According to the International Association of Accounting Professionals (iaap), despite the rising interest rates, TA Research mentioned that it was forecasted to have a more substantial loan growth of 6.7%, with a 6.5% increase for consumer (personal) loans.

For RinggitPlus, the above forecast was a huge opportunity them to provide solutions for financial management with participating banks’ personal loans available to its target audience online.

The following case study explained how RinggitPlus garnered increased personal loan applications on its website through affiliate marketing.

Situation

Limited traffic to RinggitPlus’ website for personal loans

RinggitPlus helps customers find ideal personal loans by comparing interest rates and monthly repayments based on their income level, bank preferences, and credit history.

The success of getting new customers to apply for credit cards via Involve Partners’ recommendations led RinggitPlus wanted to open an affiliate program for personal loans as one of its beneficial products to its new and existing customers online.

By setting up its affiliate program for personal loans at Involve, RinggitPlus aimed to:

- Engaging with potential Involve Partners

- Increasing traffic to RinggitPlus’ website, specifically personal loans

- Driving increase in personal loan applications at participating banks via the RinggitPlus online platform

Solutions

Identifying customers’ behaviour

Participating banks, non-banks (such as JCL and Aeon Credit), and licensed loan providers in Malaysia determine how much money they can lend to individuals based on the following factors:

- Monthly income and employment

- Credit history

- Debt-to-Income ratio

- Credit score

- Loan amount and tenure

- Documentation

- Age

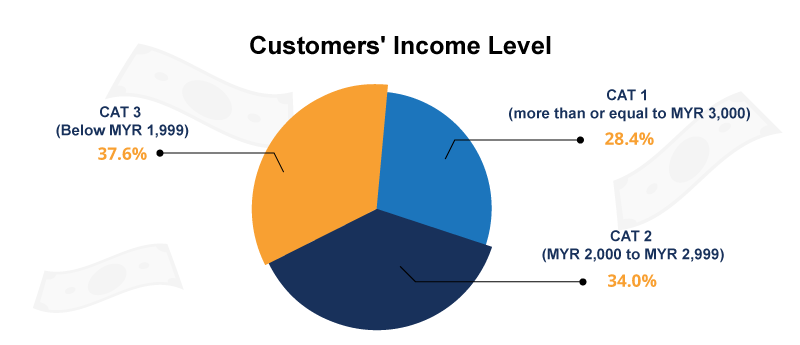

Applicants with monthly incomes of an average of MYR 2,500 applied for various bank’s personal loans via RinggitPlus’s website.

Using insights gathered from personal loan applications on its website, RinggitPlus identified the income segment and directed them to apply for loans that were appropriate for income type. For example, non-banks offered personal loans that are tailored for lower income while some banks provided personal loans for medium and high income.

Collaborating with Involve Partners

RinggitPlus offered commissions for successful leads when new customers signed up for participating banks’ personal loans at its website via Involve Partners’ trackable deep links.

On the other hand, selected potential Involve Partners were reached out to push RinggitPlus’ recommended bank personal loans to their audience. These Involve Partners were given upsized commissions in return for their promotional efforts.

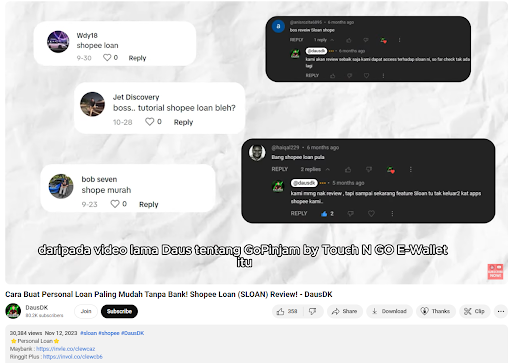

Involve Partners discovered the RinggitPlus Personal Loan affiliate program on the Involve Dashboard and picked it up to create engaging content based on their own use and for followers having interest in getting loans.

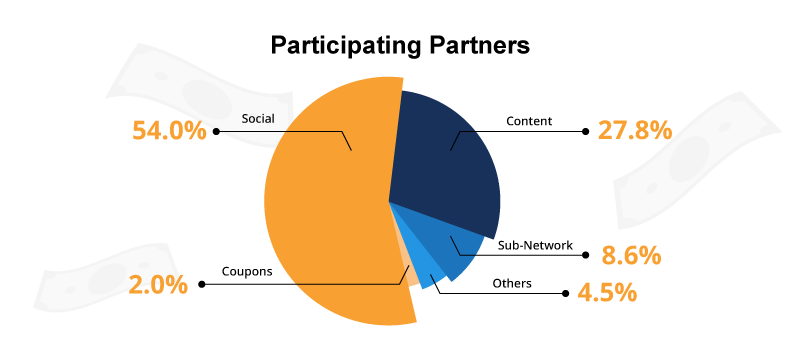

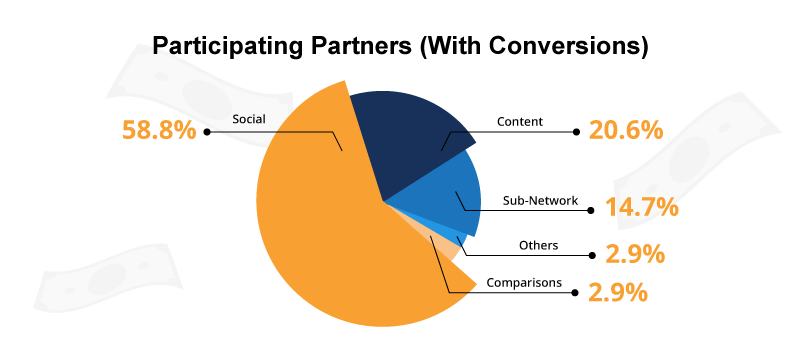

Social (54%) and Content (27.8%) promoted RinggitPlus’ bank personal loans on their blogs and social media platforms by providing edutainment content with bite-sized information about personal loans.

Most of these Involve Partners shared the following details in their promotional content:

- What are personal loans?

- What are the requirements to be eligible to apply for personal loans?

- How to apply for personal loans?

- Recommended personal loans available at banks in Malaysia

- Affiliate link: Directs followers to the RinggitPlus’ website for more information

- Call-to-action: Encourage followers to sign up for personal loans at RinggitPlus’ website

Educational resources about personal loans were provided to Involve Partners by encouraging them to browse through the RinggitPlus’ landing page, which we explain further in the next section.

Optimised RinggitPlus landing page for personal loans

RinggitPlus recommended the best personal loans with detailed information and comparison for banks across Malaysia:

- Interest/Profit Rate

- Minimum monthly income

- Loan/Financing Amount

- Loan/Financing Period (Tenure)

RinggitPlus also suggested banks, non-banks, and licensed loan providers that offer personal loans with low interest rates and online loan applications.

RinggitPlus simplified the terms with comprehensive descriptions and provided differences between various types of personal loans, such as conventional and Islamic loans.

This information was repurposed into a static infographic and video, which Involve Partners could use to provide a better understanding of personal loans to their followers.

Results – Increased sign-ups for personal loans

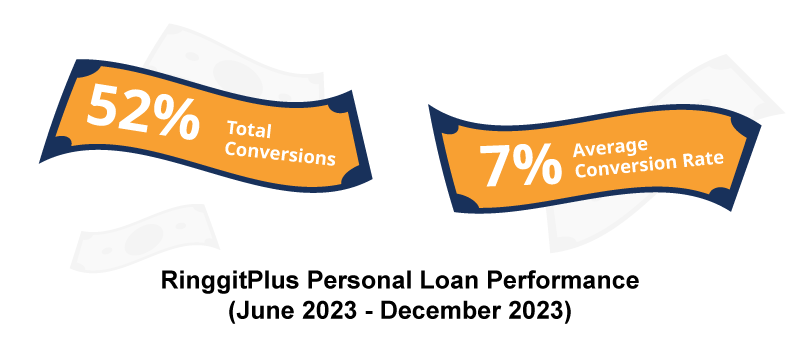

Within seven months, Involve Partners drove 52% conversions with an average conversion rate of 7%, leading to increased personal loan applications on the RinggitPlus’ website.

Social and Content were the highest performing Involve Partners who promoted and earned conversions due to engaging content that resonated with followers’ approaches in applying for personal loans.

Financial education & resources online, based on external factors such as inflation, market rates, and innovative technology, were made easily accessible through credible Influencers and Content Creators, helping individuals make informed decisions in managing their finances.

Looking to drive leads & sales on your website through affiliate marketing? Sign up as a Brand at Involve Asia, and our team will reach out to you to provide support and strategies to build & retain your business growth in the long run.