Affiliate marketing for finance brands in the Philippines explores the increased growth of Partners’ participation in promoting financial products and services to their followers in 2023.

We looked at the trends that encouraged Partners’ interest in recommending finance brands that drove the target audience to sign up for financial products and services through affiliate links:

- The rise of going digital

- Consumer adoption of digital finance

- Search trends for finance

- Educational finance-related content

- Future of fintech

Click on the following drop-down bars to view more in each section of this report.

Finance Vertical Outlook in the Philippines

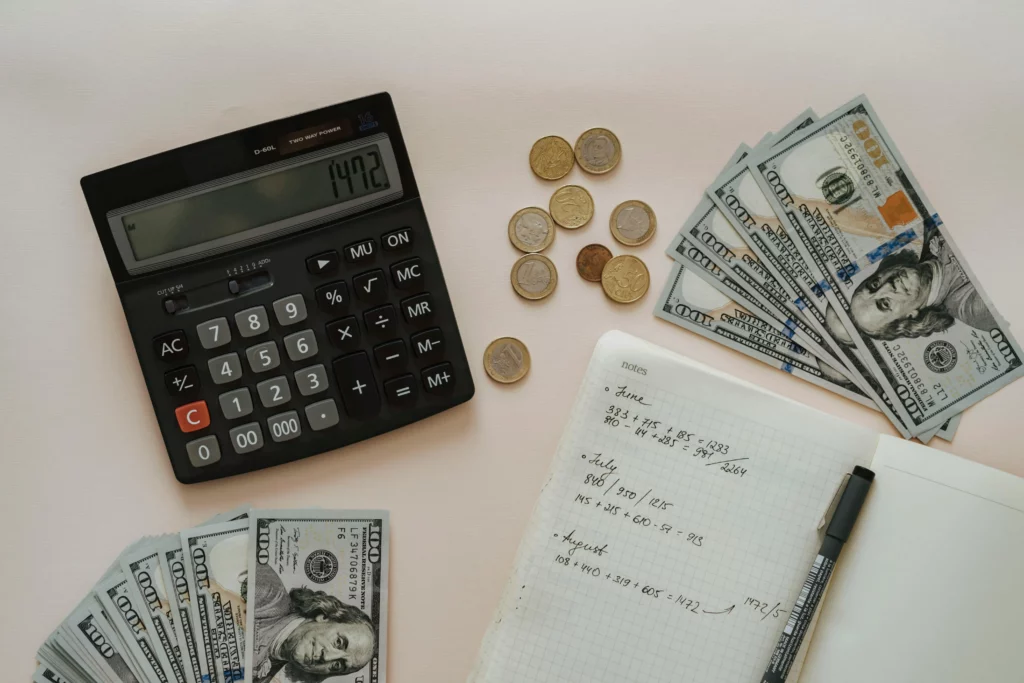

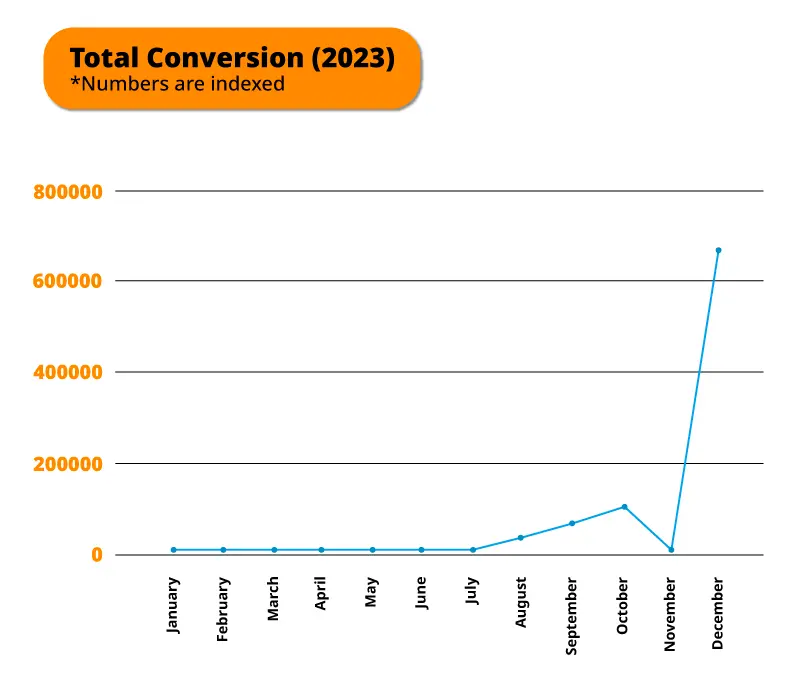

With existing and new finance brands at Involve, the MYR sales from January to October 2023 significantly increased by 34x.

In July 2023, with new Philippines finance brands adding affiliate programs with recommended products, Partners started to promote them to their followers, which led to a 171x increase in conversions till December 2023.

Conversions were based on successful sign-ups made by followers through Involve Partners’ affiliate links for credit cards, loans, and insurance.

*Note: Commission structures for different finance brands are based on application processes and approvals by banks.

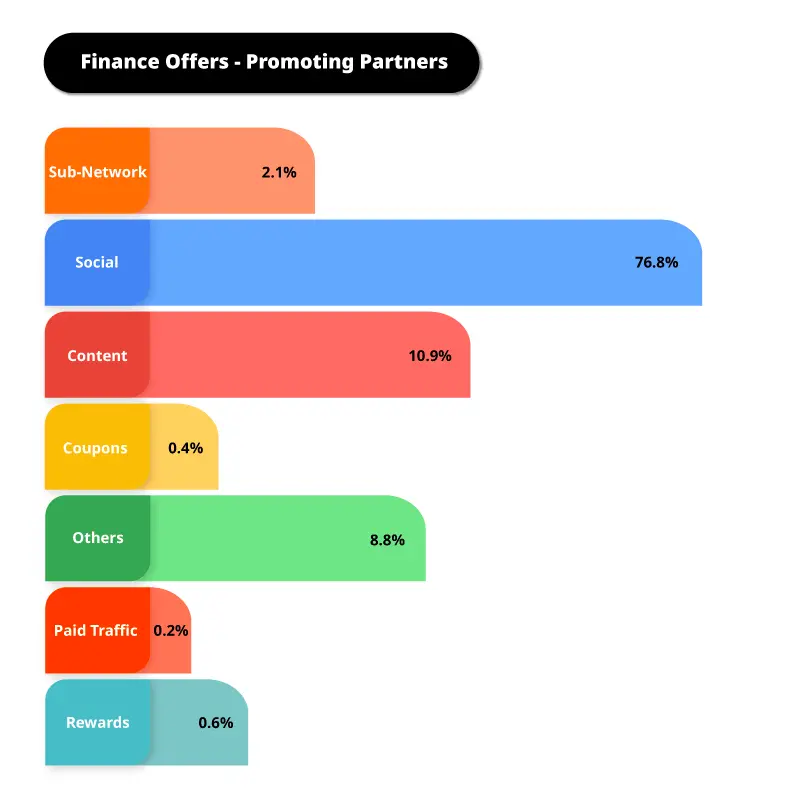

77% of Involve Partners promoting finance brands had social media platforms, followed by Content, the second highest in contributing growth in participation.

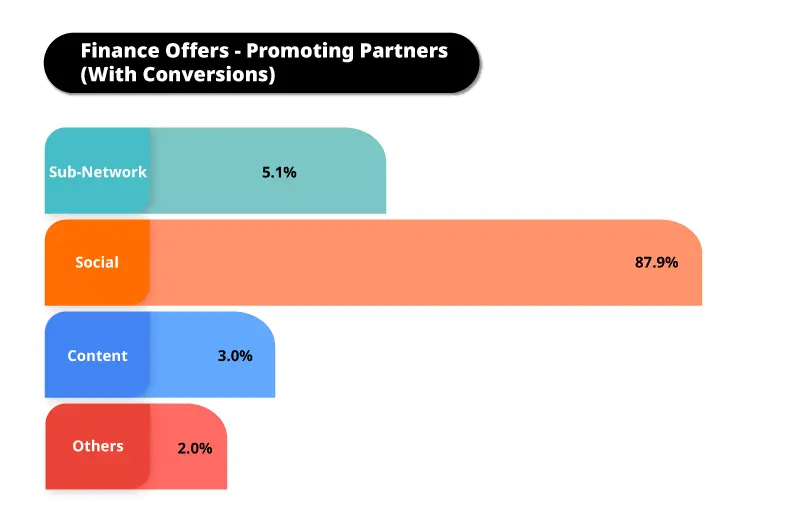

88% of Involve Partners who promoted and earned conversions from finance brands were Social.

These Involve Partners actively shared educational content on managing finances and suggested finance products and services aligned with their followers’ lifestyle needs.

Let’s dive further into how the finance trends impact affiliate partners’ promotional activities and followers’ financial decisions.

The Rise of Going Digital

In 2023, the World Bank’s Board of Executive Directors approved USD600 million in finance for the Philippines to expand the inclusion & adoption of digital payments and financial services, aligning with e-commerce and digital services markets.

The Philippines’ central bank, Bangko Sentral ng Pilipinas (BSP), released the Cybersecurity Roadmap stating that they aimed to get 50% of retail payments done digitally and onboard 70% of adult Filipinos into the formal financial system by the end of 2023.

The Philippines’ digital assets market revenue is forecasted to grow 32.7% in 2024.

In addition to that, based on the Digital Payments Transformation Roadmap 2020 to 2023, financial inclusion and financial literacy were some of the key areas to encourage Filipino consumers and small & medium enterprises (SMEs) using e-wallets, making digital payments, and submitting financial applications online.

Digitisation in finance increasingly became vital for B2C and B2B sectors due to its strong presence in online transactions, including shopping sprees on e-commerce platforms & mobile apps.

We explore how consumers’ adoption of financial products and services happened online.

Consumer Adoption of Digital Finance

In mid-2023, the share of digital payments in the total volume of retail transactions in the Philippines was over 40%, while 4 in 10 people had their e-money accounts.

Digido reported that the adoption of financial technology in the Philippines through mobile apps was forecasted to increase by 72% (with over 59.3 million users) by 2024.

Payments and transfers were expected to contribute to the steep growth of digital financial services (DFS), followed by digital lending, digital insurance, and digital wealth, which will continue to grow from a low base by 2030.

In 2020, there were over 58 million active mobile wallet users, with a significant growth of 42.1% in the total volume of digital payments. It is forecasted to reach over 81 million by 2025.

Consumers over 15 years old and above were looking for solutions to managing their finances for business and lifestyle, especially the demand for online shopping at e-commerce platforms.

According to the Global Payments Report 2023, 33% of Filipinos preferred to use digital wallets for e-commerce, while 46% of Filipinos made point-of-sale (POS) payments with cash. It was forecasted payments will be made at e-commerce sites via mobile by 2026.

Despite digital banking pursuing financial inclusion, more than 40% of the adult population in the Philippines remain unbanked due to a lack of access to financial services in rural areas, a complex regulatory landscape, and an increasing number of cyberattack threats & data breaches.

However, these challenges give the finance industry opportunities to implement solutions that provide access while ensuring efficient digital security, especially given the rise of tech-savvy consumers asking for innovative financial products and services.

Travel brands took this opportunity to influence their potential travellers to make decisions in planning their trips by reaching out to various online and offline touchpoints.

On the other hand, OECD’s “Economic Outlook for Southeast Asia, China and India” report highlighted that the pandemic shifted the travellers’ preferences, with greater interest in local travel, nature destinations and wellness tourism while being aware of environmental issues.

According to Booking.com’s “Sustainable Travel Report”, 83% of global travellers think sustainable travel is vital, with 61% saying the pandemic has made them want to travel more sustainably in the future.

Travellers seek enjoyable experiences while being conscious of giving back to earth and society, from preserving natural & cultural heritage to supporting local communities, by embracing eco-friendly practices and being inspired by sustainable tourism.

Therefore, using data-driven insights to understand travellers’ interests in personalised travel, travel brands implement impactful growth strategies to entice travellers to consider affordable and sustainable travel experiences on their next trips.

Let’s look at what travellers are searching for before making their decisions.

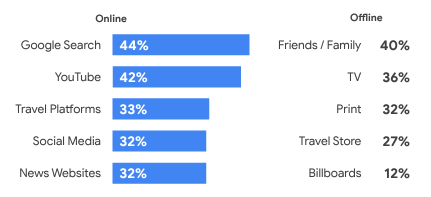

Travel brands took this opportunity to influence their potential travellers to make decisions in planning their trips by reaching out to various online and offline touchpoints.

On the other hand, OECD’s “Economic Outlook for Southeast Asia, China and India” report highlighted that the pandemic shifted the travellers’ preferences, with greater interest in local travel, nature destinations and wellness tourism while being aware of environmental issues.

According to Booking.com’s “Sustainable Travel Report”, 83% of global travellers think sustainable travel is vital, with 61% saying the pandemic has made them want to travel more sustainably in the future.

Travellers seek enjoyable experiences while being conscious of giving back to earth and society, from preserving natural & cultural heritage to supporting local communities, by embracing eco-friendly practices and being inspired by sustainable tourism.

Therefore, using data-driven insights to understand travellers’ interests in personalised travel, travel brands implement impactful growth strategies to entice travellers to consider affordable and sustainable travel experiences on their next trips.

Let’s look at what travellers are searching for before making their decisions.

Search Trends for Finance

The Year in Search 2022 for the Philippines reported that e-wallets were among the top search interests with a YoY increase of 150%, as most e-commerce platforms provided digital services (such as electronic payments) to simplify online and offline purchases.

Due to increased inflation, Filipinos were finding ways to manage their finances, such as setting budgets for buying products online, applying for insurance for essential needs, and getting loans to set up owned businesses.

Similarweb data showed that 66.6M users visited the top 100 finance websites in the Philippines, with 60% on mobile and 39% on desktop.

60% of the top 100 websites visited by users were banks that covered various financial products and services such as credit cards and insurance, while 10% specifically covered insurance.

Some users visited one of the top finance comparison websites to view various credit cards based on their preferences before applying for them.

69% of users got information about financial products and services through direct marketing channels. 17% of users searched on Google for solutions for managing their finances.

Thus, affiliate partners input popular financial keywords to drive reach and engagement on various social media platforms and search engines.

Educational Finance-related Content

Based on a study for TikTok in the Philippines, as of March 2023, #FinTok (finance on TikTok) videos garnered 5.7 billion views.

These videos became one of the approaches to providing financial literacy that enables Filipinos to take charge of their finances.

Influencers provided educational short-form videos and static images which explained financial insights and guides for followers:

- Investments

- Savings and budgeting

- Insurance and protection

- Credit and loans

- Financial planning

Influencers were given opportunities to increase awareness of finance opportunities, promote a saving culture, and be inclusive within the finance community & industry, using recommended products & services with affiliate links.

Since the COVID-19 pandemic, Filipinos shifted their financial mindset in investing their savings, including Gen Z’s interest in applying for insurance due to early offers of affordability and better coverage.

Therefore, social media is one of users’ go-to platforms for looking for credible resources that help them make financial decisions.

Future of Finance with Technology

The finance industry in affiliate marketing is likely to grow with the ongoing technological advancements.

The finance industry is leveraging technological solutions with advanced analytics to identify patterns and trends that can help provide personalisations for customer segments in affiliate marketing.

At the same time, technology will be helpful for the finance industry as it ensures compliance in affiliate marketing, such as monitoring affiliate partners’ promotions in multiple channels based on regulatory standards.

Most finance brands will likely expand their cross-channel integration in affiliate marketing, using social media, search engines, and influencers to improve customer experience and optimise marketing efforts across multiple touchpoints.

Affiliate partners may use AI technology to craft content for financial products & services, which can be used in multiple social media platforms. Still, they would adjust based on their branding and tone of voice to have continuous engagement and loyalty with their followers.

We hope this report gives you detailed insights into the increased Partner participation in promoting financial brands in the Philippines through affiliate marketing.

Looking for solutions to drive your business growth in affiliate marketing?

Contact our Account Manager or Programme Manager for more details.