In this White Paper, we explore how travel influencers became one of the top-performing Partner channels that boost significant growth in the travel industry based on the valuable insights we gathered between 2019 and 2023.

We look at the detailed insights exploring travel influencers’ performance (sales and conversions) promoting various travel brands.

To support our data, we delve into the trends of influencers in the travel industry.

- Type of social media platforms used by travel influencers

- Type of promotional travel content

- Monetise travel content

- Travel search trends

- From KOL to KOC: Travel social commerce

- Future of travel influencer marketing

Click on the following drop-down bars to view more in each section of this report.

Travel Influencers Outlook

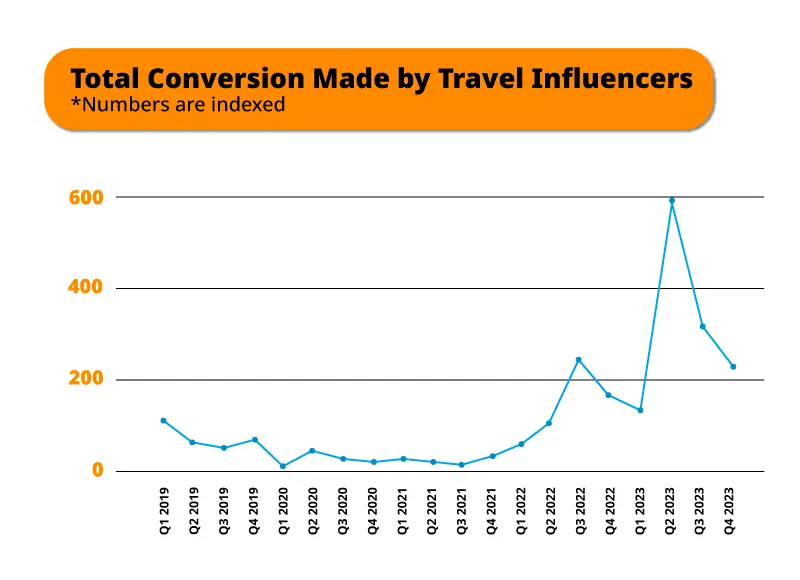

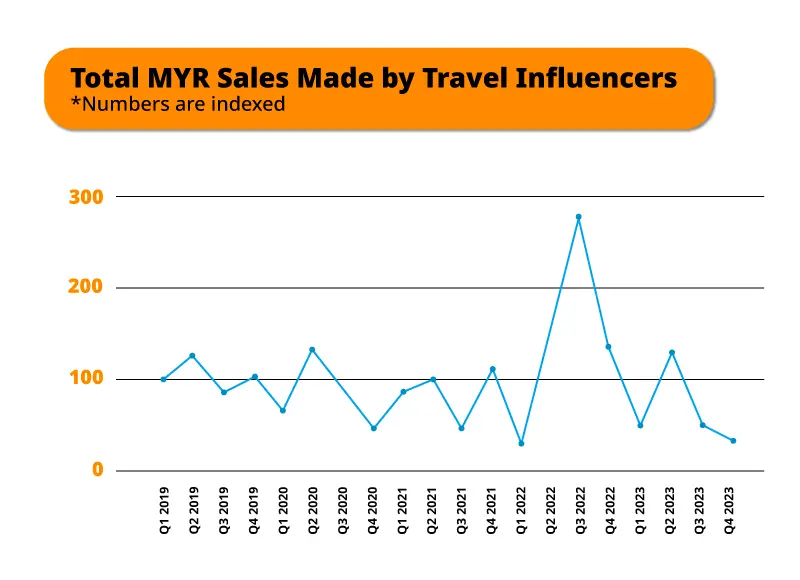

The COVID-19 pandemic affected the closure of borders and travel restrictions across the globe between 2020 and Q3 2021, leading to fewer promotions by travel influencers.

Later on, till the end of 2022, once the borders had been reopened, travel influencers started to pick up on recommending travel deals to their online followers, which led to a 10.4x increase in conversions and a 5.9x increase in MYR sales.

2022 was a significant year as customers returned to reigniting their love for travelling to their favourite destinations.

In 2023, our internal data showed that MYR Sales dropped by 35% due to increased inflation affecting weak currencies and travel fares. Yet, travel influencers continued to promote and drove conversions by 63%.

However, travel influencers at Involve Asia continued to promote exclusive deals based on their followers’ preferences while taking advantage of cost-saving travel plans that entice them to make bookings through their affiliate links.

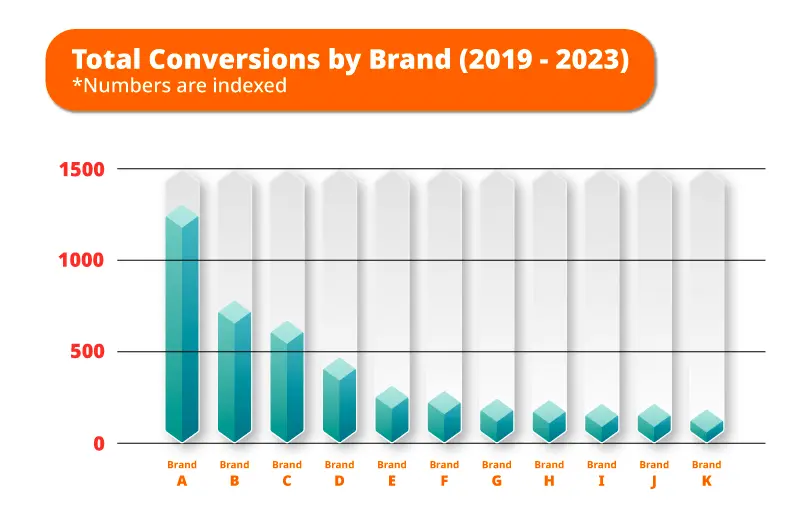

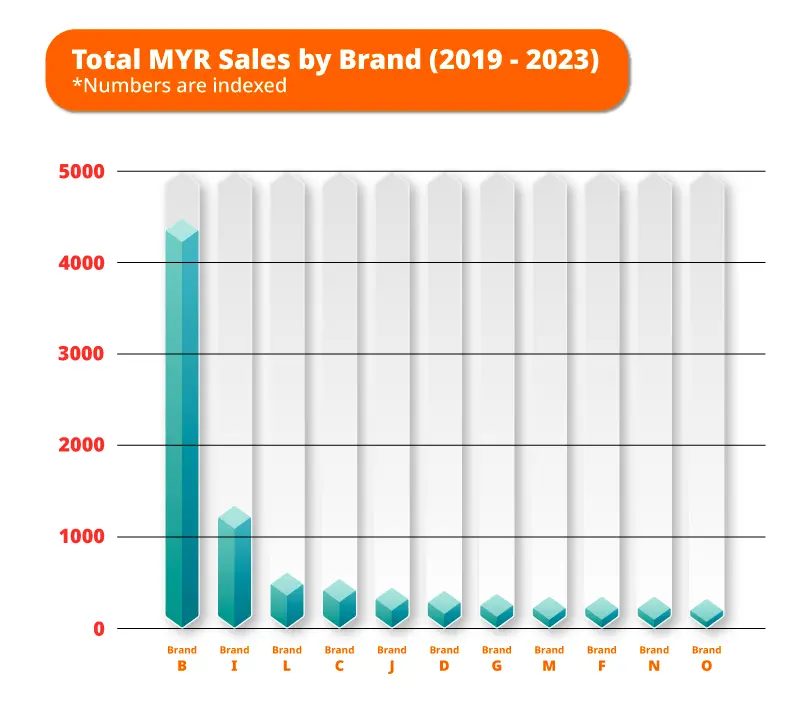

Popular travel aggregators for transportation, accommodation, and travel passes drove the most conversions and sales.

Customers preferred to book domestic and international flights through reliable airlines’ official websites, recommended by travel influencers.

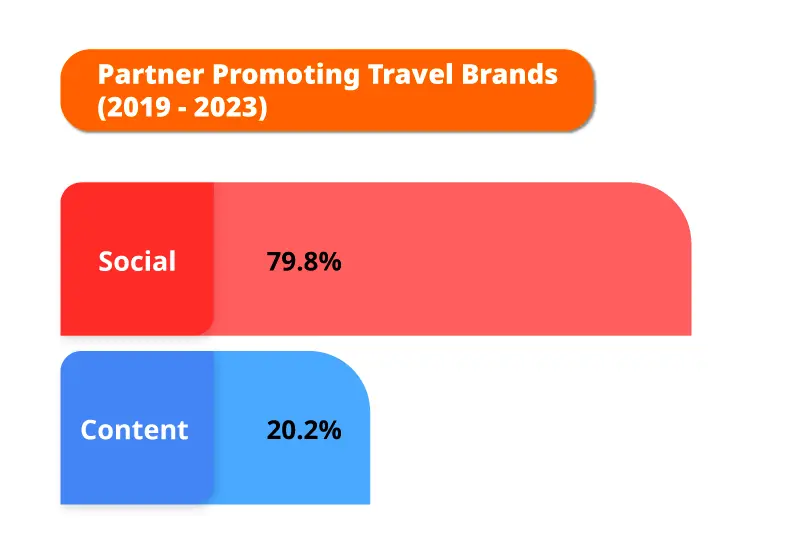

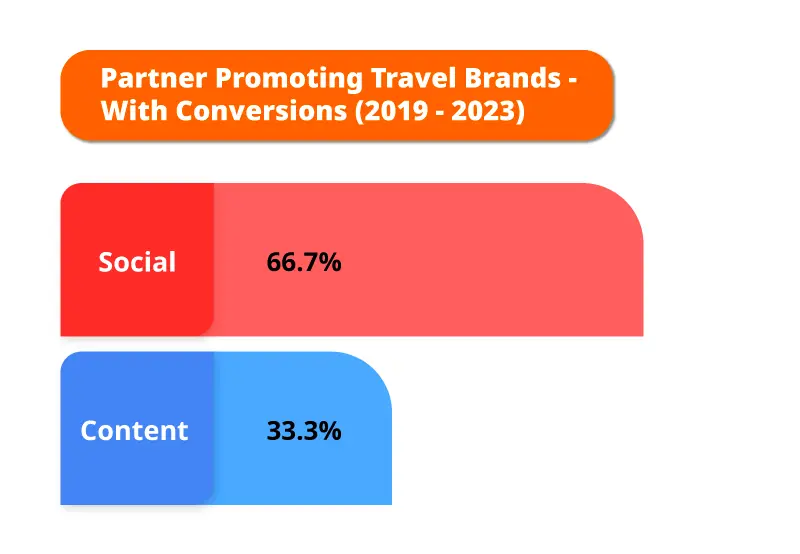

Compared to Content, 80% of Involve Partners had social media platforms where they posted engaging travel content to their followers. 70% of Involve Partners were Social who earned conversions.

Let’s have a look at how travel influencers impact engagement with content and growth in the travel industry.

Type of Social Media Platforms

According to the Tagger by Sprout Social’s 2023 Global Industry Report: Travel Index, Instagram has the highest volume of travel-related posts, with an engagement rate of 1.59%. TikTok has a higher engagement rate of 3.43% with a lesser volume of posts.

Nano and micro-influencers have the highest engagement rates of 6.84%, with small & loyal followers engaging with relevant messages and content.

Regarding followers, 52% were women who engaged more with travel-related content on social media platforms. 70% of followers between 21 and 44 refer to travel influencers as inspirations for making their travel plans.

Social media platforms also become search engines, such as Discovery, which provides personalised travel content into the user feeds based on followers’ engagement with content daily.

Statista reported that 26.5% of travellers used social media to find travel inspiration to plan their trips to destinations or activities. Specifically, 46% of Gen Z travellers use Instagram, while 50% look into Facebook before booking.

Furthermore, travellers use social media to share their visual travel experiences with a compilation of photos and videos.

So, social media is one of the most strategic marketing channels to communicate and engage between brands, influencers, and followers.

Type of Travel Content

Tagger by Sprout Social’s Travel Index further explained that videos are the top-performing content engaged by followers.

TikTok videos had the highest engagement rate of 3.44%, followed by Instagram Reels, with a 2.17% engagement rate. Followers also viewed YouTube videos, which led to an engagement rate of 1.52%.

Static photos and carousels performed well on Instagram, with an engagement rate of close to 1%.

Most of the travel content consists of reviews, a form of user-generated content (UGC) that invites travellers to view influencers’ experiences before deciding to book transportation, accommodation, and activities.

Since the post-pandemic, travel influencers have adjusted their approach to creating content to adapt to ongoing changes by focusing on staycations, throwback travel, and collaboration with other brands outside the travel industry.

By building up a strong online presence on social media in the travel industry, influencers were able to build their growth and engagement with followers and potentially be given opportunities to collaborate with travel brands.

Monetise Travel Content

According to Skift, influencer marketing for the travel industry was estimated to reach USD21 billion in 2023.

Travel influencers produce and share content on their social media platforms as their primary source of income.

For sponsored posts, Meltwater reported that a single Instagram post made by Nano and Micro-influencers can cost between USD 10 and USD 5,000. Nano-influencers charged an average of USD313 for four in-feed posts and one Instagram story, while Micro-influencers received an average of USD780 for the same amount of content.

Crowdriff stated that 73% of brands use influencer campaigns as one of its marketing strategies.

Potential travel influencers were given long-term partnerships with brands by inviting them to sponsored trips and product collaborations. They were also given exclusive promo codes and discounts for bookings. In return, travel influencers shared their travel experience with mentions about the brands to their followers.

In affiliate marketing, Involve Partners with Social earned between RM2,500 and RM18,000 per month based on their strategic approach to posting relevant travel content with deep links to various followers on social media.

Travel influencers earned commissions by promoting travel products and services, such as recommending go-to travel gear, affordable hotels or fun-filled activities.

They signed up for travel affiliate programs which provide:

- Attractive commissions & bonuses

- Detailed campaigns

- Lists of top-selling products

- Creative banners provided by brands

Deep links generated by travel influencers were added to their promotional content through links embedded in their bio and creating click-through links in stories.

Travel brands reached out to some of the top-performing affiliate partners for future long-term collaborations.

Travel Search Trends

Users increasingly relied on social media platforms as search engines by using travel hashtags where they found the most engaging posts in Discovery to get credible information.

In a TikTok study on #TravelTok community, hashtags #travelhacks (3.3 billion views) and #budgettravel (21.5M views) were frequently used when followers are looking for affordable getaways.

Meanwhile, over 670 million Instagram posts were shared with the “travel” hashtag.

To drive traffic and engagement, travel influencers and brands utilised hashtags based on specific keywords and preferences, such as recommended generic hashtags by widespread usage and specific hashtags by theme or topic (eg. mountains, solo traveller, luxury travel, and adventure travel).

Brands encouraged travel influencers to include campaign hashtags to build brand awareness, engagement, and sales.

From KOL to KOC: Travel Social Commerce

IMAARC report stated that the global social commerce market is expected to grow by 27.9% between 2023 and 2028. Based on the rising travel trends, the social commerce market is forecasted to reach more than USD79.6 billion in sales by 2025.

Meanwhile, travel brands were strategically allocating their marketing budgets for Key Opinion Consumers (KOC) more than Key Opinion Leaders (KOLs) due to the reachability and engagement with loyal followers, tight budgets, and alignment with their branding and business objectives.

Social media followers looked up to Nano and Micro-influencers (under KOCs) who are everyday consumers just like them. KOCs shared their unbiased reviews and experiences with products & services, making them relatable to their followers.

Most travel brands integrated their marketing strategy with KOCs based on the trust and credibility between KOCs and followers related to their brand values at lower costs.

Travel affiliate marketing helped KOCs deliver authentic social media content to their followers, using campaigns highlighting products and services provided by travel brands with lesser promotional suggestions and restrictions.

KOCs promoted relevant offerings to their small number of loyal followers based on their preferences, leading to more payouts based on higher conversions for various travel products and services.

Future of Travel Influencer Marketing

Travel influencer marketing will continue to grow as followers actively engage with nano and micro-influencers’ travel video content, on highly popular platforms such as Instagram and TikTok.

KOCs will repurpose their travel user-generated content on different platforms as it is not a “one size fits all” for audiences with diverse preferences and engagement levels.

With affiliate marketing, KOCs will be given a wide range of products and services with exclusive deals & creative banners by travel brands that enable them to create niche travel content with trackable deep links.

Data and analytics through deep links will become more reliable for brands and travel influencers for measuring the campaign’s effectiveness and understanding the audience behaviour based on touchpoints and user journeys, enabling them to optimise their strategies effectively.

We hope this report gives you detailed insights into how influencers impact the travel industry and their use of affiliate marketing for growth.

Interested to be part of the affiliate marketing journey with Involve Asia?

Contact our Account Manager or Programme Manager for more details.