Industry: Financial Services & Digital Banking

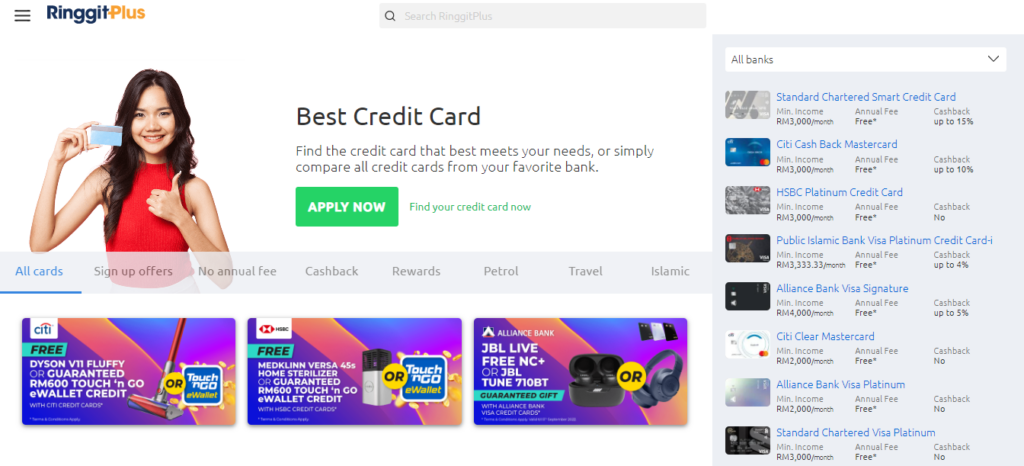

Use case: Credit cards, financial applications, digital banking products

Overview

Acquiring users for financial products is fundamentally different from ecommerce.

Users rarely convert on impulse. Instead, they research, compare, seek reassurance, and require education before submitting an application. As digital financial products become more competitive, acquisition costs continue to rise while application quality becomes harder to control.

This case study explores how RinggitPlus, a leading Malaysian financial platform, partnered with Involve Asia to scale high-intent credit applications using a performance-based affiliate marketing model – achieving a 96× increase in applications within just 12 months.

While this campaign was executed with RinggitPlus, the acquisition model and mechanics demonstrated are applicable to a wide range of financial and digital banking products.

The Challenge: Scaling Applications Without Increasing Risk

Before implementing affiliate marketing at scale, our finance advertisers usually face several constraints:

- Paid advertising costs were increasing year over year

- Traffic volume did not translate proportionally into applications

- Many users dropped off during the application journey

- Marketing spend was not always tied to completed applications

- Limited visibility into which channels drive approved or activated users

The goal was to find an acquisition channel that could:

- Reach users already researching financial products

- Improve application quality

- Scale without committing to fixed upfront costs

- Allow payouts to be aligned with performance

The Strategy: Performance-Based Affiliate Acquisition

Rather than treating affiliate marketing as a secondary channel, RinggitPlus positioned it as a core performance acquisition strategy.

The approach focused on:

- Activating trusted finance-focused publishers and creators

- Using educational and comparison-led content to support decision-making

- Aligning incentives so partners were rewarded for application outcomes

This allowed the platform to leverage existing trust relationships between publishers and their audiences – an important factor when promoting financial products.

The Key Shift: Aligning Affiliate Commissions with Application Outcomes

Initially, RinggitPlus ran a Cost-Per-Action (CPA) model, where affiliates were paid only when credit card applications were approved by the bank.

Although payouts per approved application were high (RM140+), approval rates were low and processing times were long. This limited earning consistency and reduced publisher motivation to prioritize the offer.

To improve performance, RinggitPlus worked with Involve Asia to restructure the programme into a Cost-Per-Lead (CPL) model. Affiliates were paid RM14 for every completed application sign-up, regardless of final approval outcome.

This shift lowered friction for publishers and increased promotion activity across content and social channels.

Outcome of the Commission Change

- For the advertiser: lower effective cost per application and higher lead volume

- For affiliates: more predictable earnings and higher conversion rates

By aligning incentives with measurable user actions, the programme achieved greater scalability without increasing acquisition risk.

How This Performance Model Applies Beyond RinggitPlus

- Affiliate payouts can be linked to approved or activated accounts

- Educational content helps reduce drop-off in complex applications

- Trusted third-party voices increase confidence and completion rates

- Brands only pay when measurable milestones are achieved

Results: Measurable Application Growth

Based on RinggitPlus sample campaign data, the affiliate strategy delivered:

- 96× increase in credit applications

- 42% higher conversion rate compared to baseline channels

- 3× growth in monthly affiliate-driven applications

- 40× increase in application volume from content creators

- 2× increase in average application value

- 5× improvement in average earnings per affiliate

Note: Results will vary depending on product maturity, onboarding flow, and incentive structure. The key takeaway is the scalability of a performance-based acquisition model rather than the absolute performance multiplier.

Making Financial Offers Easier to Understand

Beyond incentive structure, content quality played a major role in improving performance.

Publishers were encouraged to:

- Explain who each financial product is suitable for

- Simplify eligibility criteria and application steps

- Highlight real-world use cases and benefits

- Address common concerns and misconceptions

This educational approach reduced friction and increased user confidence during the application process.

Publisher Mix Activated (Based on Campaign Data)

Using RinggitPlus campaign data as a reference, the affiliate ecosystem included:

- Personal finance and money management websites

- Comparison-style content platforms

- Bloggers focused on lifestyle and financial planning

- Social creators producing educational explainer content

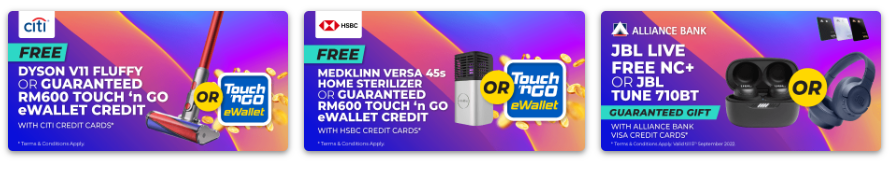

(Source: KiaEatPlay & DiscoverJB Facebook Posts)

These partners reached users who were already in a financial decision-making mindset, resulting in higher intent and stronger application performance.

Content Creators and Trust-Led Acquisition

Content creators became an important driver of scale.

Effective formats included:

- “Who should apply for this product?” explainers

- Application walkthroughs and step-by-step guides

- Pros and cons breakdowns in simple language

- Personal finance stories tied to product benefits

These formats performed particularly well on social platforms, where users value peer-led explanations over traditional advertising.

Key Takeaways for Financial Institutions

- Affiliate marketing can function as a primary acquisition channel for financial products

- Performance-based payouts align incentives across brands and partners

- Content-led acquisition builds trust earlier in the decision journey

- Quality-focused publisher ecosystems outperform volume-driven traffic

For financial products where trust, education, and intent matter, affiliate marketing becomes a sustainable and measurable growth engine.

Looking to scale applications without increasing acquisition risk?

Involve Asia helps financial brands design and execute affiliate strategies focused on qualified users, measurable outcomes, and long-term scalability.