content consistently were beneficial for continuous traffic from influencers that increased sales & conversions and promote their own channels & Advertisers’ brand.

Advertisers connected and managed specific Partners by quality more than quantity that meet each other’s affiliate marketing goals.

Having a better understanding of what they could bring to the table will grow and maintain their long-term relationship.

Advanced SaaS Technology in Affiliate Marketing Ecosystem

Involve Asia provided seamless solutions for Advertisers and Partners that help them implement better strategies in affiliate marketing.

With our latest technology, Advertisers found new Partners across Southeast Asia that enabled them to localise their strategy in implementing campaigns. Device, platform and sales reports were just a few core metrics that are available for our Advertisers to analyse.

Features available in one platform enabled Advertisers to share marketing assets for campaigns, track affiliate sales made on their websites, and manage commissions to be given to Partners.

We also provided insights for Advertisers and Partners so they can optimise their affiliate marketing strategy and drive sales & conversions, such as their overall performance & conversions and Consumer Insights.

Online Shopping is Here to Stay

The dramatic shift in e-commerce resulted in this evolution during COVID-19 and it transformed the way of retail into a new age.

According to Bain & Company, in 2015, they reported that 100 million users in Southeast Asia shopped online. Around 310 million users browse through e-commerce platforms in 2020 followed by a rapid increase to 350 million users in 2021.

Advertisers continued to boost their brand awareness on the lower level, such as affiliate marketing, without having to spend high budgets on search engine optimisation and media.

The high traffic to online stores during the pandemic drove sales and return of investment due to customers’ active online shopping habits.

Most customers shopped for popular items and great deals online without hesitation. They were constantly looking for information and recommendations at online stores and content made by influencers and content creators.

This opened great opportunities for small and medium enterprises (SMEs) to set up their stores online at frequently visited websites and online marketplaces like Shopee and Lazada. Our Marketplace Affiliate Program (MAP) enabled these SMEs to set up their own Affiliate Programs at Involve. Catering to their needs of brand introduction, brand engagement, sponsorships and Partnerships in one convenient place.

Localisation & Diversification for Content and Connections

Localisation provided detailed canvases about the niche audiences’ culture, norms and expectations. It helped to build bridges with the newer audiences from different populations.

Advertisers established affiliate partnerships with trusted voices and specific customer demographics drives better reach and leads to sales and conversions.

To overcome uncertainty, Advertisers and Partners had to diversify their products and services to counter increased competition in the industry.

It provided better opportunities for open communication with various parties and strengthens the affiliate community.

2021 Key Stats

We looked into our data by clicks to determine how effective Partners’ audiences click on their affiliate links that will lead to generating sales on Advertisers’ websites.

Total Sales and Clicks

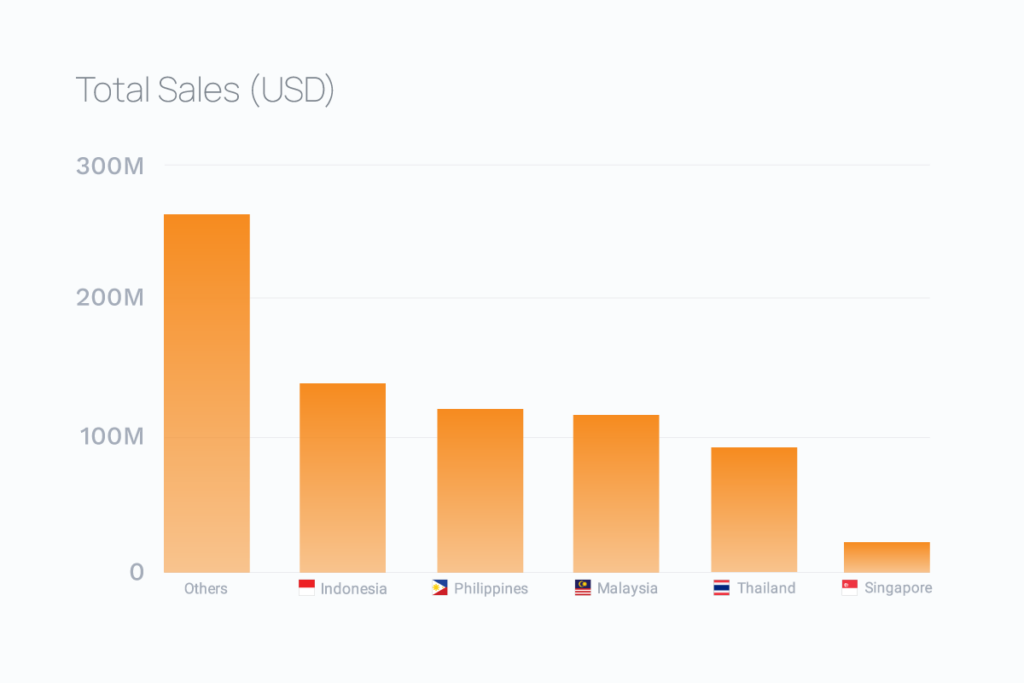

More than 2 billion clicks were sent to Advertisers in 2021. 72% of Click traffic were for Advertisers primarily in SEA with a focus on Malaysia, Philippines, Indonesia, Thailand and Singapore.

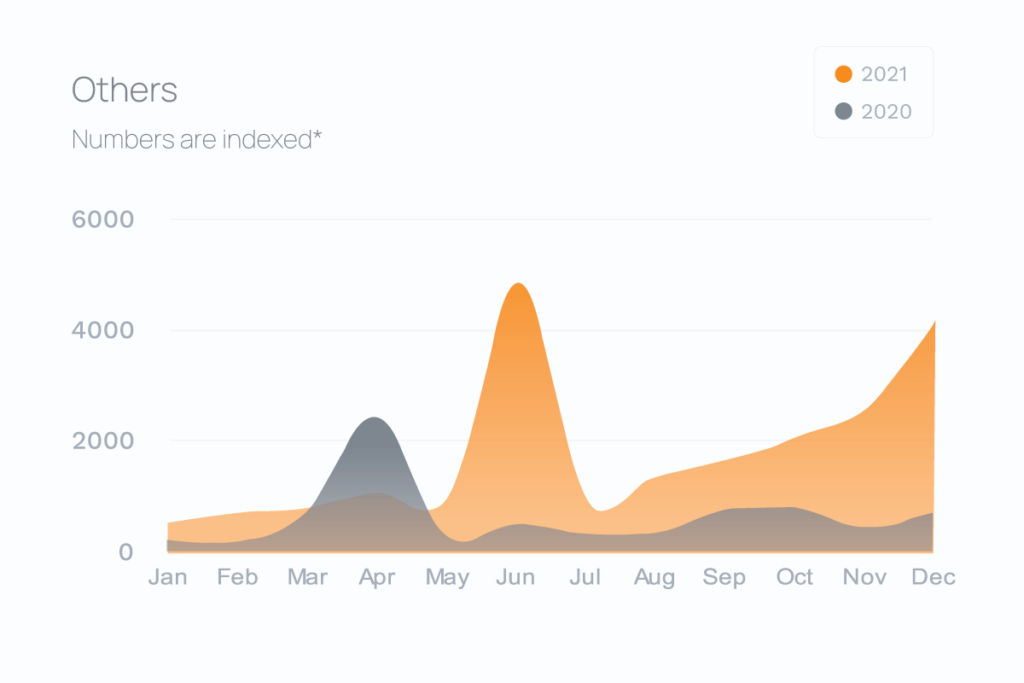

Further breakdown of Click countries included a mix from APAC, Europe and America, with Partners registered in these countries. These may include Partners registered in a country that is different from their promotional country (e.g. registered in Australia, but promoting in the Philippines).

- 2021 saw a total of USD $750 million GMV (Gross Merchandise Value) generated for our Advertisers

- 65% of GMV was made in South-East Asia, with a focus on Malaysia, the Philippines, Indonesia, Thailand and Singapore

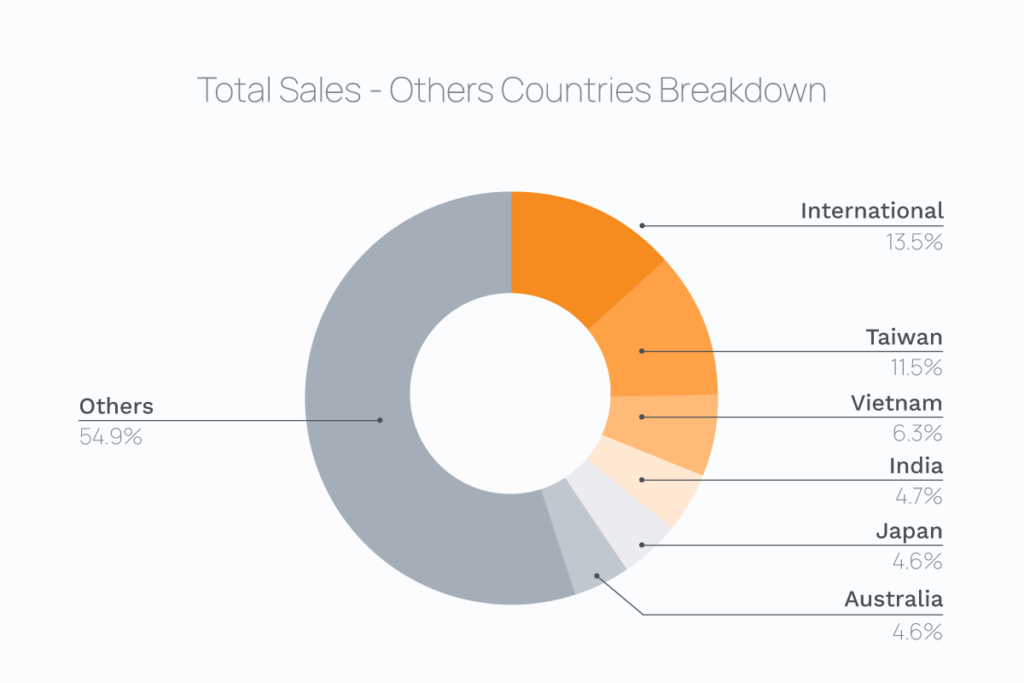

- GMV in ‘Others’ countries saw 13.5% made internationally, as certain Offers accepted Global traffic

- Countries in APAC (Asia Pacific) made up the majority of Sales made in ‘Others’ countries, with Taiwan, Vietnam, India, Japan, Australia, China and Hong Kong contributing to more than 20% of GMV in ‘Others’

- The remaining 80% of GMV in ‘Others’ countries was a mix from APAC, Europe, UAE and America

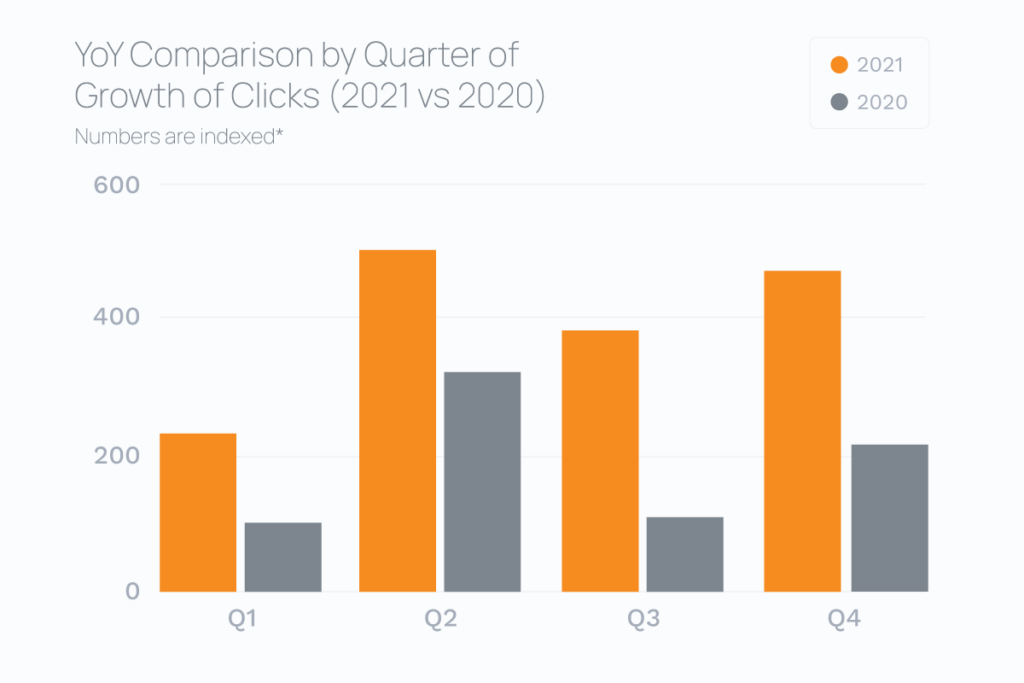

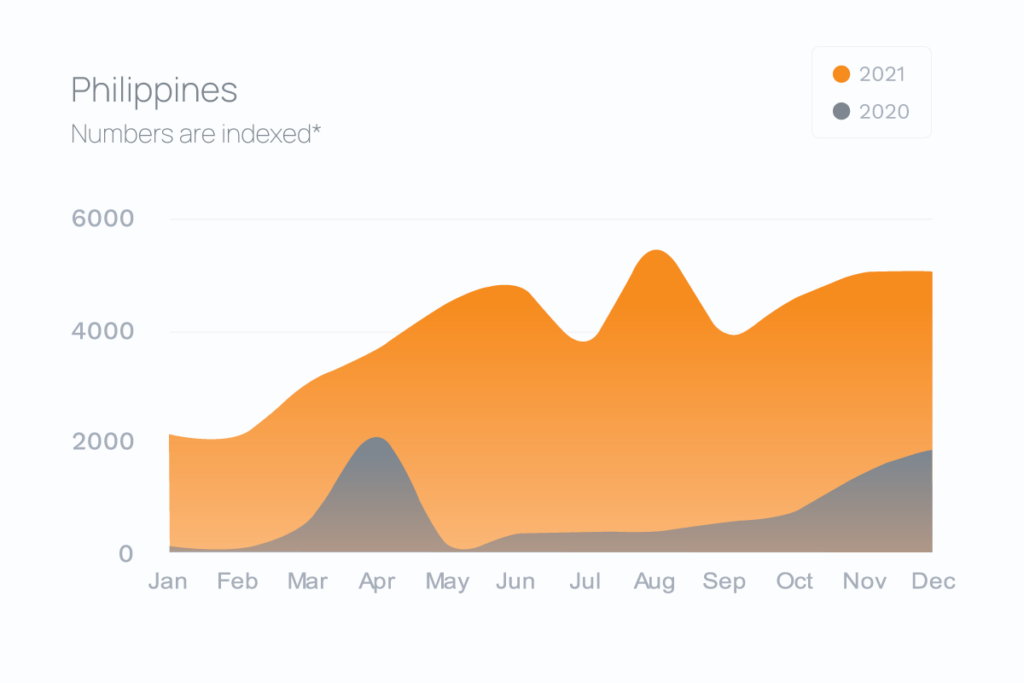

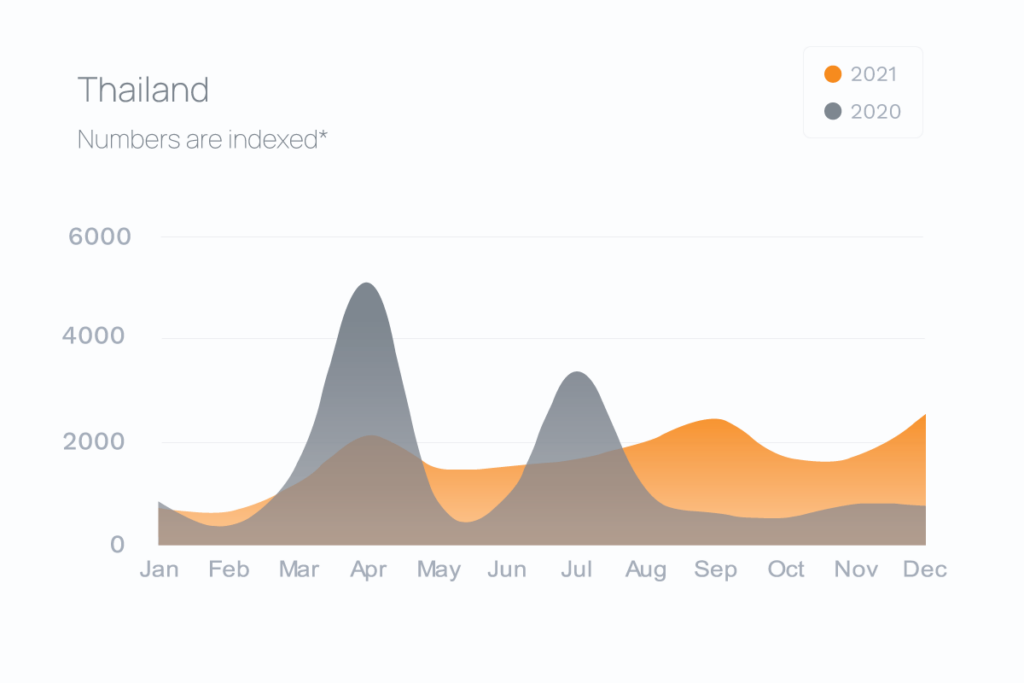

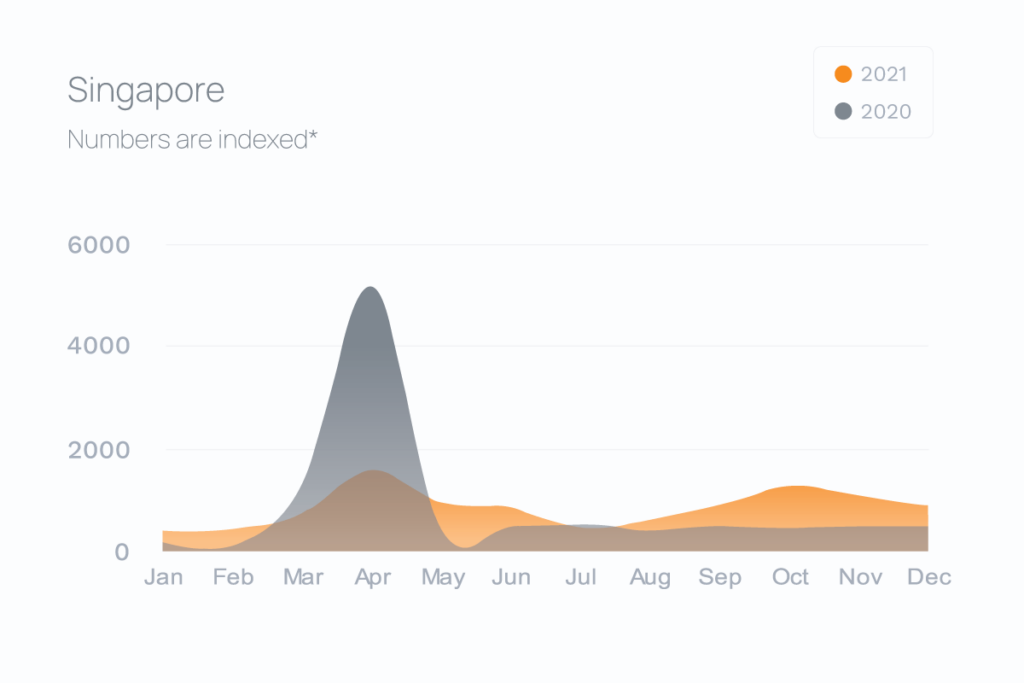

Growth of Clicks in 2021

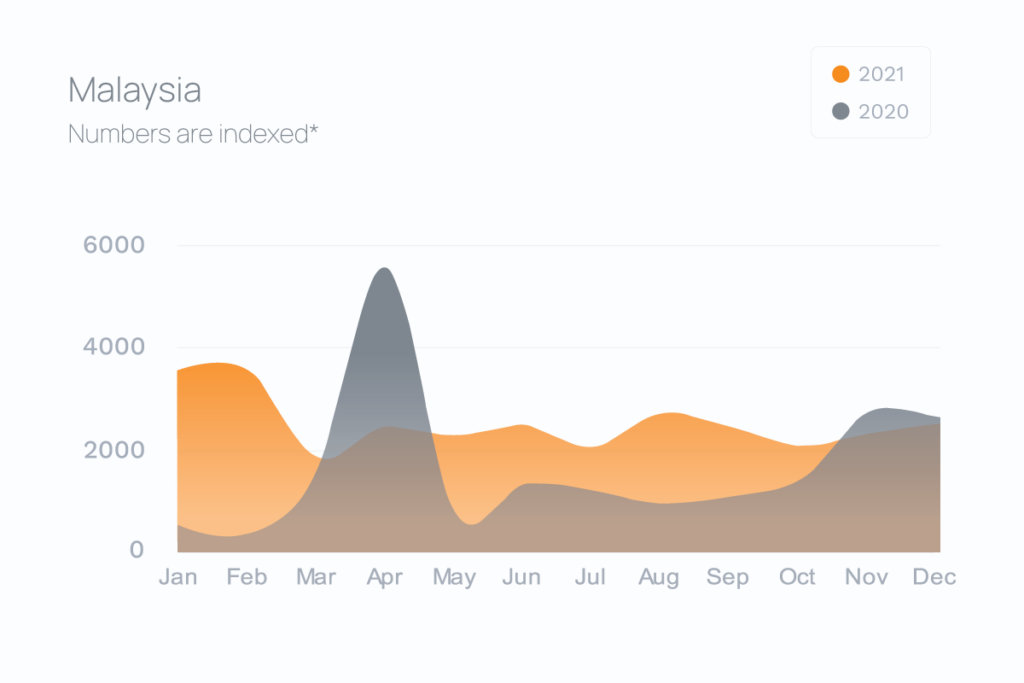

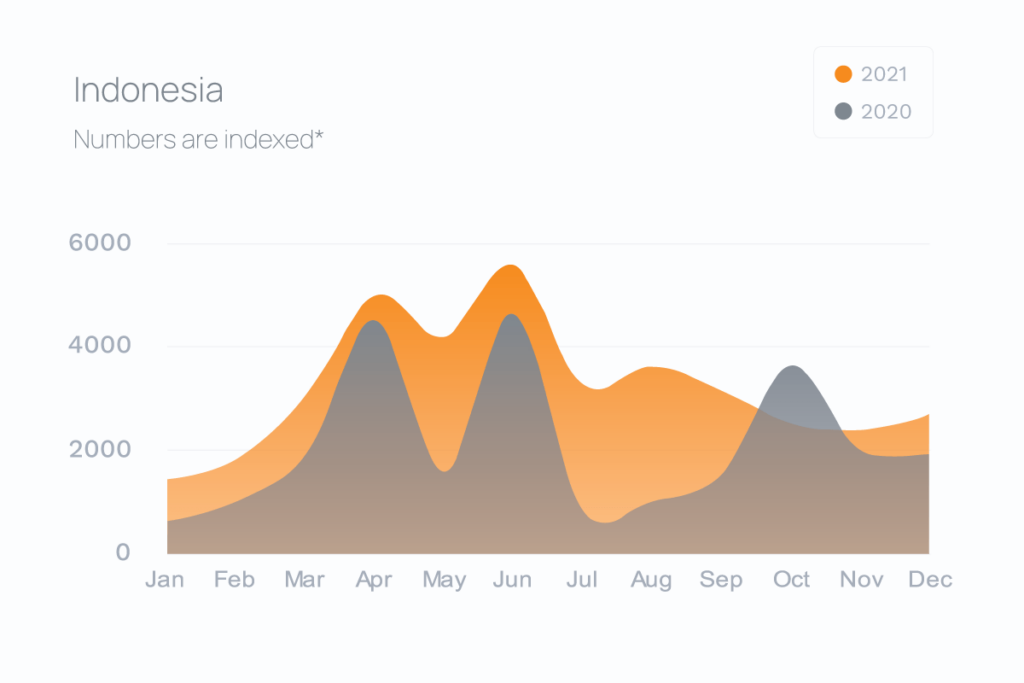

The peaks at specific months happened due to key events and campaigns (such as double-date sales) run by Advertisers and promoted by Partners.

- Total Clicks doubled in 2021 from 2020

- 9 out of 12 months of the year had a double increase in Click performance. Only April saw a slight drop in Click performance by 24%.

- Each country showed an upward trend towards the end of the year for extra promotions of end of year sales

Category Performance

Using its own technologies Involve successfully captured the overall achievements of its Partners, based on the overview of total conversions made by Involve’s Partners and pattern of consumer online purchasing behaviour in five different regions of Southeast Asia, top-performing categories and offers for the whole year of 2021.

20 Million conversions were registered on Involve’s platform, including the double-digit sale starting from April 2021 to December 2021.

E-commerce platforms like the big three (Lazada, Shopee and Alibaba) had projected a steady growth across Southeast Asia for several years to come. The emergence of double-digit sales made things into a whole new level of competition.

- Partners in the Philippines made the most conversions through promoting Home & Living, Women’s Fashion and Health & Beauty products from Lazada, Shopee, SuuBalm, Buildmate, Perfume PH and Swarovski

- Malaysian Partners’ consumers contributed to total conversions for the following popular categories

- Home & Living – Shopee, Lazada, MR DIY and Photobook

- Health & Beauty – AirAsia, Watsons, Royale Pharma and Favful

- Groceries & Pets – Shopee, Lazada, AirAsia and Pets Wonderland

- In Indonesia, the most popular categories that earned conversions were:

- Health & Beauty – Blibli, Tokopedia and Mama’s Choice

- Women’s Fashion – Tokopedia and Shopee

- Home & Living – Informa, ACE Hardware, Ruparupa, Miniso and Shopee

- In Thailand, the following categories were the center of attention in driving conversions

- Home & Living – NocNoc, HomePro and Lazada

- Health & Beauty – Konvy, Watson and Shopee

- Marketplace – Tesco Lotus and JD.TH

- Partners in Singapore featured Electronics, Groceries & Pets and Home & Living items from Amazon, Shopee and Lazada

Double-Date Performance

Double-digit sales matter for Advertisers to take part in them because consumers look forward to these events to secure their purchases. Partners (including content creators, influencers and ad networks) actively promote to help boost sales during these events.

Gathering campaigns for double-digit sales from Advertisers and relaying this information to Partners through our marketing communication assets was the most effective through our proprietary Deals Pages (launched in July and paying out on Clicks) and our Festival Pages (launched in November, to gather campaigns in one convenient page for Partners). Partners were encouraged to participate in promoting double-digit sales through extra commissions and bonus payouts.

Typical campaigns ran for 5-10 days before a double-digit sale. This ensured full exposure for Advertiser’s pre-hype sales, special product highlights & SKUs, and gave ample time for Partners to create and release content before D-Day.

The ritual of ‘add to cart’ phenomena seen in consumer behaviour was leveraged during these sales. Especially with planned flash sales and exclusive codes to be used only during the double-digit day itself.

Compared to the total conversions in 2021, the conversions for double-digit sales attributed an average of 15% across all regions.

Key highlights of the double-date performance:

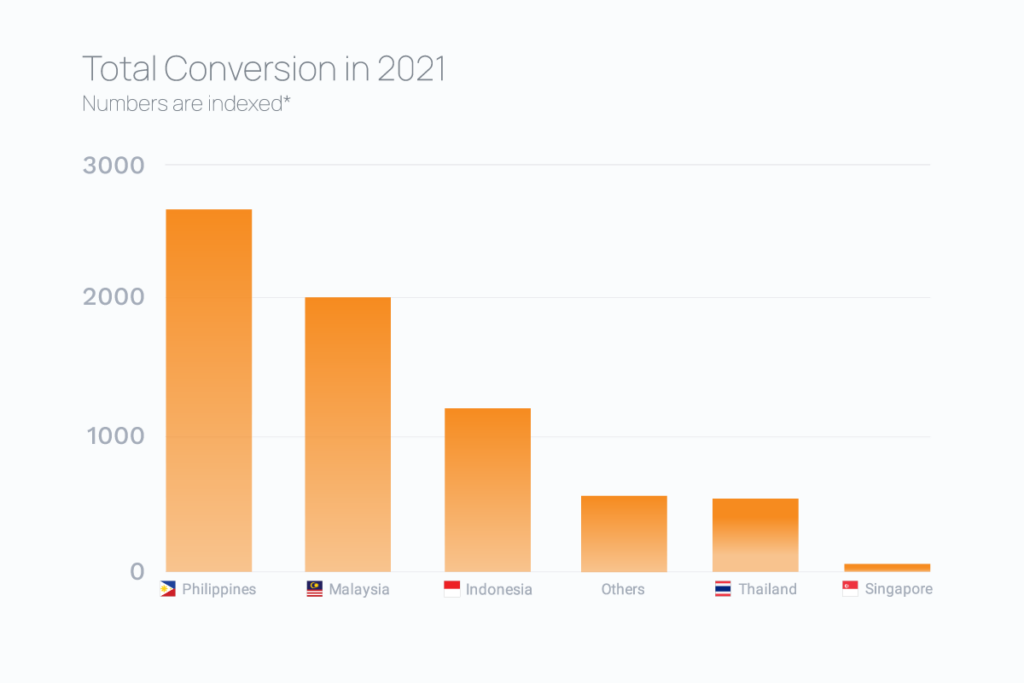

- Amongst the five regions, The Philippines conquered the total conversion for double-digit sales then followed by Malaysia, Indonesia, Thailand, other countries and lastly, Singapore. Philippines’ conversions for 8 double-digit sales had almost surpassed half of the total conversion by Involve’s Partners made throughout the year. Such initiatives that can be derived from 8.8 sales are Super Voucher Drop, RM0.88 Crazy Flash Sale and 88% off deals.

- Through observation, most partners across the regions focused on 11.11 Sales (a celebration of Singles day) which is the largest and most popular annual global shopping festival – now widely adopted in Southeast Asia. Most brands leveraged the 11.11 phenomenon as a fast-paced combination of sales promotions, sales incentives, entertainment, variety and the fear of missing out.

- Other shopping festivals in 2021 that gained traction in the SEA region were Black Friday and Cyber Monday. Many Advertisers had campaigns around this event – mainly Fashion and Health & Beauty categories. Partners had started incorporating this into their campaign calendars too.

- 12.12 sales focused on ‘reminding’ and enticing shoppers to purchase the item they have been eyeing since November – or earlier – giving them their last chance to purchase their last-minute Christmas gifts.

Thus, Advertisers were encouraged to put more budget on pushing popular items and deals during the peak double-digit sales, leading to boost conversions and sales in e-commerce platforms.

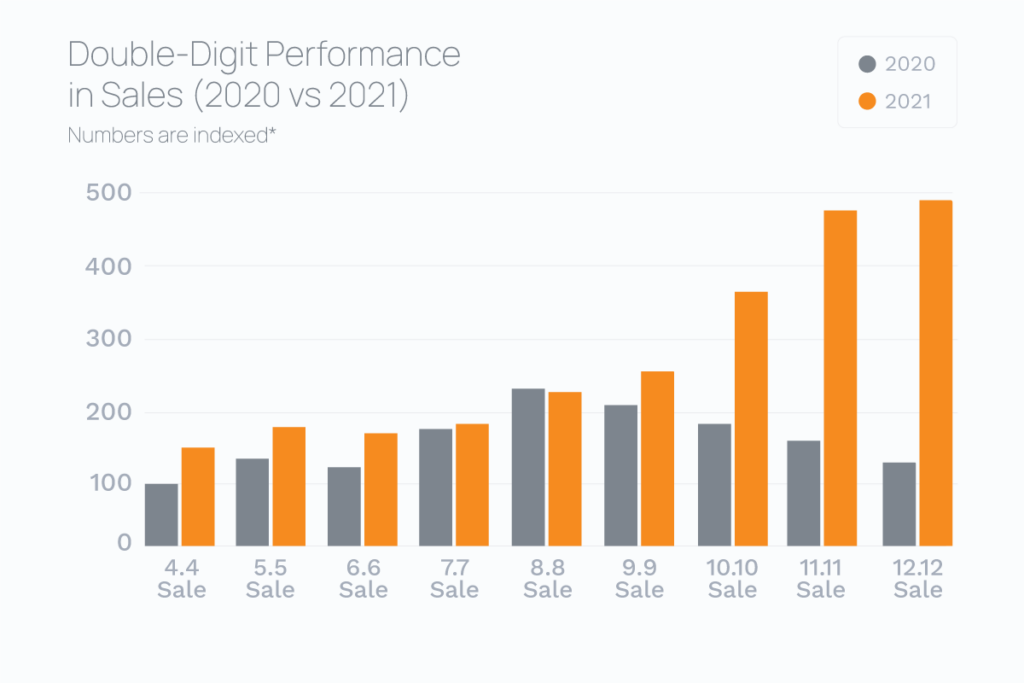

MoM Performance – Sales

- The significant increase in Sales at the end of 2021 compared to 2020 showcased marketing efforts developed throughout 2021, that included proprietary Deals pages, Festival Pages and high usage of marketing assets – namely popups, dashboard banners, featured Advertiser listings and e-mail marketing

- Compared to 2020, marketing efforts were fully established only in November 2020 and assets were at the beginning stages of creation and adoption. Popups, dashboard banners, Deals Pages and Festival Pages did not exist during that period, and campaigns at the time were focused on promoting CPUC (Click traffic) more than CPS (Sales)

- In 2021, 10.10 Sales, 11.11 Sales and 12.12 Sales were the most popular double-digit sales consumers preferred to make their purchases during these events, leading to drive the highest total sales among the rest of the double-digit sales

- Deals CPUC pages and Festival pages, filled with ongoing campaigns, provided options for new & existing Partners to earn commissions from unique clicks and sales

- Double-Digit Sales in 2021 saw a steady upward trend, with 11.11 and 12.12 more than doubling its performance from the start of the year

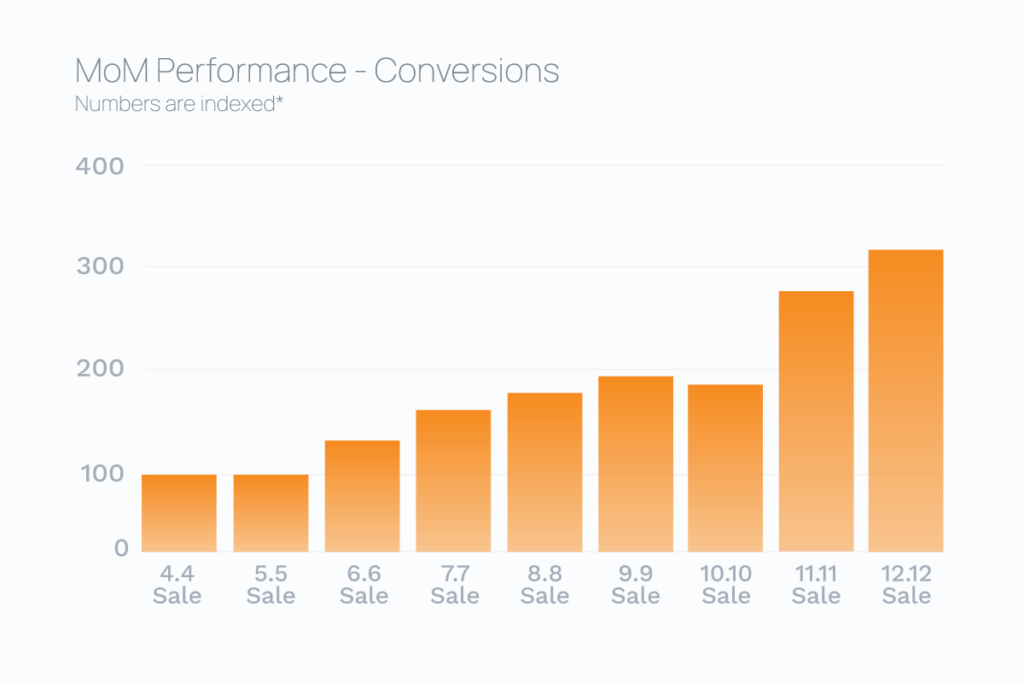

MoM Performance – Conversions

- Deals CPUC pages helped new & existing Partners make conversions from 7.7 Sales to 10.10 Sales by earning commissions with bonus payouts from unique clicks on Advertisers’ popular campaigns available on these pages

- Our Festival Pages and heavy push on marketing communications during 11.11 Sales and 12.12 Sales contributed to sales and unique clicks conversions

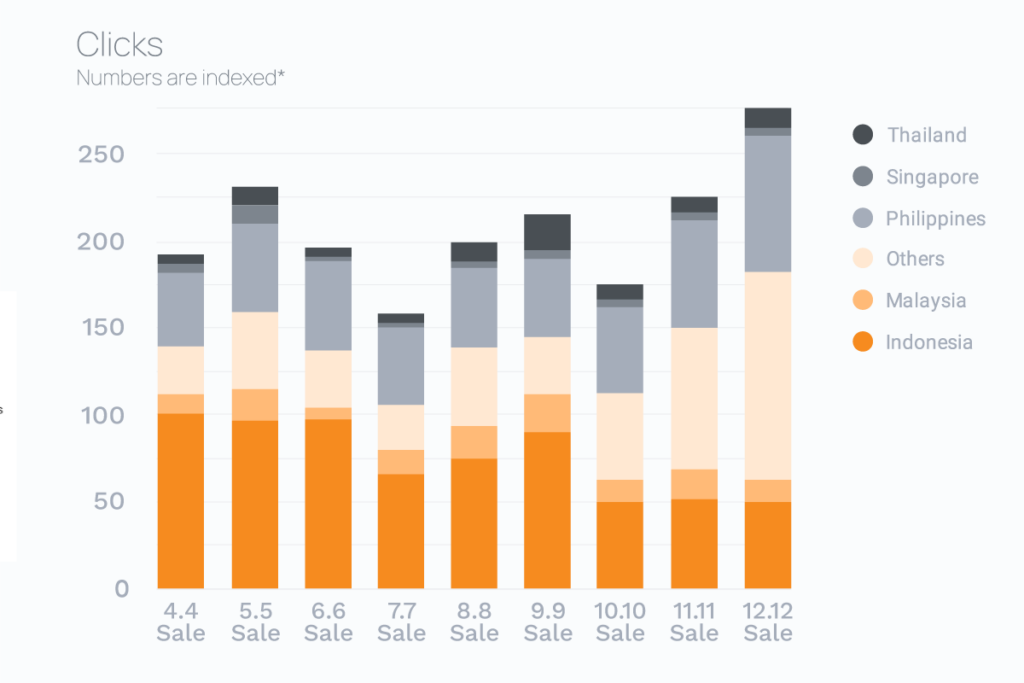

Total Number of Clicks (by Country)

- Indonesia customers contributed most of the clicks during Ramadan season (4.4 Sales and 6.6 Sales) and 9.9 Sales

- Partners’ affiliate links generated from the Festival Page and made for directing their audiences to click on the ‘Buy Now’ button at Deals (CPUC) page impacted the increased total number of clicks during 11.11 Sales and 12.12 Sales to earn more commissions at the year-end

- In Malaysia and Singapore, 5.5 Sales had the highest total of clicks during the Ramadan season

- 9.9 Sales in Thailand garnered the highest total of clicks due to special deals from popular Advertisers such as Shopee 9.9 Super Shopping Day and Lazada 9.9 Mega Brand Sales

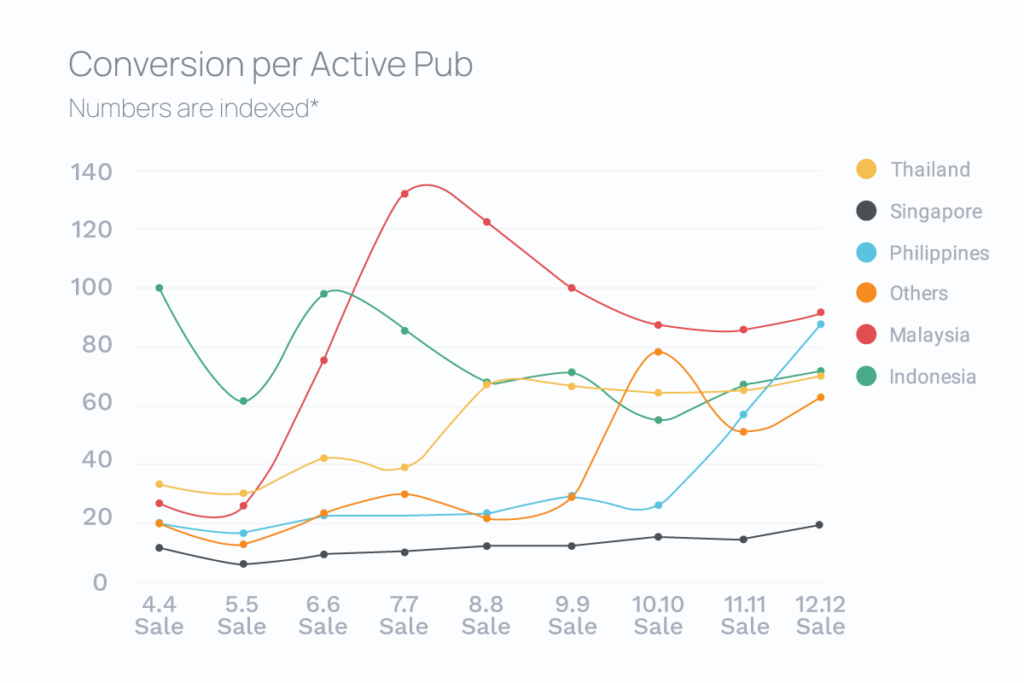

Total Number of Conversions (by Country)

- The huge increase total of conversions in the Philippines from 10.10 Sales to 12.12 Sales showed the active Filipino Publisher participation in earning conversions from promoting Advertisers’ year-end deals

- Malaysian Partners earned conversions from featuring Shopee and Lazada mid-year promotions on their content during 7.7 Sales and 8.8 Sales

- Indonesian Partners’ audiences preferred making purchases during seasonal and popular double-date sales such as Ramadan and Shopping Day. Popular marketplaces in Indonesia (Lazada, Tokopedia and Blibli) shared the hottest deals during 11.11 Sales

- Thai Partners earned more conversions from 8.8 Sales to 12.12 Sales after they were introduced to more exciting Offers and deals to promote on their content

- Only a small amount of active Singapore Partners (ad networks and coupon & loyalty websites) earned conversions from promoting double-digit sales

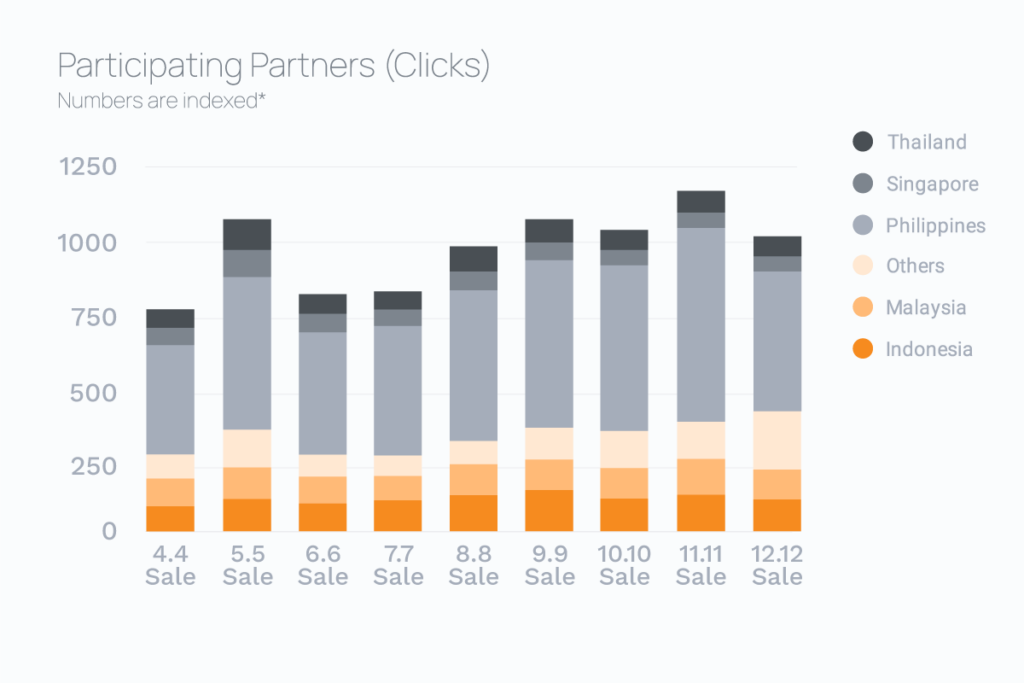

Participating Partners

- Most of the Partners in the Philippines picked up the Offers (including Shopee and Lazada) and promoted them during double-digit sales, especially for 5.5 Sales, 9.9 Sales, 10.10 Sales and 11.11 Sales.

- Partners in Indonesia, Malaysia, Singapore were actively participating in promoting 5.5 Sales during the Raya season

- The majority of Partner Participation during double-digit campaigns increased mid-year onwards with more brand participation from Advertisers that provided more promotions geared towards Year-End Sales

- The biggest sale event during 11.11 saw Partner participation increase from 10.10, toward a slight drop for 12.12. However, this did not affect Sale Performance which still saw an upward trend.

- Overall, Partner Participation remained steady throughout the year with gradual increases from mid-year to 11.11

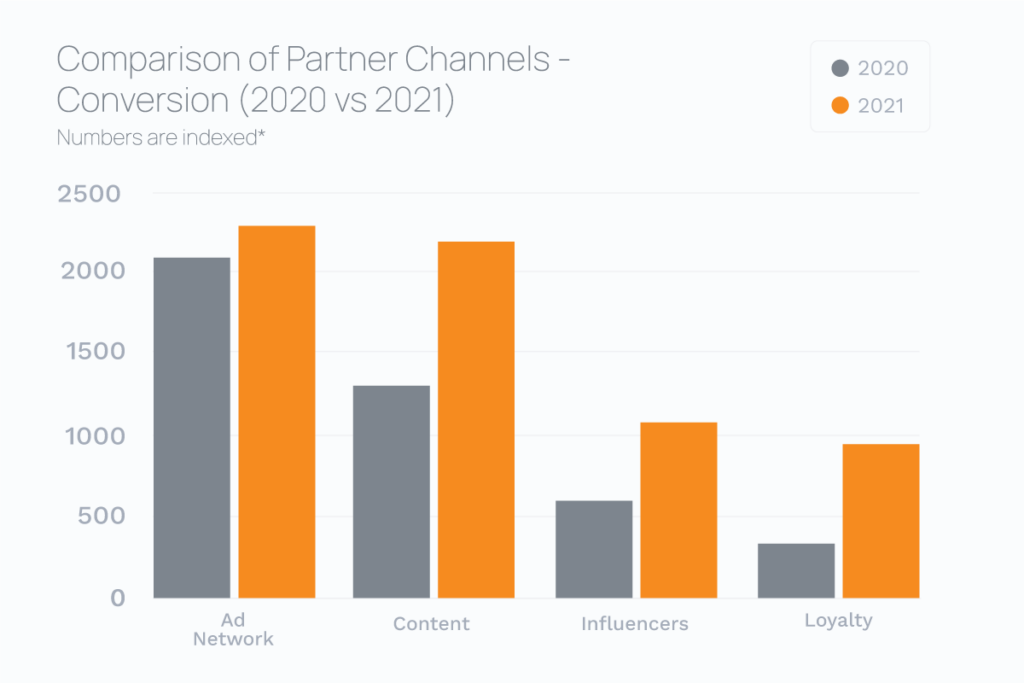

Top-Performing Partners

Our Involve Partners determined which Offers to promote, based on their niche audience by category, on their content. Partners diversified in promoting ranges of product categories on various platforms (social media, blogs and websites) to acquire new audiences and retain loyal followers.

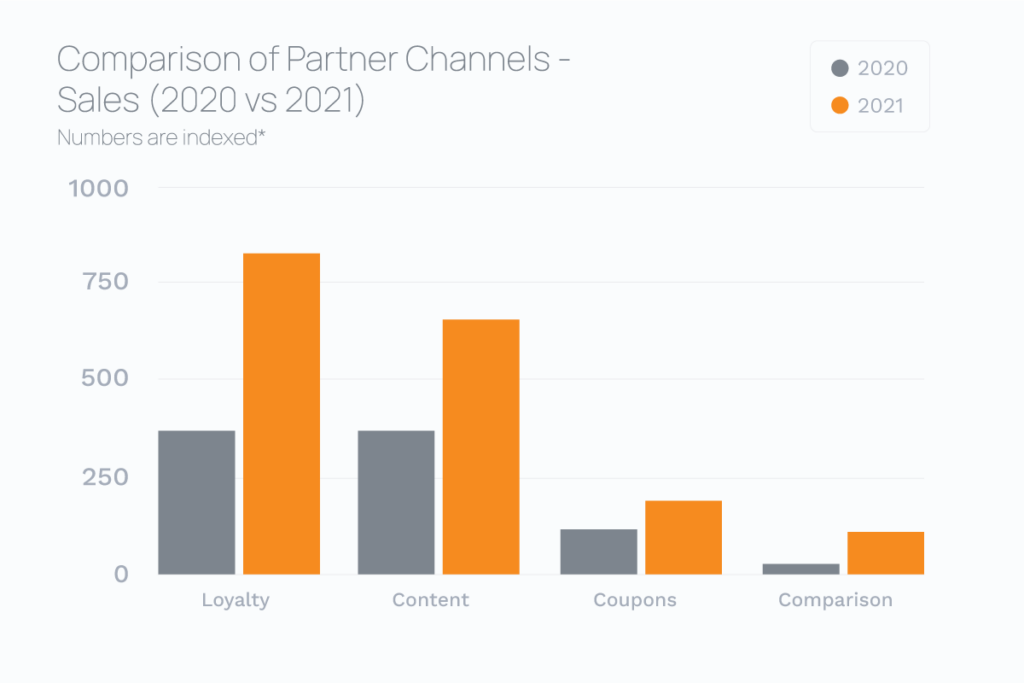

- In 2021, conversions made on ad networks significantly increased and maintained a total of RM750K in sales.

- Content creators and influencers contributed 1.8x more conversions within a year

- Loyalty networks garnered 3x more conversions

- Content creators and loyalty networks brought almost 2x total sales through promoting specific products and campaigns to their target audience

The following top 3 categories by Offer and Partners in each country shows how significantly important for Advertisers to connect and manage ideal Partners that drive sales on their e-commerce platforms.

Malaysia

Marketplace

Partner Channel | Conversion Rate (%) |

Influencer | 42.8 |

Content | 25.4 |

Ad Network | 24.8 |

- Partners under Influencer and Content drove the most clicks and conversions from promoting Shopee and Lazada

- Ad Network earned more from featuring Decathlon’s promotions

Services

Partner Channel | Conversion Rate (%) |

Content | 41.8 |

Influencer | 22.1 |

Coupons | 12 |

- For Content, Influencer & Coupons, most of the Partners feature Energy Watch that encourages their followers to learn about the developing energy ecosystems of Malaysia, Southeast Asia and beyond

- Partners in Coupons shared TIME Internet and Kinokuniya promotions on their platforms

- Two Partners in Influencer garnered clicks and conversions from encouraging their followers to fill up YouGov surveys so they can enjoy great rewards

Health & Beauty

Partner Channel | Conversion Rate (%) |

Influencer | 23.5 |

Comparison | 11.7 |

Loyalty | 11.4 |

- A few top-performing Partners in Influencer mostly promoted mother & baby products and deals on their platforms

- One of the top-performing Partners in Comparison drove the most sales in highlighting various Health & Beauty products (available on Hermo) on their website

- Partners in Loyalty clicks and conversions in Health & Beauty category through featuring promotions from Watsons, Caring Pharmacy, Sasa and Zenyum

Indonesia

Marketplace

Partner Channel | Conversion Rate (%) |

Loyalty | 40.9 |

Coupons | 23.3 |

Influencer | 14.8 |

- Partners in Loyalty and Coupons actively promoted Shopee, Lazada, Tokopedia, JD.ID, Ruparupa and Decathlon

- Most of the Influencers featured popular items and promotions from JD.ID and Ruparupa

Health & Beauty

Partner Channel | Conversion Rate (%) |

Content | 64.1 |

Ad Network | 45.9 |

Loyalty | 13.2 |

- Content creators were active in recommending Holika holika and Hansaplast to their followers

- Most top-performing Partners in Ad Network promoted health products from Nutrimart, Hansaplast and Mama’s Choice

- Partners shared health promotions from Enfa, Kalcare and Farmaku on their Loyalty platform

Services

Partner Channel | Conversion Rate (%) |

Loyalty | 12 |

Coupons | 2.7 |

- Partners in Loyalty and Coupons mostly shared popular promotions from Gramedia and Domino’s Pizza

- Loyalty platforms featured im3 Ooredoo (mobile subscription) and Vayalife (eco-friendly consumer and homeware products) deals

- Partners highlighted deals from Grab and Niagahoster on their coupon websites

Philippines

Marketplace

Partner Channel | Conversion Rate (%) |

Loyalty | 80.5 |

Influencer | 32.8 |

Coupons | 27.2 |

- Loyalty platforms mostly shared Shopee and Decathlon deals

- Shopee and Lazada were the only marketplaces where Influencers search for popular items & deals to feature on their content

- Coupons website and social media pages drove sales and conversions from Lazada deals with discounts, cashback and free shipping

Services

Partner Channel | Conversion Rate (%) |

Ad Network | 59.4 |

Influencer | 36.1 |

Loyalty | 5.8 |

- Partners under Ad Network and Influencer dominated in driving clicks and conversions by actively promoting Buildmate’s DIY & Home Improvement items and deals

- Ad Network also shared the latest mobile app services (Codashop and Lalamove) to their clients

- Only a few Loyalty platforms featured Photobook promotions on their websites

Fashion

Only two Partners under Coupons drove the most clicks and conversions in the Fashion Category, leading to a conversion rate of 8.9%.

Thailand

Marketplace

Partner Channel | Conversion Rate (%) |

Loyalty | 54.1 |

Coupons | 15.2 |

Ad Network | 8.9 |

- Shopee and Lazada dominated in the Marketplace for Loyalty and Ad Network Partners to share promotions with their clients

- Loyalty platforms also shared JD.TH and Tops promotions

- Partners managing Coupons websites look for popular promotions on JD.TH e-commerce platform

- NocNoc, Tops and OfficeMate promotions were featured on Ad Network’s platforms

Health & Beauty

Partner Channel | Conversion Rate (%) |

Ad Network | 9.3 |

Loyalty | 6.4 |

Coupons | 2 |

- Konvy and RSMall promotions were mostly shared by Ad Network and Loyalty

- One of the Partners in Loyalty featured Beautrium promotions on their platform

- Ad Network and Coupons promoted Decathlon campaigns

Fashion

Partner Channel | Conversion Rate (%) |

Loyalty | 4.5 |

Ad Network | 3.9 |

Coupons | 2.3 |

- ALDO and Dapper promotions were shared on Loyalty and Ad Network platforms

- Loyalty platforms highlighted Skechers and Anello promotions while Ad Network featured Adidas promotions

- Coupons websites focused on promoting Charles & Keith deals

Singapore

Marketplace

Partner Channel | Conversion Rate (%) |

Coupons | 59.6 |

Influencer | 26.5 |

Ad Network | 18.7 |

- Coupons and Ad Network mostly shared promotions from Shopee and Lazada promotions

- Coupon websites also featured AirAsia promotions

- Influencers only promoted Home & Living and Electronics items and deals from Harvey Norman

Fashion

Partner Channel | Conversion Rate (%) |

Loyalty | 7.8 |

Coupons | 4.1 |

Ad Network | 0.5 |

- For Partners in Loyalty, XIXILI, myBra, Poplook, ALDO and Skechers were the most frequently shared promotions

- Partners mostly shared Skechers and Poplook promotions on their Coupon websites

- Adidas, Poplook, Determinant and Skechers promotions were featured on Ad Network’s platforms

Services

Loyalty channels were the only Partners, with a conversion rate of 10.2%, who drove clicks and conversions in Services, specifically Amazing Graze, Photobook and Kinokuniya.

Last year’s trend & performance has shown great potential for us, Advertisers and Partners to go further in boosting more than 2x growth of sales & conversions on e-commerce platforms in 2022 and beyond.

With Involve’s technology and resources, Advertisers will be able to plan out budgeting and establishing strategies in aligning their top-selling products (by categories) and upcoming campaigns (including double-digit sales) with Partners’ promotions in various channels.

Looking for a great opportunity to connect with Partners and drive sales? Contact your Account Manager to plan your next campaigns.