Affiliate marketing for travel looks into the broader scope of trends and performance of how Partners and Affiliates drive their growth in the travel industry, from pre-pandemic to post-pandemic periods.

We look at the key performance indicators (clicks, sales, and conversions) across Southeast Asia that focus on Partners promoting Travel brands.

We analyse the trends that impact the overall performance of the travel industry:

- The rise of revenge travel

- Consumer behaviour

- Search trends for travel

- Travel content on websites and social media platforms

- Travel loyalty programs

- Future of travel with technology

Click on the following drop-down bars to view more in each section of this report.

Travel Industry Outlook - Indonesia, Malaysia & Thailand

Involve Partners based in and with traffic in the Philippines and Vietnam have the least performance growth compared to Indonesia, Malaysia and Thailand.

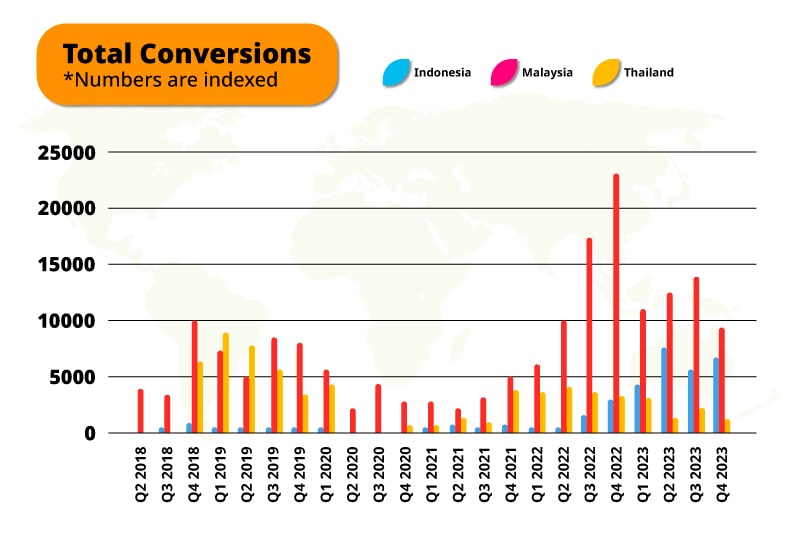

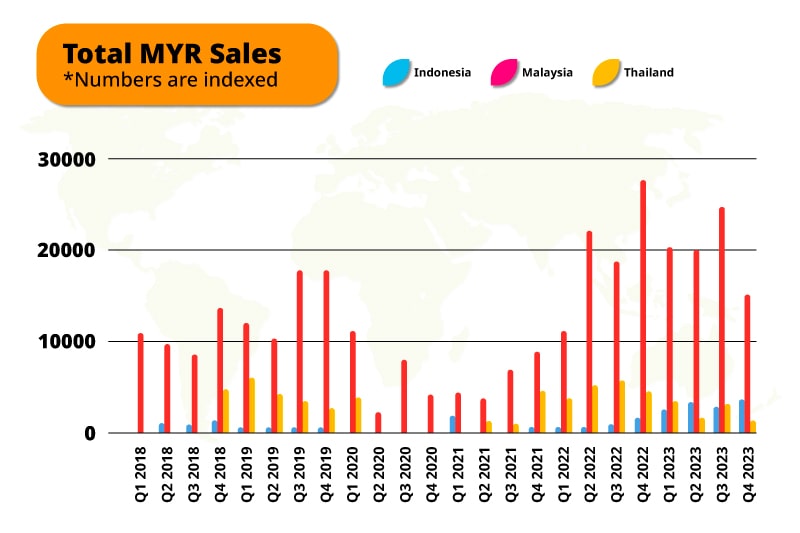

Between Q1 2020 and Q2 2021, total conversions, sales, and revenue dropped tremendously in those three countries due to the closure of travel borders impacted by the COVID-19 pandemic.

From Q3 2021 onwards, the travel restrictions are slowly decreasing, which gives people the opportunity to jump back into travelling, along with the trend of “revenge travel”.

Thus, a massive opportunity for Involve Partners to bring back travel-related promotions, leading to boosted conversions.

From Q1 2022 to Q2 2023, Involve Partners actively promoting travel brands in Malaysia significantly increased by 27% more than during 2018 and 2019.

Travel brands in Thailand have a steady total number of sales during the pre-pandemic and post-pandemic.

Involve Partners based in and have traffic in Indonesia are starting to pick up in sharing travel destinations and activities through well-known travel brands, contributing an increase of total sales by 33% from the beginning of Q2 2022.

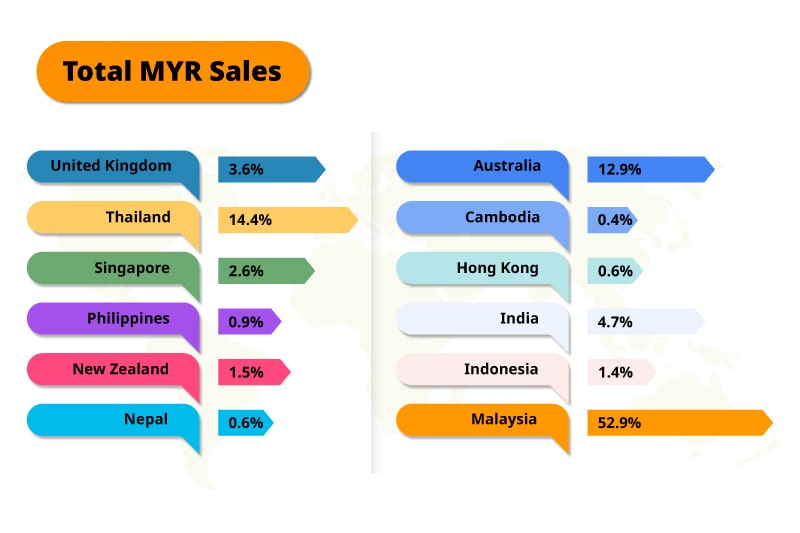

The following top 5 countries, where customers made bookings online for departure, contribute the highest for total sales and revenue for major airlines:

- Malaysia

- Thailand

- Australia

- India

- United Kingdom

The increased number of point-of-sales in various countries allows major airlines to increase flights by popular demand in selected destinations.

Let’s dive deep into how the trends impacted the growth of the travel industry across Southeast Asia.

The Rise of Revenge Travel

“Revenge travel” started to pick up in 2021 and gradually became trending till 2023 as travellers visit their desired destinations across the globe after most countries have reopened their borders for travellers.

Despite the high flight fares and weak currencies due to inflation, travellers are willing to spend consciously to compensate for their lost time during the COVID-19 pandemic.

The report on Southeast Asia’s aviation industry stated that, in comparison between March 2019 and March 2023, the passenger traffic levels in 11 of the 14 large airports across the region .were slowly recovering, with a 77% recovery rate of Southeast Asian carriers and a 78% recovery rate for foreign airlines.

Since customers’ expectations in travelling have changed significantly to the “new normal”, travel booking operators and agents are pivoting solutions to provide seamless & frictionless experiences for leisure and business travel.

At the same time, the use of mobile and contactless technologies for bookings is also taken into account, as 58% of all customer interactions globally are now digital, compared to 36% before the pandemic. In comparison, 64% of travellers agree that technology will be more important while on vacation.

To take advantage of the rise of revenge travel, travel brands must understand the travellers’ behaviour, from preferences to approach in booking online, which we will explain further in the next section.

Travellers' Preferences and Behavior

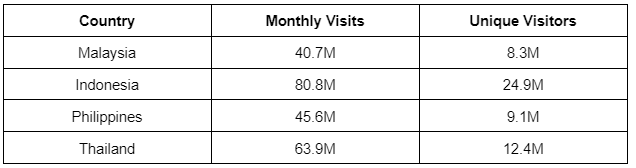

Based on the top 100 websites in the Travel Industry at SimilarWeb, close to 70% of unique visitors browse through the websites on mobile.

The top websites frequently visited (with 5 pages per visit) are specialised in flights, transportation, and accommodations. Direct (54%) and Organic Search (31%) contributed the most traffic to travel websites.

Visitors aged between 25 and 34 years old browse more than 6 websites to research and plan their trips based on their preferences, including travel budgets, before making bookings.

The Google Think Travel Report mentioned that leisure and business travellers’ preferences and behaviour for “value for money” experiences significantly changed from pre-pandemic to post-pandemic period, based on the following factors:

- Major milestone event

- Longer planning/booking cycle

- Less frequent, longer duration

- Strong preference for luxury and convenience

- Specific quarantine preferences

This report further explained that travellers are more meticulous in planning their trips, which led to a 17% increase in the average booking window for accommodation, transportation, and activities. Furthermore, 87% of respondents will take an international trip five days or longer to make their trips more worthwhile.

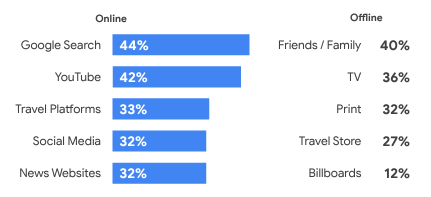

Travel brands took this opportunity to influence their potential travellers to make decisions in planning their trips by reaching out to various online and offline touchpoints.

On the other hand, OECD’s “Economic Outlook for Southeast Asia, China and India” report highlighted that the pandemic shifted the travellers’ preferences, with greater interest in local travel, nature destinations and wellness tourism while being aware of environmental issues.

According to Booking.com’s “Sustainable Travel Report”, 83% of global travellers think sustainable travel is vital, with 61% saying the pandemic has made them want to travel more sustainably in the future.

Travellers seek enjoyable experiences while being conscious of giving back to earth and society, from preserving natural & cultural heritage to supporting local communities, by embracing eco-friendly practices and being inspired by sustainable tourism.

Therefore, using data-driven insights to understand travellers’ interests in personalised travel, travel brands implement impactful growth strategies to entice travellers to consider affordable and sustainable travel experiences on their next trips.

Let’s look at what travellers are searching for before making their decisions.

Travel brands took this opportunity to influence their potential travellers to make decisions in planning their trips by reaching out to various online and offline touchpoints.

On the other hand, OECD’s “Economic Outlook for Southeast Asia, China and India” report highlighted that the pandemic shifted the travellers’ preferences, with greater interest in local travel, nature destinations and wellness tourism while being aware of environmental issues.

According to Booking.com’s “Sustainable Travel Report”, 83% of global travellers think sustainable travel is vital, with 61% saying the pandemic has made them want to travel more sustainably in the future.

Travellers seek enjoyable experiences while being conscious of giving back to earth and society, from preserving natural & cultural heritage to supporting local communities, by embracing eco-friendly practices and being inspired by sustainable tourism.

Therefore, using data-driven insights to understand travellers’ interests in personalised travel, travel brands implement impactful growth strategies to entice travellers to consider affordable and sustainable travel experiences on their next trips.

Let’s look at what travellers are searching for before making their decisions.

Search Trends for Travel

Google’s “e-Conomy SEA” report shows that more than 50% of top travel search volumes in Vietnam, Malaysia, and Singapore are for destinations within Southeast Asia. Australia, Japan, India, and the United States are travellers’ top destinations.

Since 2019, the outbound travel demand in Southeast Asia has grown steadily quarter-by-quarter.

In 2023, the growth in search interest for types of Southeast Asia destinations increases over +50%:

- Beaches/coastal destinations

- Cultural/historical/heritage destinations

- Nature attractions

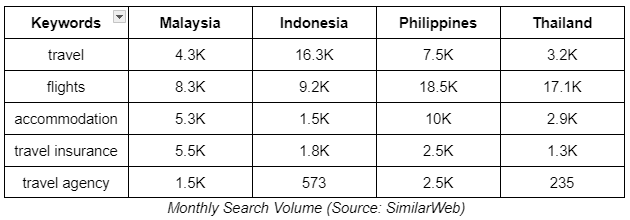

Globally, travellers look for the following keywords when planning their future trips.

With high search activity, brands can invest in search ads to enhance their affiliate marketing efforts, which then helps amplify and drive user intent to their websites.

In 2019, the travel industry spent USD$16 million on Google ads and utilised Google tools, such as YouTube, Google Reviews, and Google Maps.

Besides looking for hotels, transportation, and information about destinations on search engines, predominantly Google, travellers also search for travel-related information on websites and social media platforms.

In the next section, we explain how travellers engage with online infotainment content.

User-Generated Travel Content Is Trending

According to the Future Market Insights report, the Travel & Tourism user-generated content market is estimated at US$184 million in 2022 and is projected to grow to US$744 million by 2032, with an increased CAGR (Compound Annual Growth Rate) of 15%.

Online videos & images are the most potent form of communication, which boost tremendous growth in engagement and traffic to travel brands’ websites.

85% of consumers prefer user-generated content to company-branded content, while 82% of consumers said that user-generated content plays a significant role in their decision-making process for planning their trips.

Social media has influenced the way users plan their trips. In 2022, 60% of Gen Zs and 40% of millennials use social media for travel purposes. Furthermore, 46% of Gen Zs rely on Instagram to make travel decisions, while 50% of millennials prefer to view travel content on Facebook.

Regarding sharing content on social media, 90% of millennials share photos when travelling. Over 670 million Instagram posts only have the “travel” hashtag.

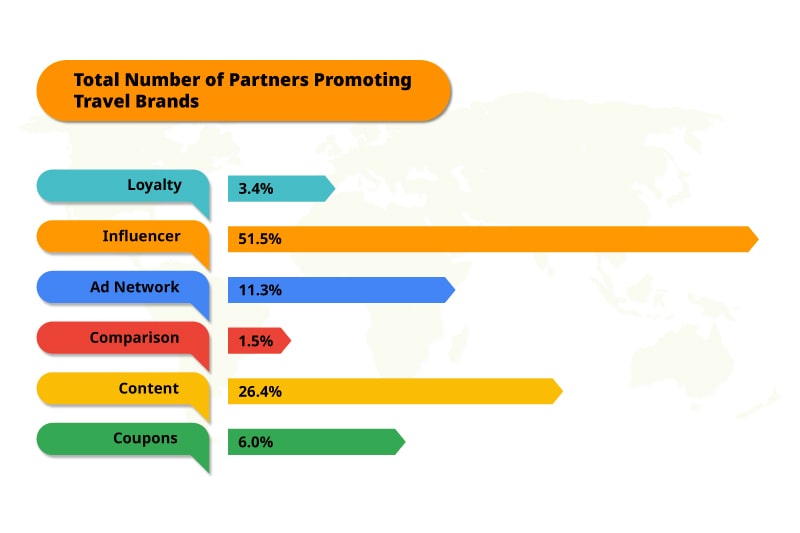

78% of participating Involve Partners drove higher sales through sharing personalised travel recommendations on websites and social media platforms.

A study done by Elite Daily highlighted that 43% of millennials consider authenticity for quality content.

Personalisation is essential for travel content as travellers seek content specifically for them at frequent touchpoints, such as Google, YouTube, TikTok and Instagram.

Most travel brands take the initiatives to understand travellers’ behaviour and preferences as to what content they resonate with. These travel brands utilised user-generated content as leverage in creating effective marketing campaigns, especially for affiliate partners to pick up and promote them to their engaging audience.

Involve Partners with engaging loyalty networks also boost revenue-driven travel brands’ awareness. In the following section, we will explain how customers are enticed to purchase travel products & services through loyalty networks.

Loyalty Programs in Travel Industry

In the Nielsen study, 84% of consumers are more drawn to a brand that offers a loyalty program, and 66% of customers that receive rewards influence their spending behaviour.

Running loyalty programs is one of the most efficient ways to acquire and retain loyal customers in the travel industry, leading to increased customer lifetime value & customer stickiness on platforms and boosting revenue.

For every purchase made on travel loyalty programs, customers can earn points and discounts for future purchases. For example, frequent flyers can redeem airline miles to use them for flights, hotel stays and other rewards.

Brands and affiliate partners strategically implement loyalty programs based on multiple customers’ personas to drive better leads. According to a Hospitalitynet study, 68% of customers actively engaged in the loyalty program when it offered them attractive rewards, such as cash/freebies, upgrades and discounts.

In addition to that, affiliate partners featuring these rewards, provided by travel brands, in their loyalty programs to increase sustainable growth in revenue and relationships with customers, using the following promotional strategies:

- Weekly promotions on the loyalty program website

- Personalised emails for those interested in travel deals

- Detailed travel blog articles with travel brands’ promotions

- Edutainment content on social media platforms

Affiliate partners are given long-term collaborative relationships with travel brands, offering more opportunities in implementing creative & innovative strategies to attain goals.

Our “Affiliate Marketing for Travel” White Paper concludes with how technology impacts the travel industry on various touch points, influencing purchasing behaviour online and beyond.

The Future of Travel with Technology

Adopting innovative technology is one of the most significant advantages for travel brands having the efficient capability to streamline processes and provide seamless experiences for travellers, including booking their trips, checking in their flights, and delivering insightful information about their travel destinations.

The Google Travel Study shows that 74% of travellers plan their trips with the help of the Internet, while 13% of travellers reach out to travel agencies for assistance in preparing the trips for them.

Furthermore, the Skift 2020 report highlights that 43% of surveyed travel brands agreed that digital transformation is vital for their businesses, while the Statista July 2020 study shows that 55% of respondents believe that technology helps further personalise travel.

Since the beginning of 2021, travellers have shifted their approach to planning their trips, such as using mobile devices for bookings, relying on advanced travel search engines for reliable information, and making contactless payments.

When it comes to data, at least 50% of executives in the travel industry responded that the integration of analytics tools helps monitor travellers’ behaviour and preferences, which they can use to improve their immersive experiences and drive business growth.

Therefore, travel brands should invest in technology to better improve their affiliate programs that bring in the following benefits:

- Identify potential affiliate partners to collaborate with easily

- Integrate campaign materials and product information seamlessly

- Monitor affiliate performance efficiently

- Ensure faster conversions and payments for affiliate partners

We hope this report gives you in-depth insights into the relationship between affiliate marketing and the travel industry.

Interested to be part of the affiliate marketing journey with Involve Asia?

Contact our Account Manager or Programme Manager for more details.