Involve Key Stats 2022 looks into the full-year trend and performance of our Advertisers and Partners, compared to 2021.

We look into the key performance indicators (clicks, sales, and conversions) by countries across Southeast Asia, including the product categories Partners promoted, the audience’s online purchasing behaviours, double-date sales, and top-performing Partners.

We also look into the following sections to further understand the overall performance:

- Travel brands

- Financial brands

- 11.11 Sales

- 12.12 Sales

In 2022, top-performing categories and campaigns, including double-date sales, contributed over 4.6 Billion clicks & 23 Million conversions and drove more than USD214 Million in total sales in Malaysia, Indonesia, the Philippines, Thailand, Singapore and Vietnam.

Home & Living, Health & Beauty, Electronics, Women’s Fashion, and Travel were the top 5 categories that drove the most sales and conversions during off-peak sales and peak double-date sales in 2022.

Double-digit sales during Q3 & Q4 2022 boosted high performance in terms of clicks, sales and Partners’ participation.

Ad networks, coupons, content creators, influencers and loyalty networks increased the total of conversions and sales in 2022. They actively promoted Home & Living, Groceries & Pets, Women’s Fashion, Electronics, Health & Beauty, and Travel brands.

Click on the following drop-down bars to view more in each section of this report.

Introduction

We look into the key affiliate marketing trends that brought significant growth in 2022:

- 50% investment placed on collaborating with diverse affiliate partners

- Travel & finance brands continue to grow YoY by 20%

- Increased by 76% in sales after watching virtual livestream

- 22% YoY increase in mobile shopping app usage

- Data-driven strategies – up to 23x increase in companies’ overall performance

50% Investment Placed on Collaborating with Diverse Affiliate Partners

“Most brands put 50% investment on loyalty programs, rewards & cashback, vouchers, rebates, and coupon publishers that brought better performance in consumers’ online shopping experience.” – Performance Marketing Industry

Brands expand their collaborations with Partners beyond influencers and content creators to create more opportunities for them to promote their products and services.

Diversifying affiliate Partners drives higher average order values (AOV) and conversion rates via new & existing revenue streams and engaging with a broader audience.

Therefore, creating and building long-term relationships with various affiliate Partners is vital to driving awareness, sales & revenue.

It’s a win-win benefit for both brands and affiliate Partners!

Travel & finance brands continue to grow YoY by 20%

“ A recent survey of more than 1,200 senior marketers showed that 95% of leading retail, travel and personal finance brands had performance partner programs in place. ” – Partnerize

The COVID-19 pandemic has impacted travel & finance brands to pivot their strategies to find better opportunities while staying afloat through uncertainties for the past two years.

Travel and finance brands are some industries that adapt to unforeseen changes and implement their strategies based on trends & customer base.

Travel brands, including flights and accommodations, are reaching out to new & existing customers and encouraging them to get back on their feed for travelling by recommending popular destinations with amazing deals.

At the same time, COVID-19 travel restrictions are still considered while doing their utmost best to provide comfort and convenience for fellow travellers.

Finance industries continue to create solutions for customers searching for credit cards and personal loans with the best deals available. In addition, digital banking services and financial comparison sites ensure hassle-free online applications for financial products.

Increased by 76% in sales after watching virtual livestream

“Customers often make purchases online after watching live streams virtually, which increased 76% in sales worldwide.” – Statista

As the trend of being connected is on the rise, more people are inclined to spend their time watching and making online purchases through Livestream shopping.

This mindset-changing approach for online marketplaces has created a win-win situation for both consumers and sellers.

Consumer behaviour has driven more sales growth, which creates the tension of impulsive purchases by giving a better engagement.

Online marketplaces such as Shopee and Lazada have used Affiliate Marketing to increase their products’ sales.

Many brands work with influencers, or content creators who have many followers, to promote their products on live streaming platforms.

A common way for brands to encourage customer loyalty is by giving out promo codes, running giveaways, and hosting contests through webinars and live events.

22% YoY increase in mobile shopping app usage

“We foresee that the total number of mobile shopping app visits will increase 22% year-on-year to 450 billion.” – Data.ai

Due to the pandemic, people have turned more to buying products through mobile apps.

Mobile apps allow Advertisers to

- Build brand awareness,

- Increase sales,

- Stay in touch with loyal customers

Today’s most significant challenge for Advertisers is providing a user-friendly interface for customers who prefer online shopping through their mobile devices.

To keep the customers returning, Advertisers need to ensure that their apps are easy to use and stay on top of the latest e-commerce trend.

Mobile app optimisation is beneficial as it is easier to navigate the app browsing experience for any user visiting the site.

Data-driven strategies – up to 23x increase in companies’ overall performance

“Companies using data-driven strategies increase 23x in acquiring customers, 6x for retaining customers, and 19x more profitability.” – Mckinsey Global Institute

Brands continue to rely on complex data, which gives them a deeper understanding of their target customers’ journey and affiliate partners’ promotions on various platforms.

Using reliable data monitoring tools for tracking campaigns’ performance, the robust insights help brands adjust their affiliate programs, including commission rates and campaigns, that cater to niche affiliate Partners with minimal effort.

Data also plays a vital role in identifying potential affiliate Partners brands would like to collaborate with in long-terms.

Therefore, incorporating data into the affiliate marketing strategy enables the build-up of brand exposure, target audience & affiliate Partners portfolio, attribution based on traffic, sales & leads, and revenue.

2022 Key Stats

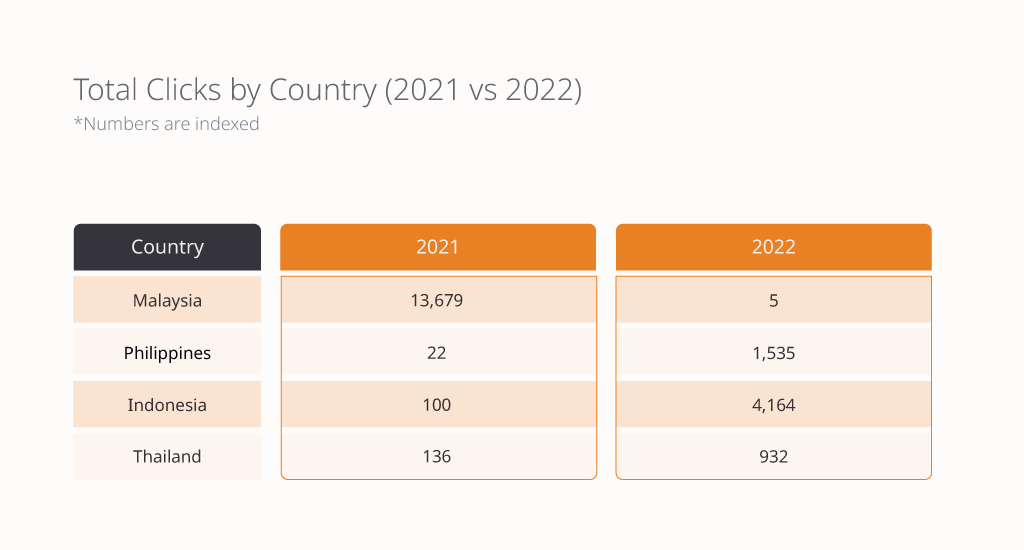

We analysed our data by looking at the number of clicks on Partners’ affiliate links to determine how effectively Partners’ audiences generate sales for Advertisers.

We also looked into the performance of Involve to our Partners and Advertisers in terms of contributing to conversions and sales by country across Southeast Asia.

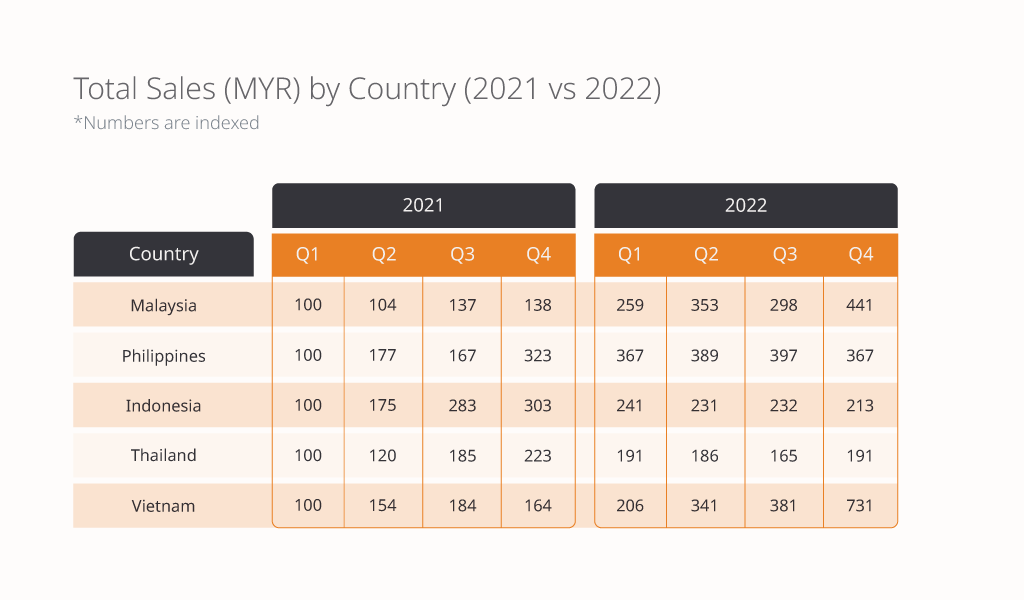

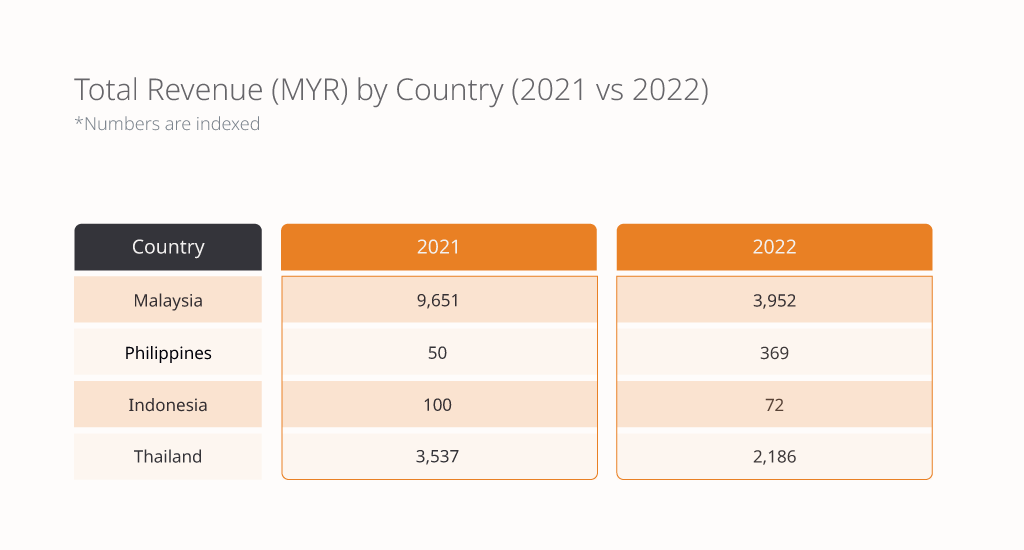

Total Sales (MYR) by Country

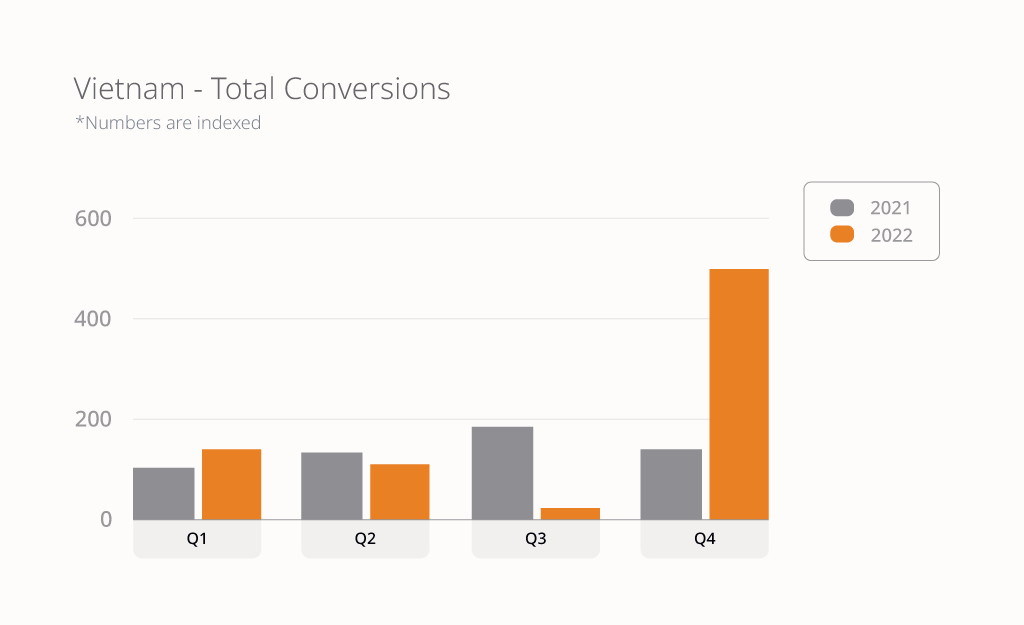

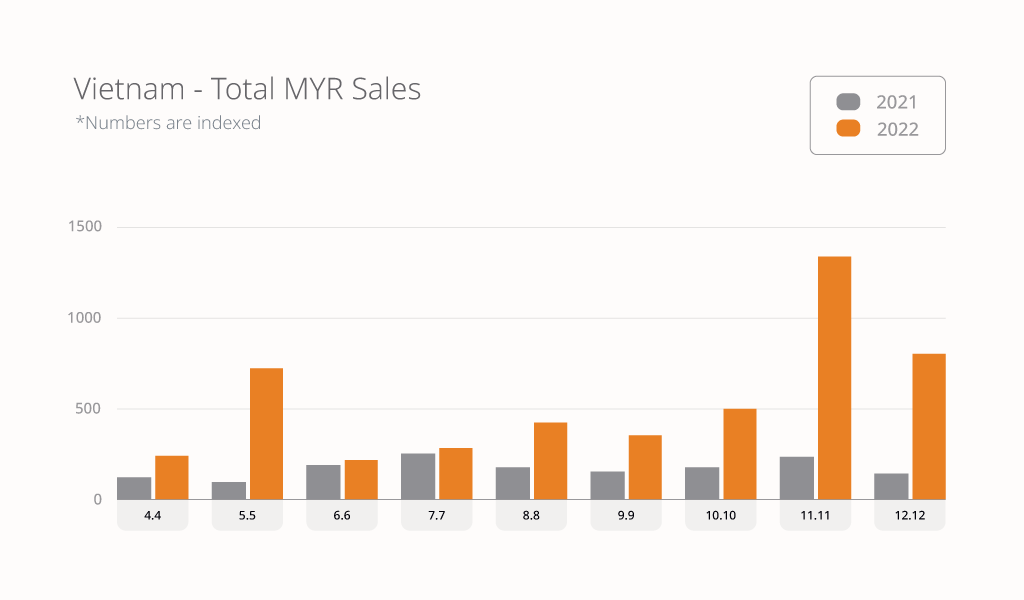

- The total sales in Vietnam during Q1, Q2 & Q3 showed a slight increase in performance. The number grew by 4x in Q4, making 2022 a huge success for Vietnamese Advertisers.

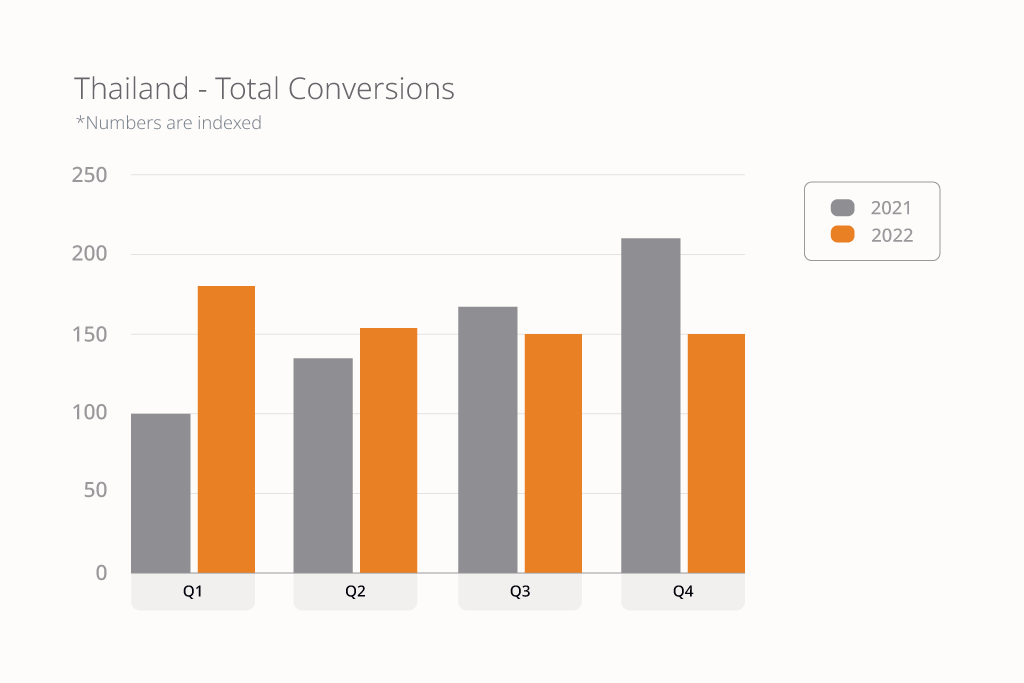

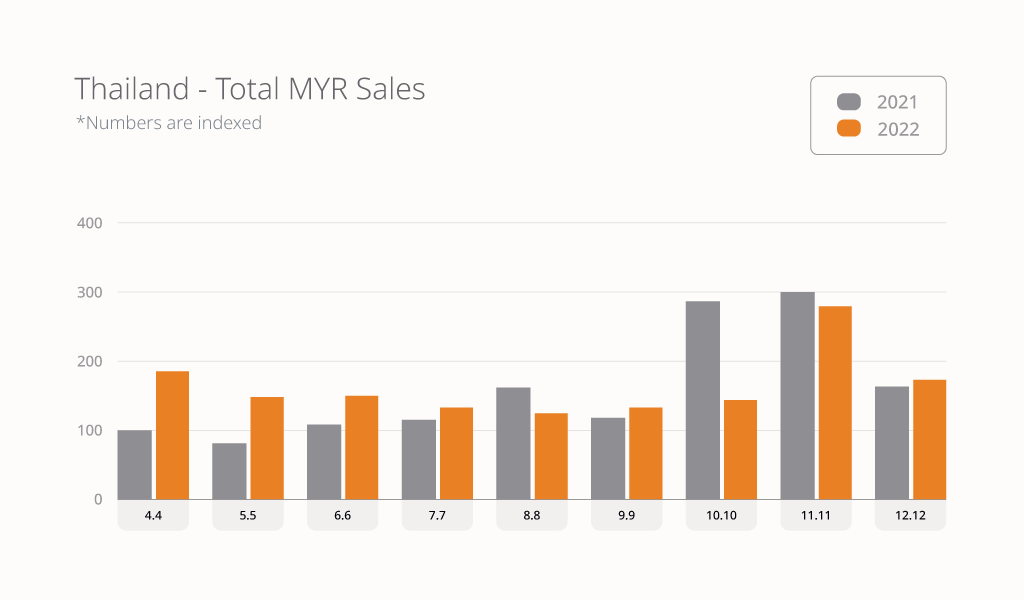

- There was a 91% increase in sales for Q1, between 2021 and 2022, in Thailand. 55% increase in sales can be seen in Q2 while Q3 & Q4 show a slight decrease in sales for 2022.

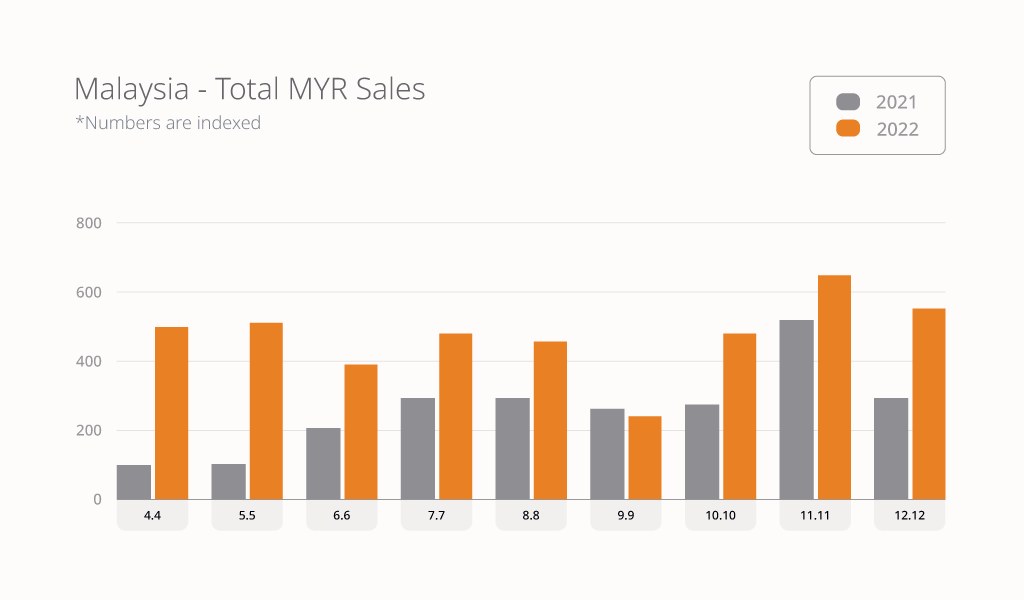

- In Malaysia, 3X increase in sales were reported for Q1 & Q2 of 2022 while the sales increased by 2X in Q3 & Q4 of 2022.

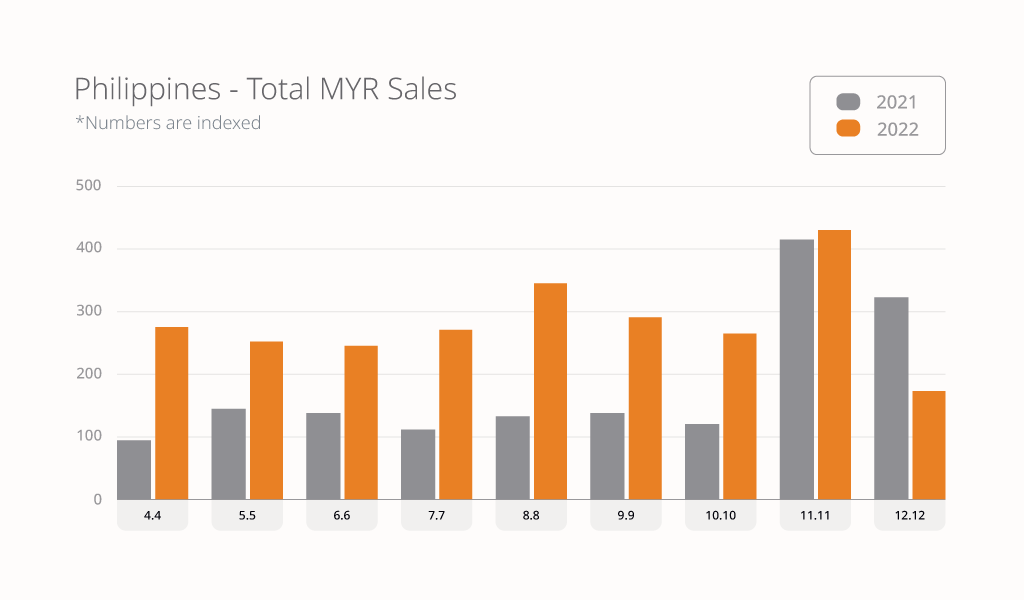

- In 2022, total sales in the Philippines increased close to a 3X increase from Q1 to Q3 followed by a 2x increase in sales for Q4.

- For Indonesia, the first half of 2022 reported an incremental number of sales generated for our Advertisers in Indonesia. Sales increased by 2X by 10 Million MYR over the first two quarters of 2022.

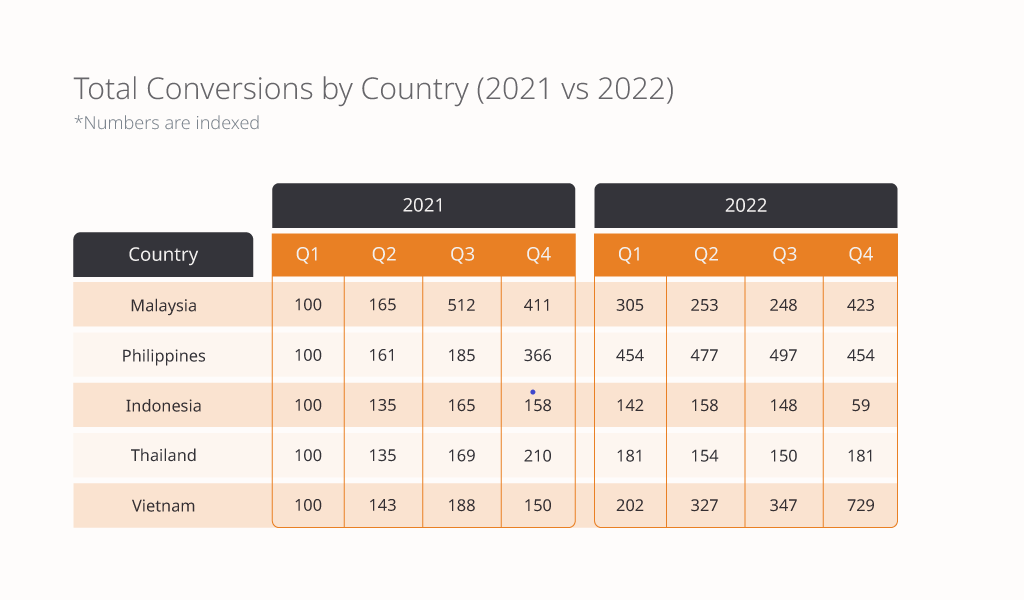

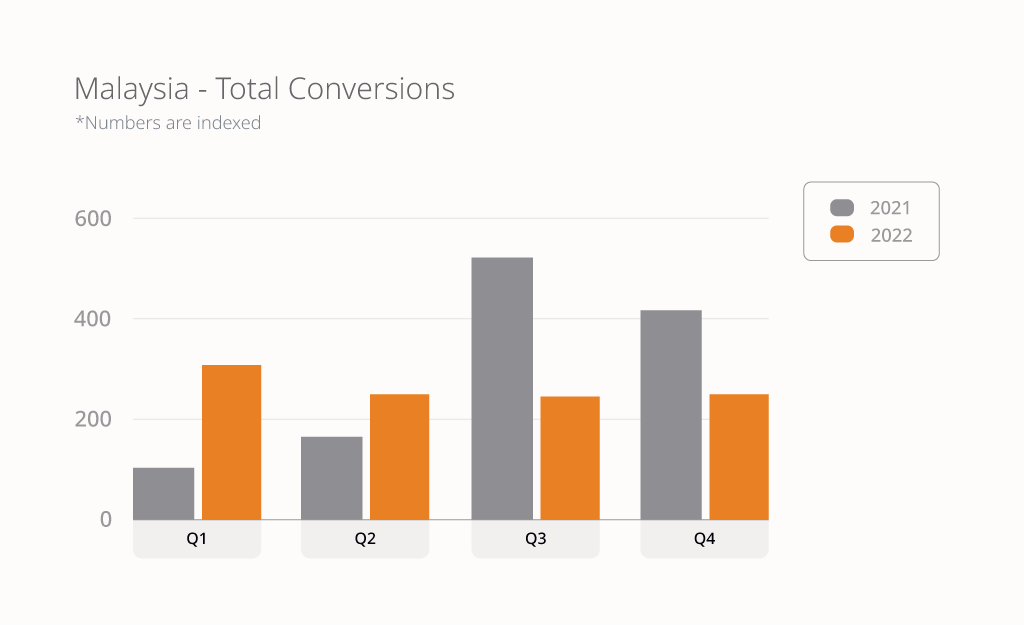

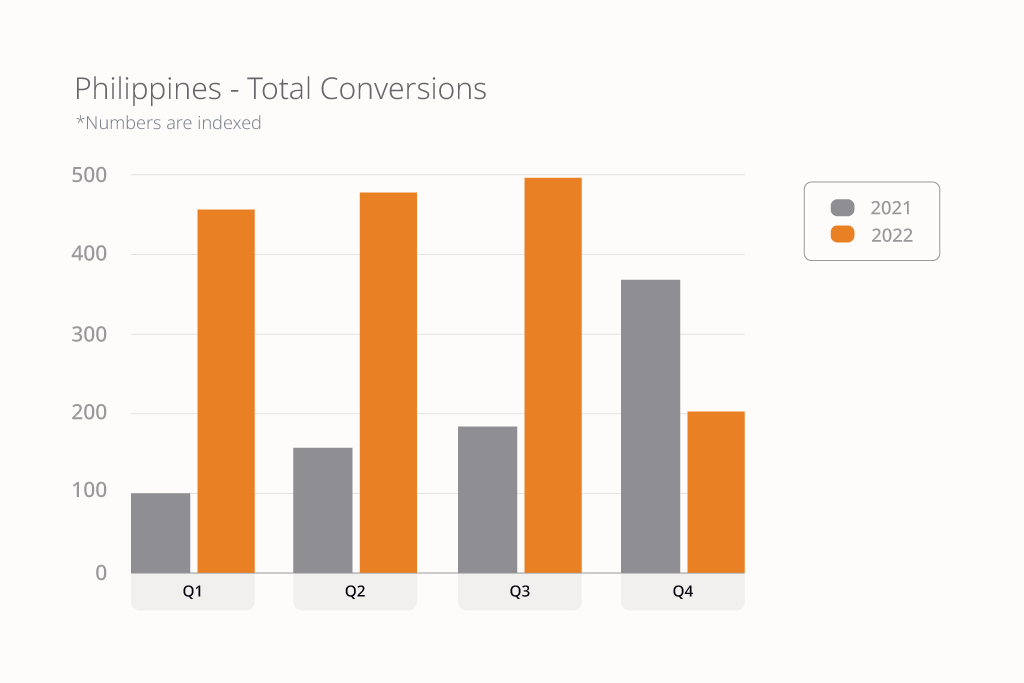

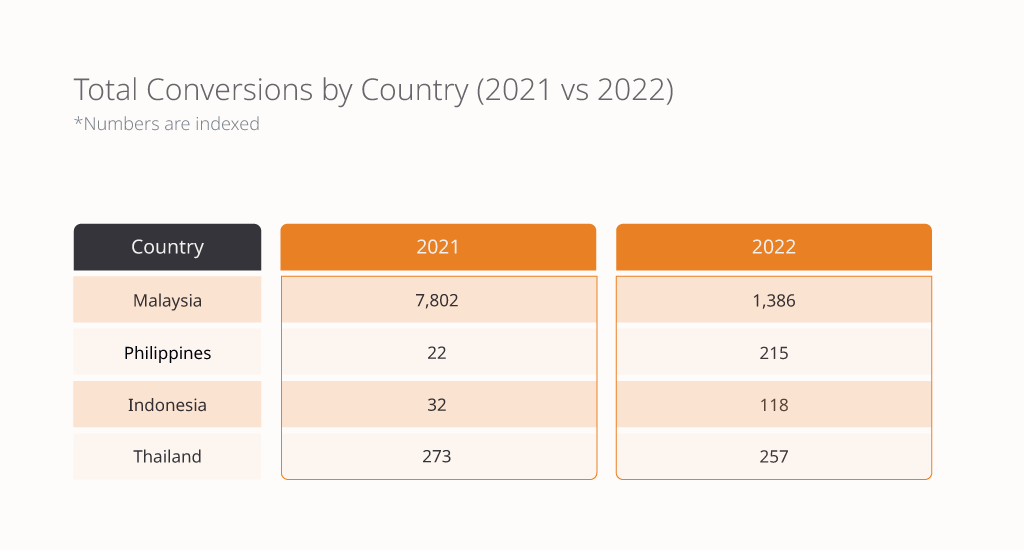

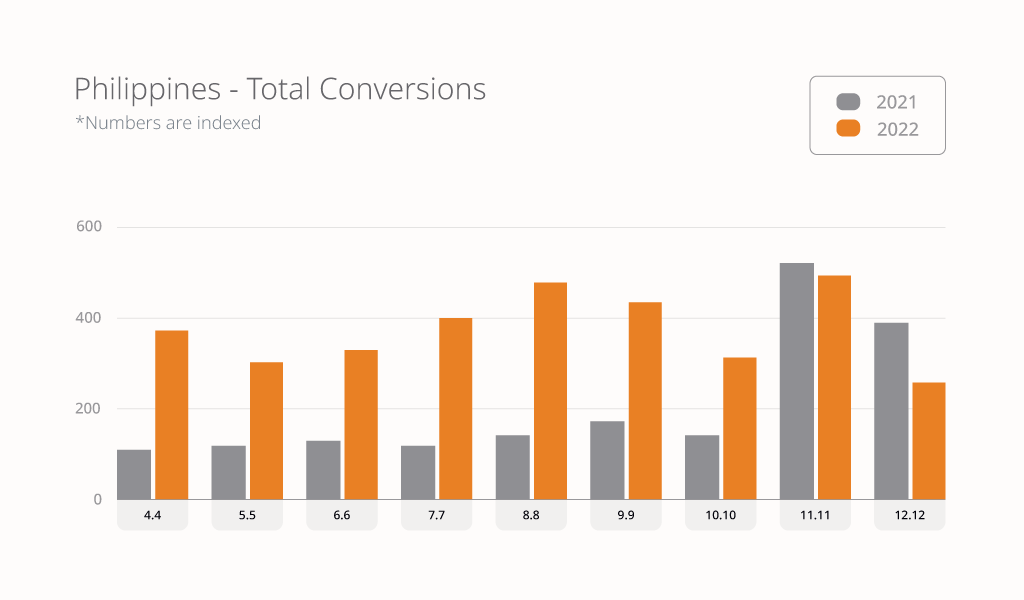

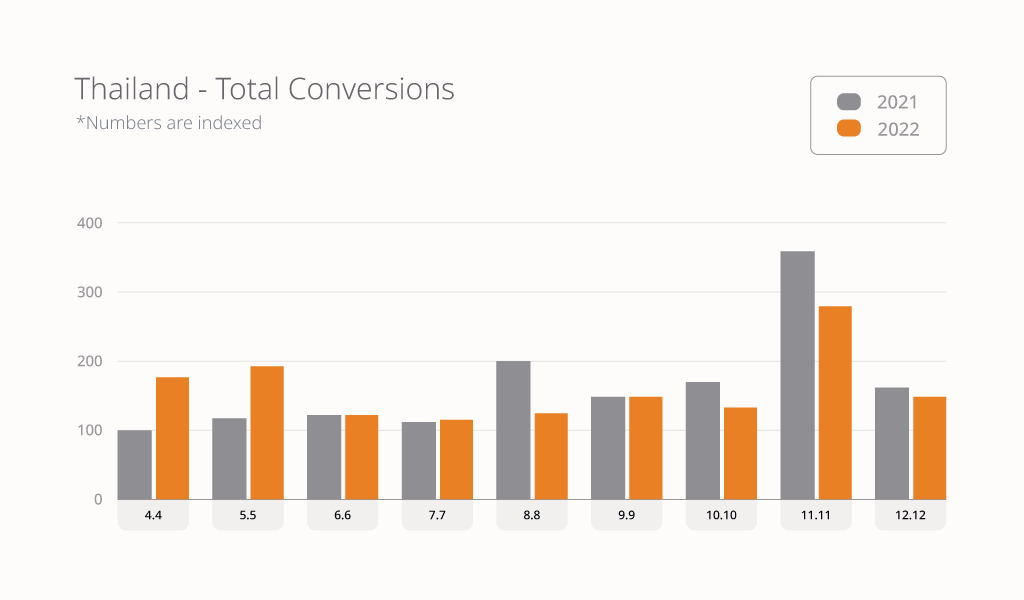

Total Conversions by Country

- Conversion rates in Thailand jumped to 81% in the first quarter of 2022.

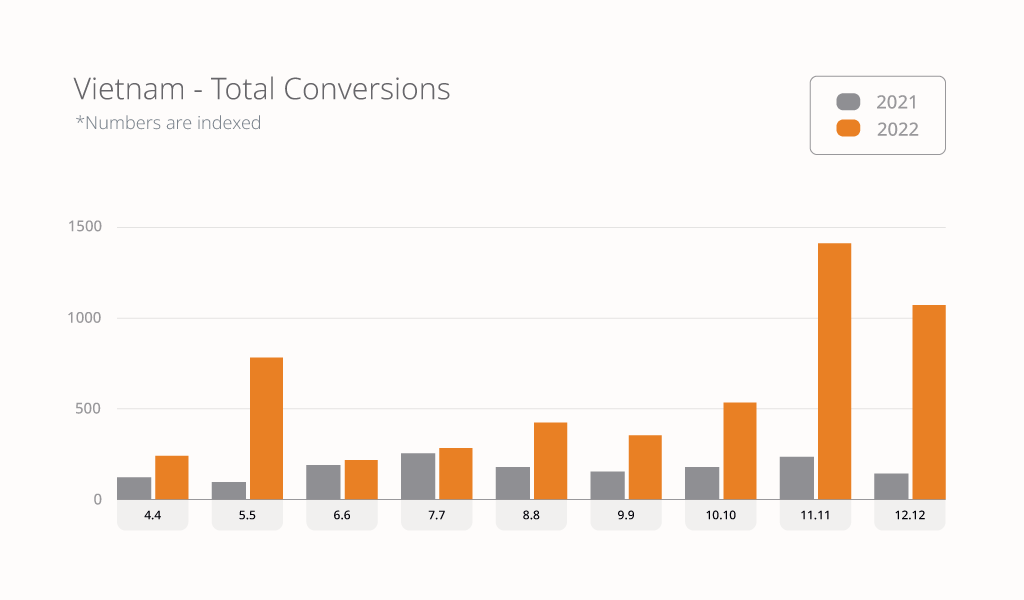

- In 2022, there was a significant increase in sales, conversions & clicks for each quarter and a 4x growth overall for Q4 in Vietnam.

- There was a 3X increase in conversions for Q1 2022 in Malaysia. In 2022, there was a 2X increase in conversions for Q2, a significant decrease for Q3, and followed by a slight increase for Q4.

- The total conversions in the Philippines reported a close to a 3x increase from Q1 to Q3, and for Q4, there’s a 2X increase in conversions.

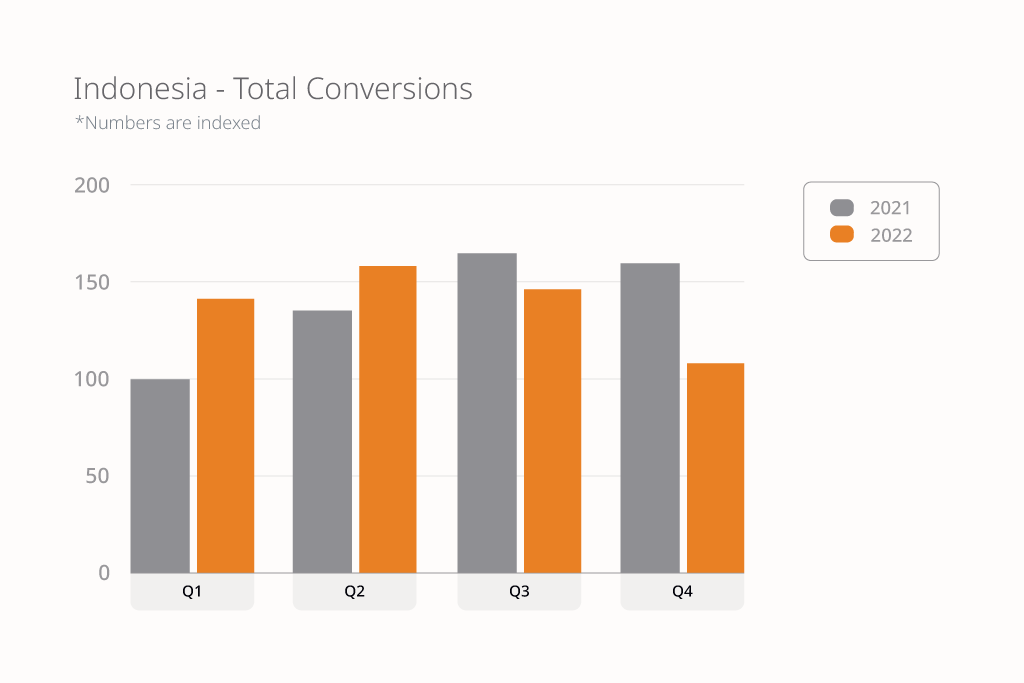

- In Indonesia, there was a 42% increase in conversions for Q1 & a 23% increase for Q2 compared to the total conversions in 2021.

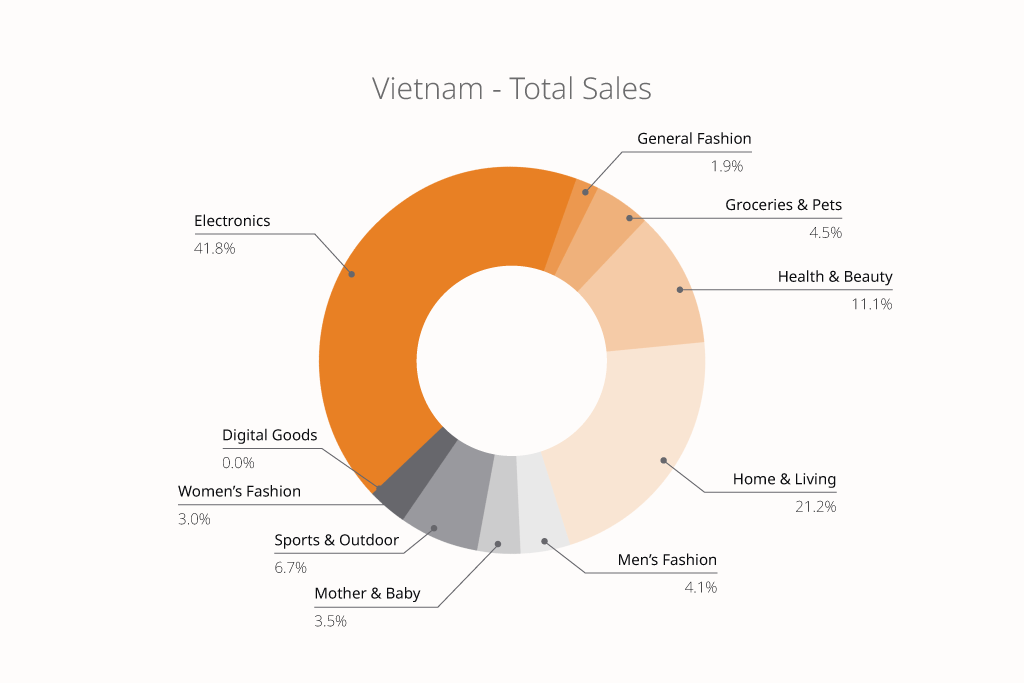

Category Performance

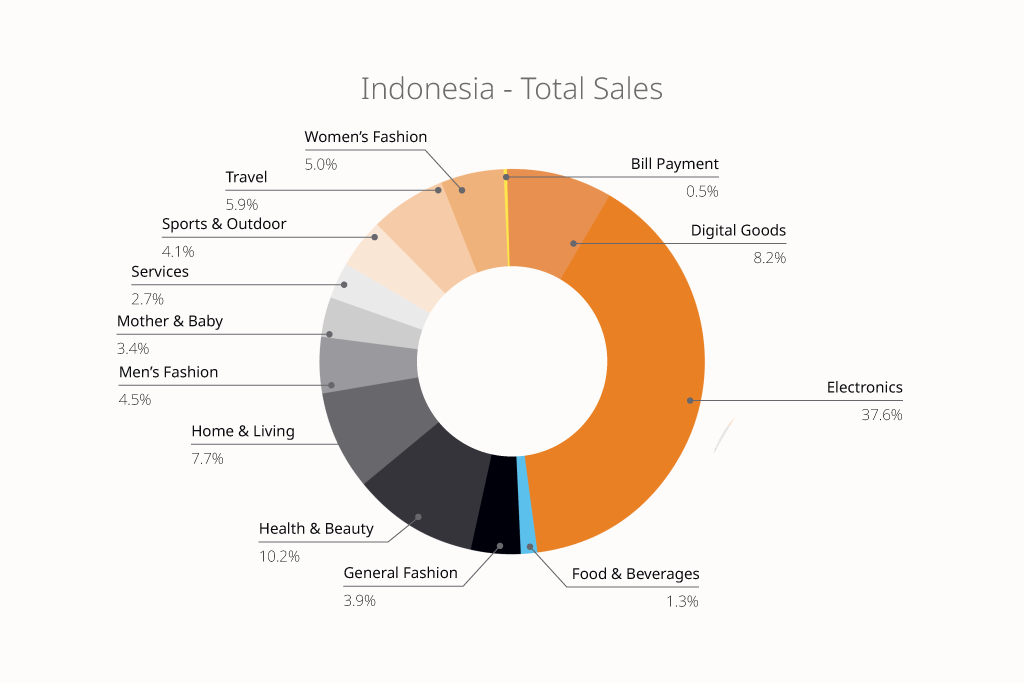

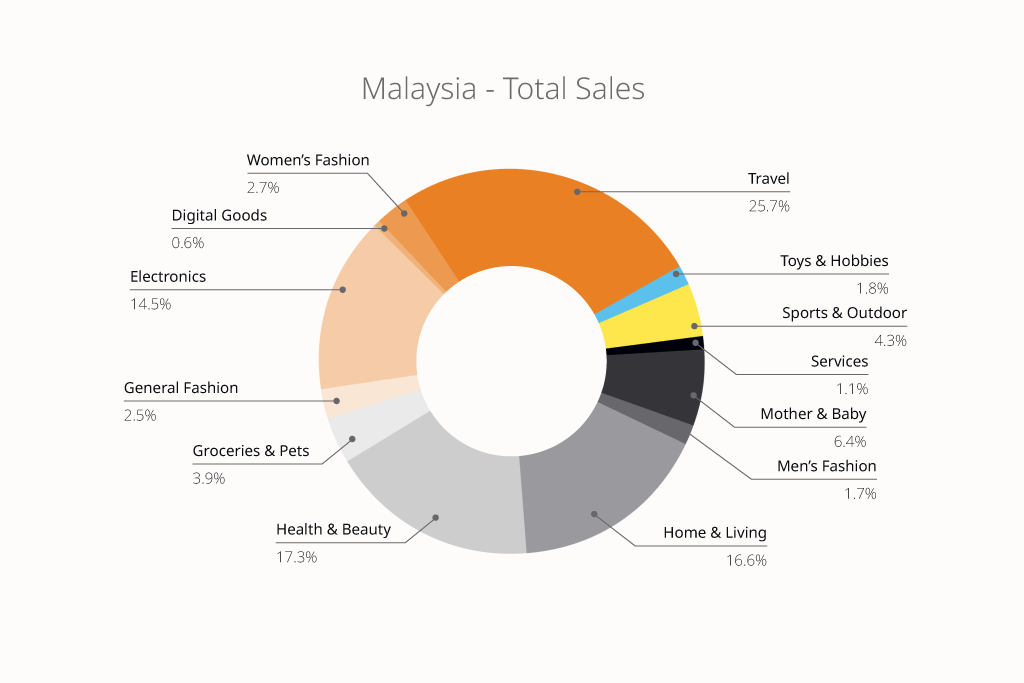

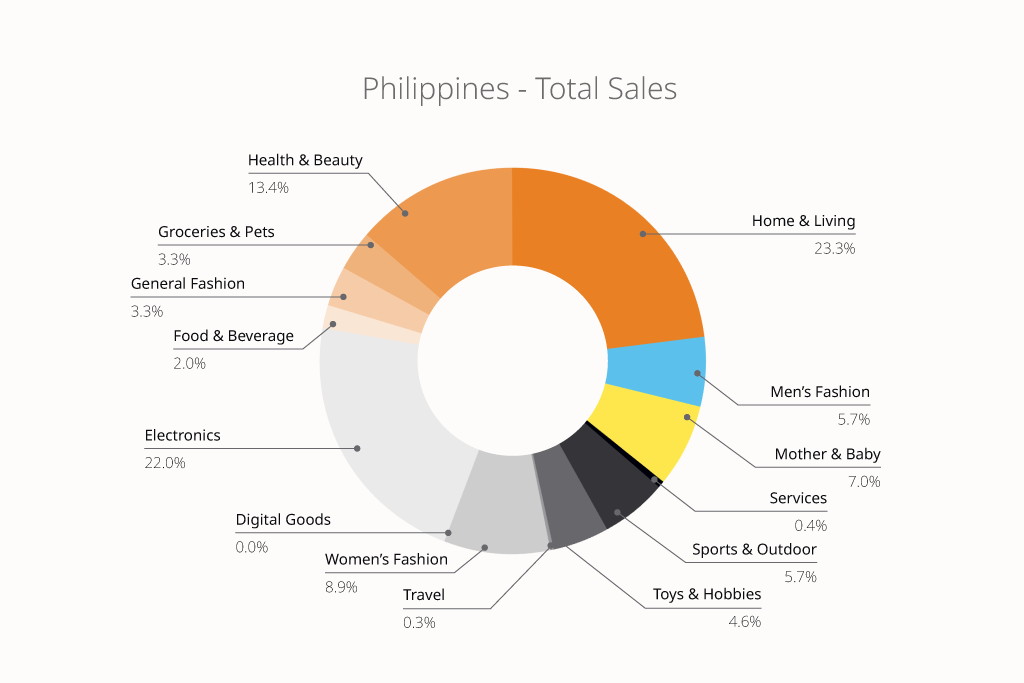

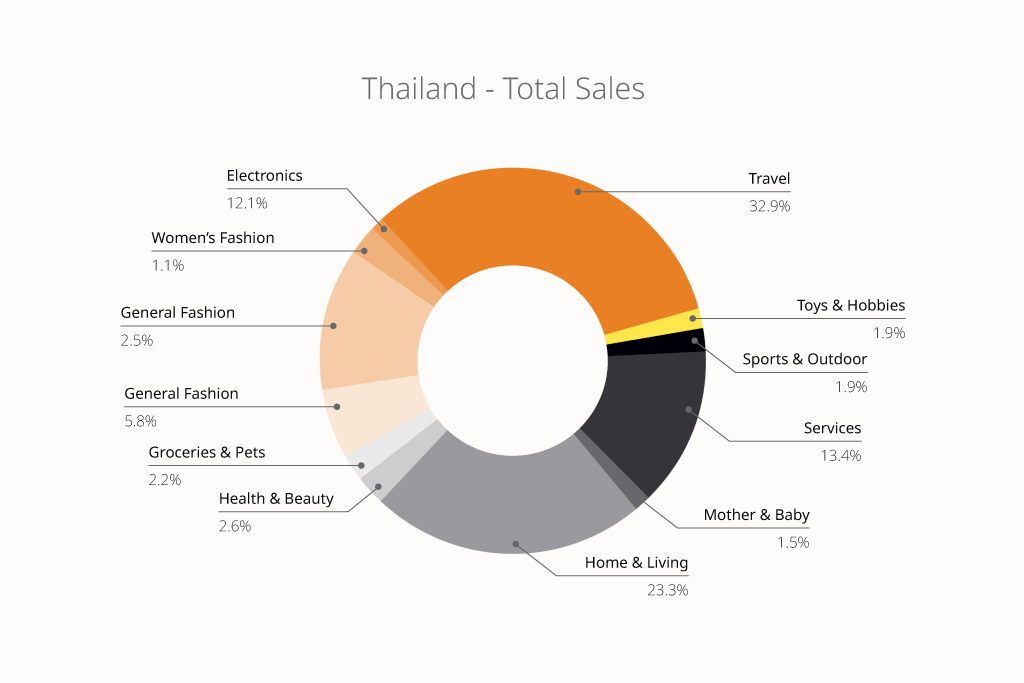

Involve’s seamless technology successfully captured the overall performance based on customers’ online shopping journeys that contributed to the total conversions in Malaysia, Indonesia, the Philippines, Thailand, and Vietnam, for top-performing categories and Offers in 2022.

Comparing 2021 and 2022, total conversions significantly increased to 90 Million conversions (4.5x more) gathered on Involve’s platform. The total number of conversions for 2022 includes the double-date sales from April 2022 to December 2022.

The engagement with double-date sales continues to grow, encouraging brands to implement better strategies with special deals for new & existing customers. At the same time, brands consistently adapt to the evergoing changes alongside their competitors in the e-commerce industry.

Total Conversion

Partners in Indonesia drove more conversions in Q1 and Q2 2022 during Ramadan.

- Home & Living

- Health & Beauty

- Women’s Fashion

- Electronics

- Toys & Hobbies

Partners’ promotions led to a high total of conversions for Q1 and Q2 2022 during the Ramadan and Chinese New Year season.

New & Existing customers mostly did online shopping at Shopee and Lazada in the following top-selling categories:

- Home & Living

- Health & Beauty

- Groceries & Pets

- Toys & Hobbies

- Mother & Baby

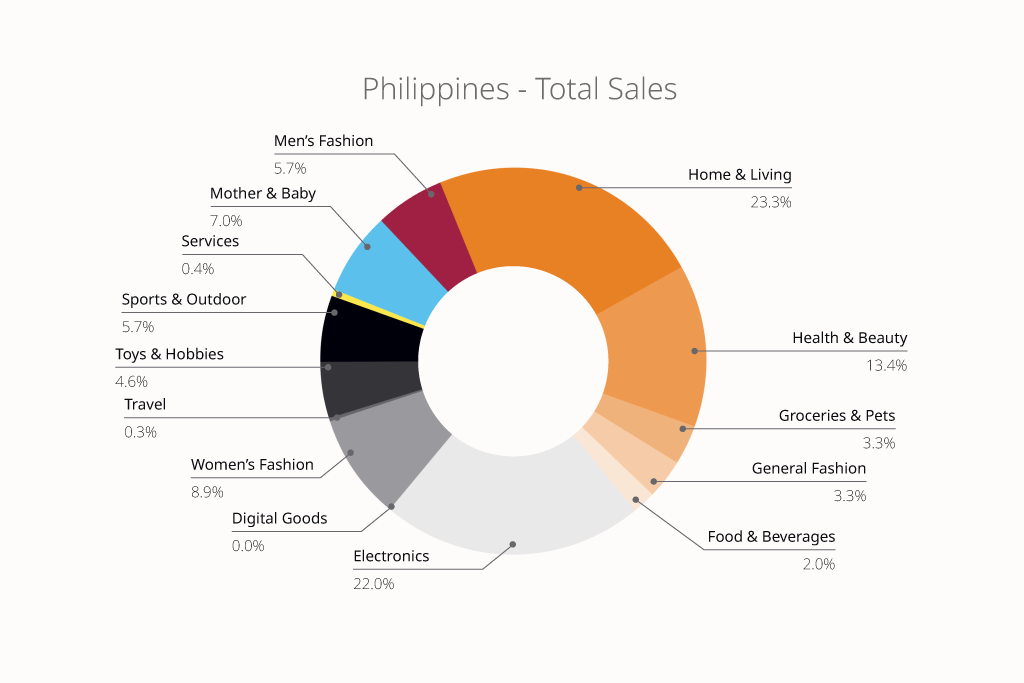

Philippines Partners drove the highest total conversions throughout the first three quarters of 2022 by promoting these categories from Shopee and Lazada to their target audiences:

- Health & Beauty

- Home & Living

- Women’s Fashion

- Electronics

- Mother & Baby

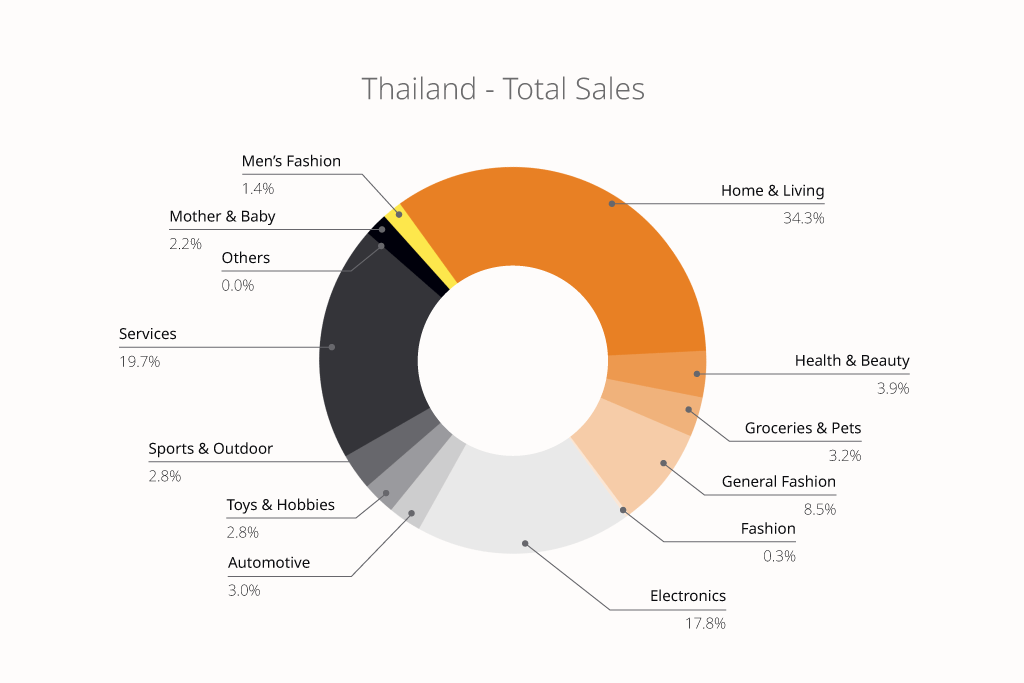

Involve Partners in Thailand actively drove more conversions in Q1 and Q2 2022. They consistently promote the following top-selling categories to their target audience:

- Services

- Home & Living

- Health & Beauty

- Groceries & Pets

- General Fashion

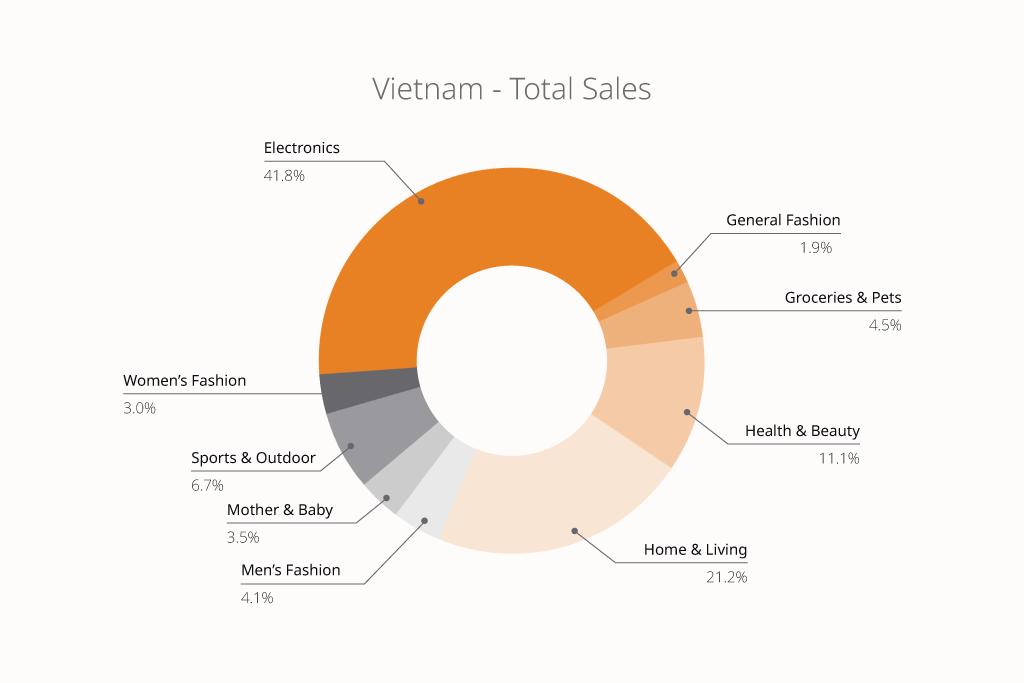

Partners who have traffic in Vietnam drove the highest total conversions in Q4 2022, where New & existing customers purchase recommended products during non-peak and peak sales, such as Christmas, Black Friday, Cyber Monday, and year-end sales.

Online Shoppers mostly bought items on Shopee & Lazada in the following top-selling categories:

- Health & Beauty

- Home & Living

- Men’s Fashion

- Electronics

- General Fashion

Travel Brands

The travel restrictions for the COVID-19 pandemic were lifted in 2022, leading for travel brands (flights, accommodations, and activities) pivoting their strategies by providing packages with exclusive deals for popular destinations.

- Customers made flight bookings at the point of sale* Malaysia’s and Thailand’s national carriers – Malaysia, Thailand, Singapore, Australia, US, UK, and India

- These national carriers shared ongoing exclusive promotions with special deals based on the popular cities around the world, such as Malaysia, Thailand, US, UK, and more

*Note: “Point of sale” is flight from destination

Finance Brands

Customers in Southeast Asia were starting to look for credit cards and loans that provide better benefits in their daily lifestyle, including online shopping, which gives cashback and discounts for credit card holders.

Finance brands find ways to provide seamless solutions to apply for these financial products in convenient platforms.

Most financial brands used cost-per-action instead of cost-per-lead, which Partners didn’t need to wait to receive commissions once banks had approved the customers’ applications.

Customers in Indonesia, Philippines, and Thailand clicked on the Partners’ affiliate links to learn more about the products & services.

In 2022, small conversions were made when new customers successfully signed up for credit cards via Involve Partners’ affiliate links.

Successful applicants for participating credit cards received exclusive gifts.

Financial brands in Malaysia, Thailand, and the Philippines spend less revenue on promoting their products & services once they started using the cost-per-lead commission model.

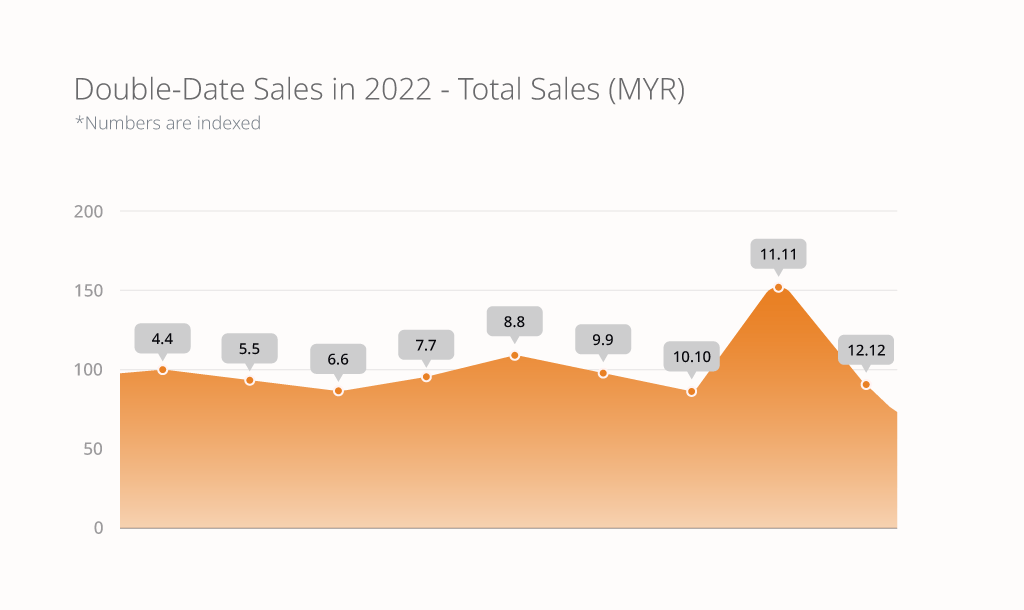

Double-Date Performance

Double-digit sales bring significant growth as more new and existing customers purchase online during pre-sales and peak periods. Involve Partners actively make preparations in running their content to ensure customers swiftly add recommended items to the cart before the big days, boosting traffic, sales & conversions.

Sharing Advertisers’ promotions on Involve Dashboard and marketing communication assets (EDMs, pop-ups & dashboard banners) were most effective for Partners to discover and select promotions they want to feature on their content. Partners were also encouraged to promote double-digit sales by giving them extra commissions and bonus payouts.

Advertisers’ campaigns normally run for 5 – 10 days before the peak day of double-digit sales. It gives Involve Partners a headstart for preparing content to be released, which will build Advertiser’s exposure. Their content includes pre-hype sales, special product highlights and SKUs.

The habit of ‘add to cart’ continues to grow as ‘FOMO’ (fear of missing out) customers do not want to miss the opportunity to purchase recommended products at affordable prices with exciting deals.

Exclusive flash sales & promo codes drive higher order value and conversion rates for Advertisers and Partners during the double-digit sales cycle.

In 2022, total conversions for double-digit sales increased by an average of 11% across Southeast Asia regions.

Key highlights of Double-Date Sales Performance 2022:

- Consistent promotions by Partners drove the most conversions & sales for 11.11 sales as it is one of the largest e-commerce sales in Southeast Asia.

- Black Friday and Cyber Monday also garnered sales for Fashion, Health & Beauty, and Electronics

- 12.12 Sales encouraged shoppers to purchase must-have items for Christmas and Year-end gifts

So Advertisers focus on adding their budgets to double-date sales and highlighting top-selling products based on the customers’ preferences at the e-commerce sites throughout the double-digit sales.

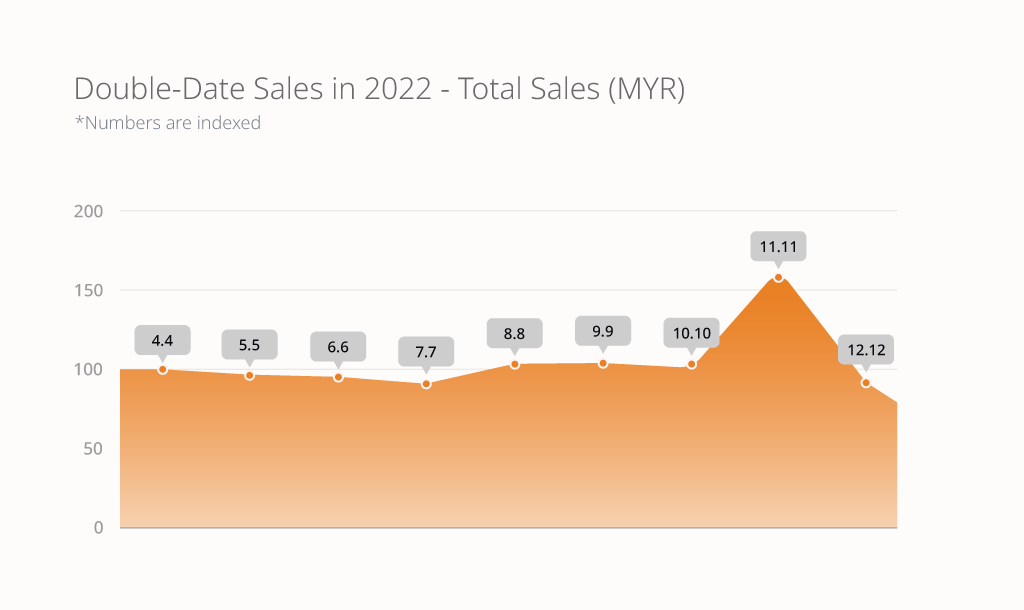

MoM – Sales

- Double-date sales in 2022 saw a steady upward trend in Q2 and Q3 followed by 11.11 Sales that doubled its performance

- 11.11 Sales is the most popular double-date sales, leading to drive the highest total sales among the rest of the double-date sales

- Customers are also engaged in online shopping during the 8.8 Sales, 9.9 Sales, and 10.10 Sales

- Involve Partners received monthly ongoing double-date sales updates via EDMs, featured Offers, pop-up & dashboard banners, giving them options to promote specific brands’ promotions for their target audiences

- Coupon page, with updated exclusive promo codes, helped Partners to increase high order basket value and conversion rate

MoM – Conversions

- The launch of the coupon page provided exclusive promo codes to Partners, leading to higher basket value and conversion rates

- 11.11 Sales is the most popular double-date sales in 2022, which boosted the highest number of conversions due to Partners’ active promotions on their channels

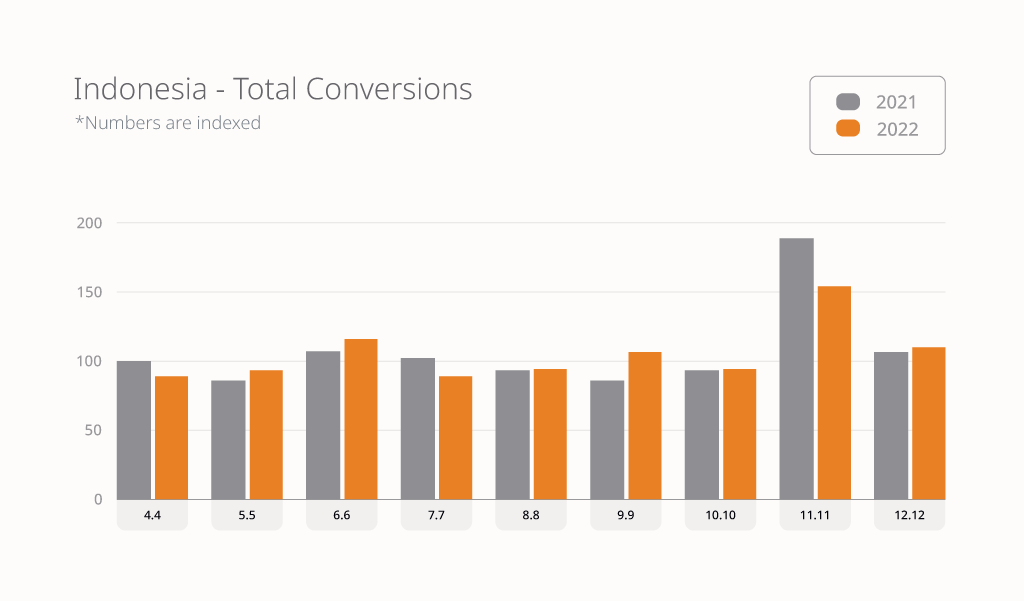

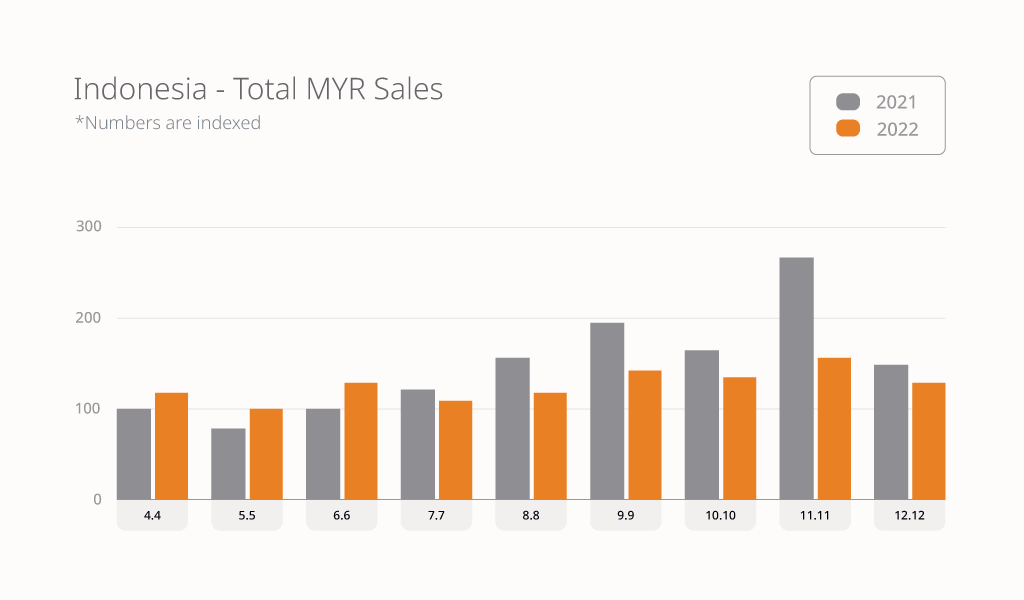

Indonesia

- Between 2021 and 2022, the number of conversions significantly increased by 25% during the 9.9 sales due to the exclusive coupon codes used upon purchase

- Sales garnered a 27% increase for 5.5 and 6.6 Sales as customers made their purchases for the Ramadan season

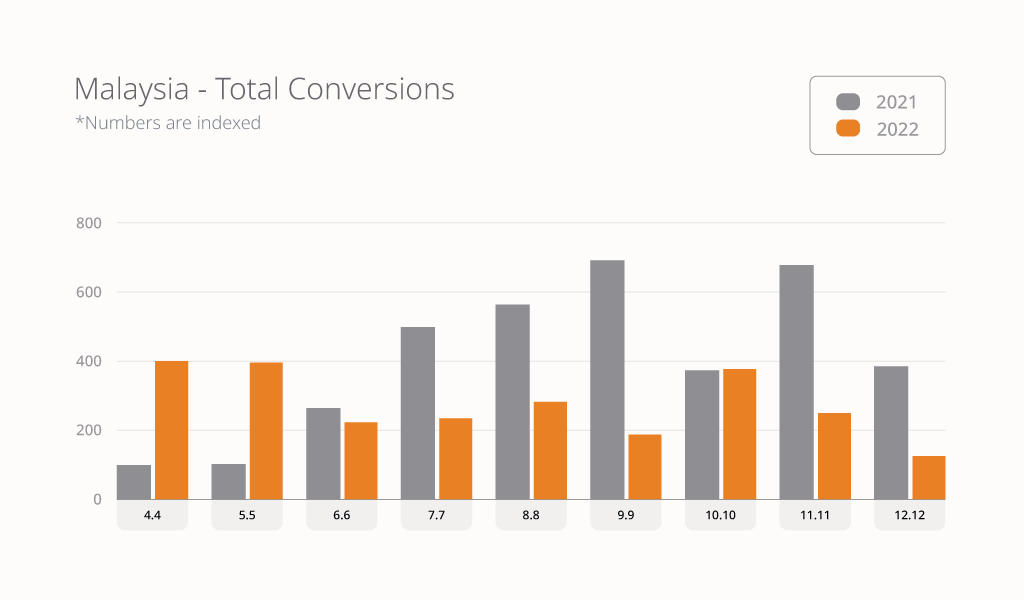

Malaysia

- 4.4 Sales drove a 2x increase of total conversions while 5.5 Sales garnered threefolds of total conversions.

- High conversions during 4.4 Sales and 5.5 Sales happened during Ramadan.

- During Ramadan, promotions drew a 4x increase in sales for 4.4 and 5.5 Sales

- 12.12 Sales garnered a huge growth in sales with a 3x increase as Partners encourage customers to make purchases for Christmas & year-end gifts at affordable prices

Philippines

- The total conversions tremendously increased from 4.4 Sales to 10.10 Sales with an average of 2x increase in 7 months

- Partners’ consistent promotions on their channels led to a high participation of New & Existing Customers doing online shopping at popular e-commerce websites, including Shopee & Lazada, during double-date sales

- High conversions brought huge sales for Q2, Q3, and 10.10 Sales with an average of 2x increase

- Seasonal & thematic promotions led Partners in high participation in driving a 2x increase in sales for 4.4 Sales, 7.7 Sales, and 8.8 Sales

Thailand

- Partners drove more conversions than the rest of the double-date sales in April 2022 and May 2022

- Comparing 2021 and 2022, 4.4 Sales has a 74% increase in sales, followed by a 57% increase in sales for 5.5 Sales

- 4.4 Sales, 5.5 Sales & 6.6 Sales have the highest total sales, compared to Q3 & Q4 2022, with an average 67% increase in double-digit sales for Q2 2022.

- The seasonal sales in Q2 2022 impacted the growth of sales.

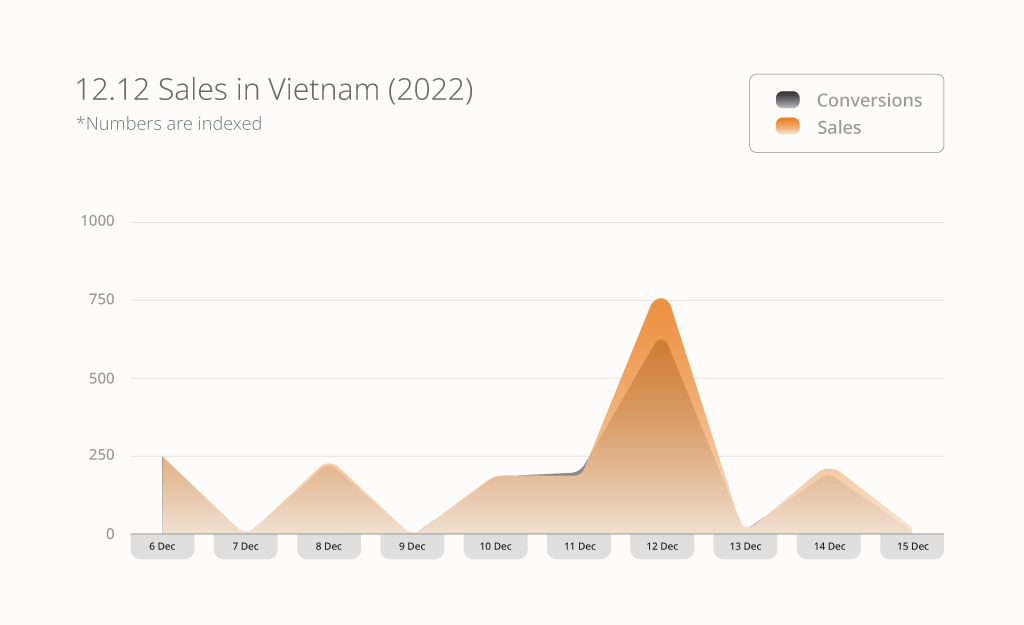

Vietnam

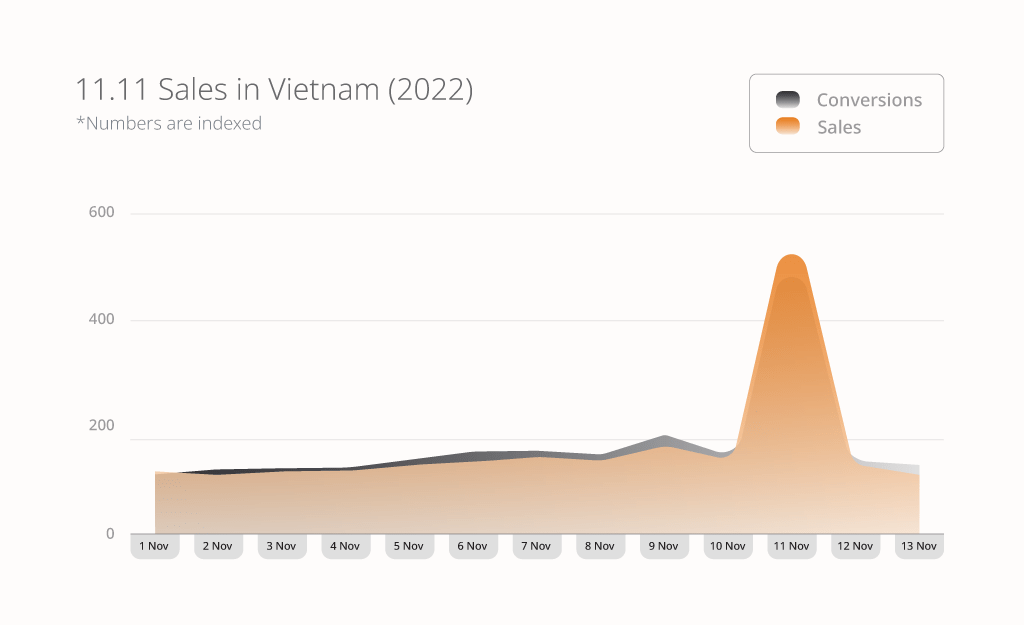

- Total conversions for 12.12 Sales grew significantly in 2022 with a 9x increase, followed by 11.11 Sales with an 8x increase.

- Comparing 2021 and 2022, 5.5 Sales garnered a 10x increase in conversions.

- New & existing customers were starting to make purchases at the brands’ websites via Partners affiliate links during these double-date sales.

- 11.11 Sales dominate with the highest total sales, followed by 12.12 Sales and 5.5 Sales

- Total sales for 11.11 Sales and 5.5 Sales increased by 7x while 12.12 Sales garnered a 6x increase in sales

- This is a fantastic opportunity for Advertisers to reach out to Partners who have huge traffic in Vietnam, where New & Existing customers actively engaged with online shopping

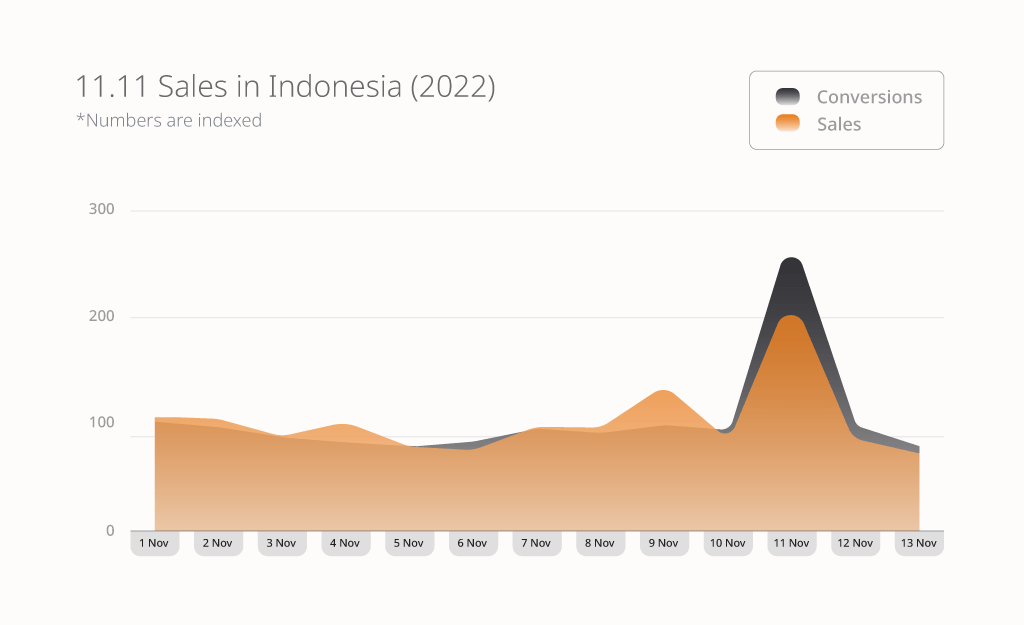

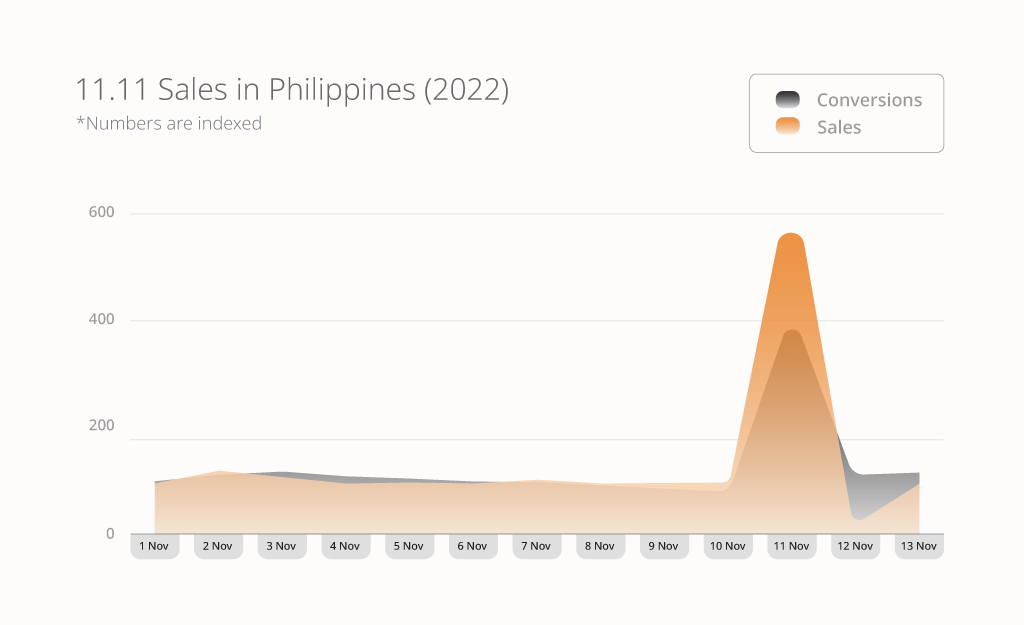

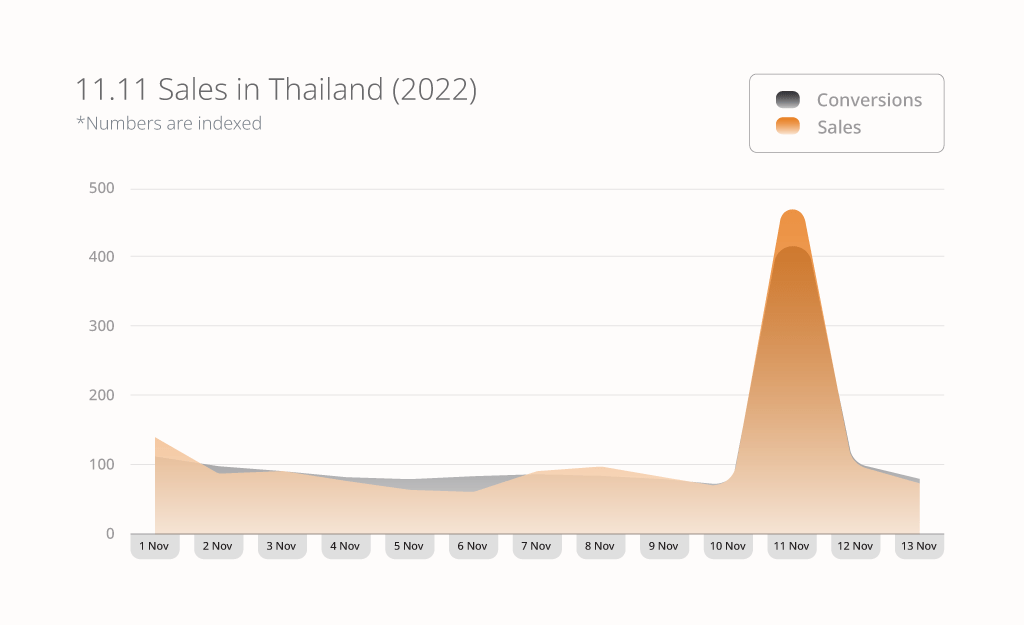

11.11 Sales in 2022

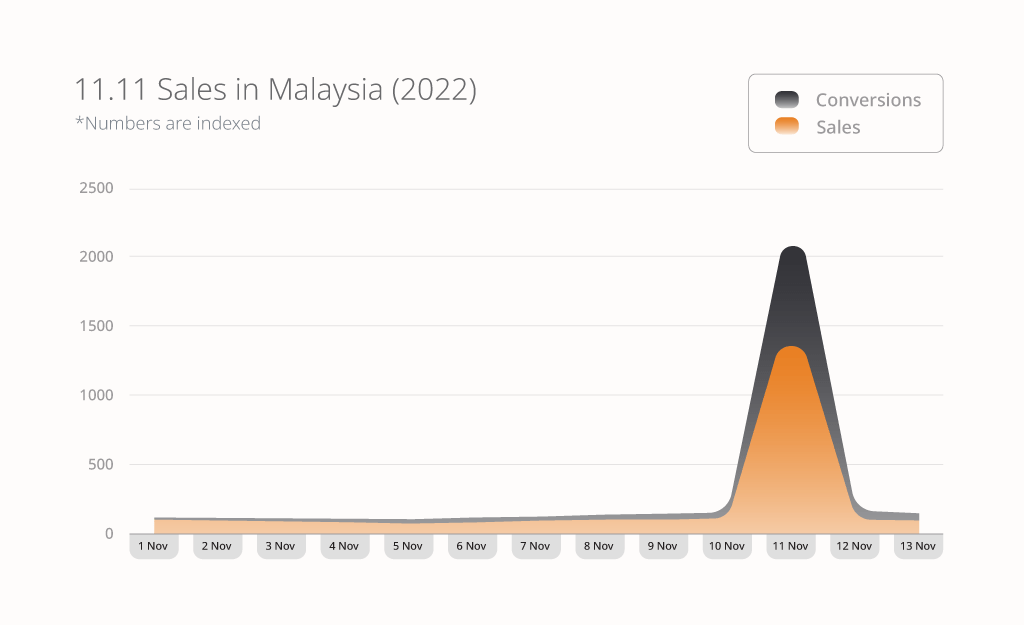

Throughout the promotion period for 11.11 Sales in 2022, there was an upward trend in growth for conversions and sales towards 11 November across Southeast Asia. Partners also shared brands’ promotions for those who have traffic in Southeast Asia.

Partners promote 11.11 Sales and encourage their audience to add recommended products to the carts before making purchases with exclusive deals on the big day.

- Malaysia Partners started to promote 11.11 Sales on 7 December

- Indonesia Partners consistently shared the brands’ 11.11 sales during the non-peak and peak day of 11.11 Sales

- Philippines Partners were most active in promoting 11.11 Sales, from 1 to 3 December, followed by the peak day

- Thailand Partners started promoting 11.11 Sales on 6 December

- From 31 October till the big day, Vietnam Partners actively participated in promoting 11.11 Sales

Top Categories in 11.11 Sales

- In Indonesia, customers look for affordable tech gadgets on e-commerce websites

- Customers preferred to purchase health & beauty and home & living items on popular e-commerce platforms

- Customers looked for affordable packages and deals at reliable travel websites

- Malaysian customers made their travel arrangements through popular national carriers

- Most of the sales for popular marketplaces are garnered from customers’ frequent purchases for health & beauty, home & living, electronics, and mother & baby

- Customers in the Philippines mostly made purchases on the marketplaces at the top-selling categories – Home & Living, Electronics, Health & Beauty, Women’s Fashion, and Mother & Baby

- Travellers mainly made their flight bookings at Thailand’s national carrier

- Customers shopped for home & living items, fashion apparel, and electronics at one of the popular marketplaces

- Customers also made purchases at home & living e-commerce platforms

- Food & grocery deliveries were ordered through mobile apps

- Customers mainly purchase products on the top-selling categories at one of the leading marketplaces in Vietnam – Electronics, Home & Living, Health & Beauty, Men’s Fashion, Sports & Outdoor

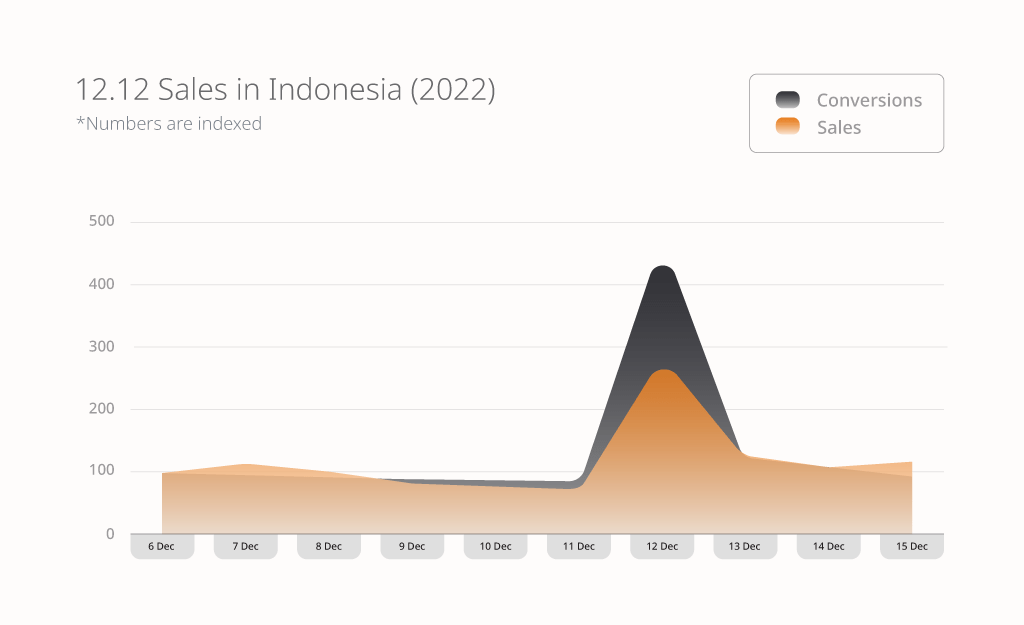

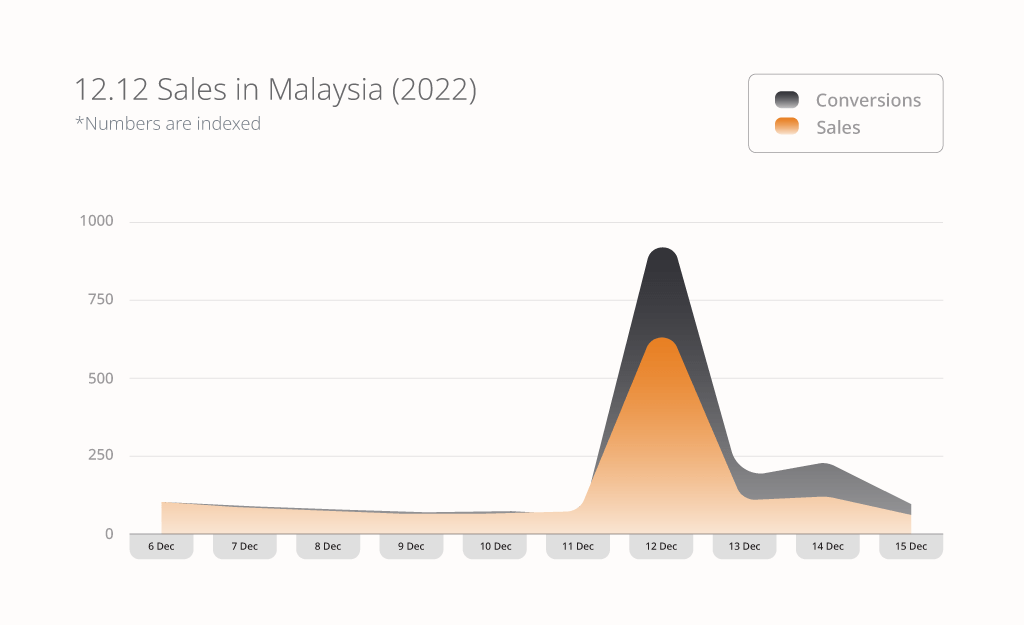

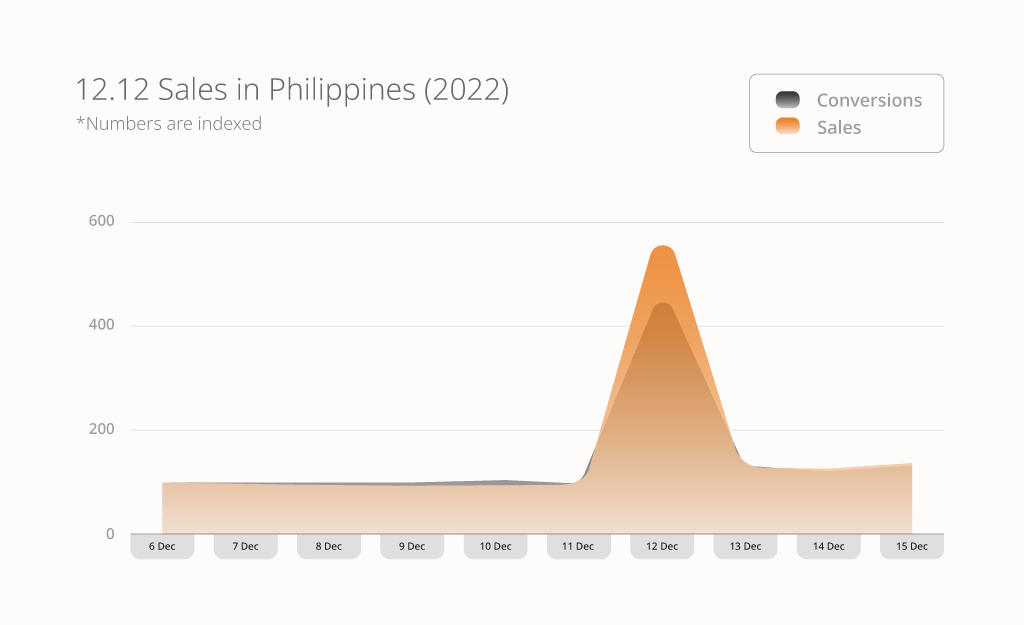

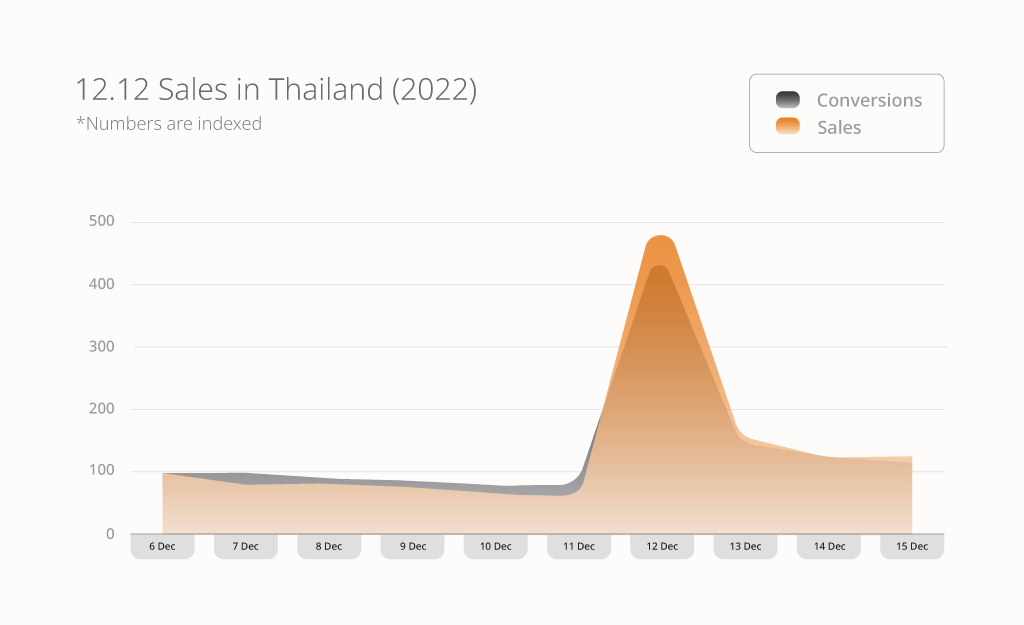

12.12 Sales

Across Southeast Asia, 12 December had huge spikes in conversions and sales.

Compared with other countries in Southeast Asia, customers in Malaysia made more purchases on 12 December.

Customers still shop online during the after-sales, from 13 to 15 December.

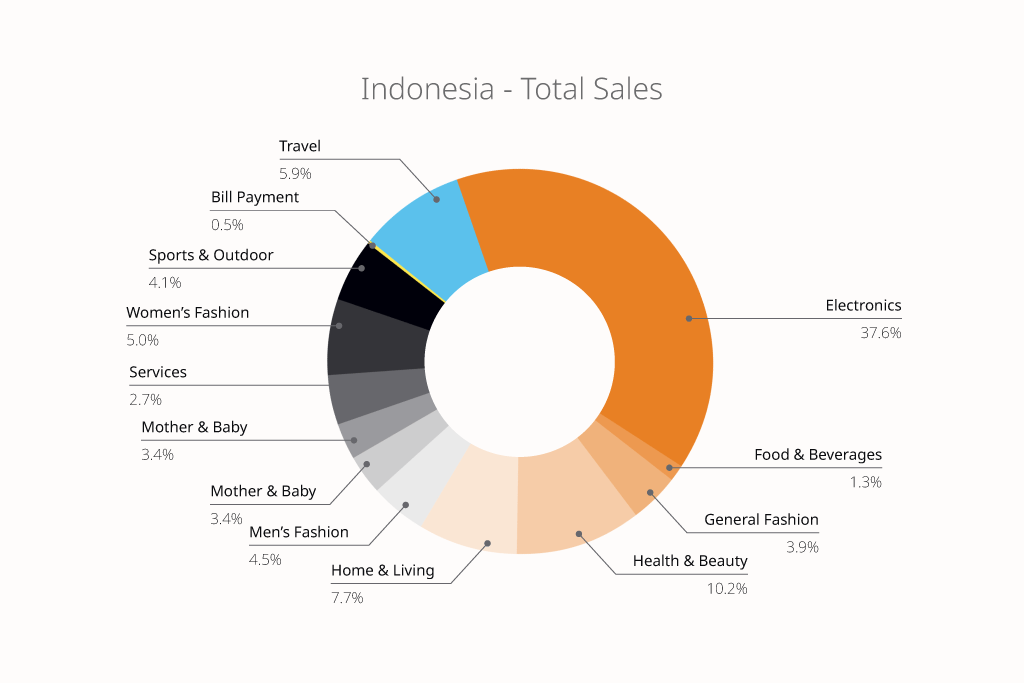

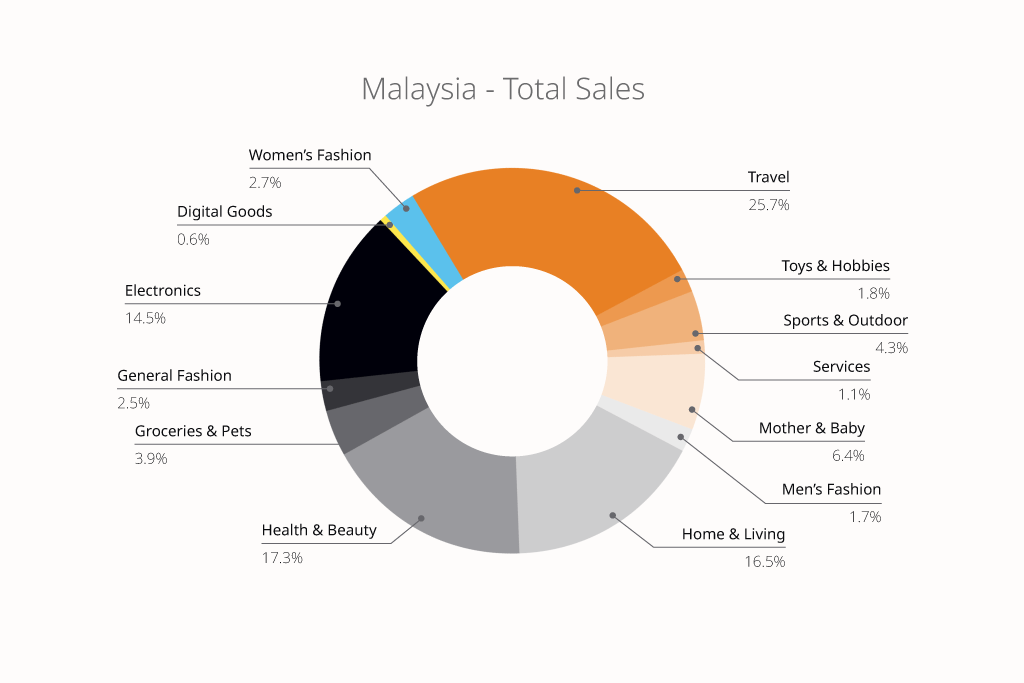

Top Categories in 12.12 Sales

- Customers mainly purchased tech gadgets on popular e-commerce platforms in Indonesia

- Customers also preferred to buy home & living items

- Health & beauty products drove better sales

- Travellers made their bookings at popular travel websites

- Popular travel websites for flights and bus routes earned the most sales from travel bookings for the year-end holidays

- Customers shopped more at during the 12.12 Sales, including the after-sales, for top-selling products at affordable prices – Health & Beauty, Home & Living, Electronics, and Mother & Baby

- Customers also looked for health essentials at the local pharmacy’s website while mattress & gift services earned more sales for home & living products

- Customers mostly made year-end purchases during the 12.12 Sales, including the after-sales, at the top-selling product categories – Electronics, Health & Beauty, Home & Living, Women’s Fashion, Mother & Baby

- Home & Living and Electronics are the top-selling product categories sold at leading marketplace platforms online

- Customers made orders for food & grocery deliveries through mobile apps

- Customers in Vietnam purchased Partners’ recommended items in the top-selling product categories – Electronics, Home & Living, Health & Beauty, Sports & Outdoor, and Men’s Fashion – from, non-peak to after sales.

Top-Performing Partners

Our Partners have a good understanding of their audience and what they are looking for. They promote offers based on their content categories and niches. Some Partners use social media to attract new followers and keep current ones.

Many Partners use blogs as an extension of their social media presence. Others publish articles on their websites, which is also a great way to attract potential customers.

To help you get started, we’ve compiled some of our top-performing partners by country and brand category.

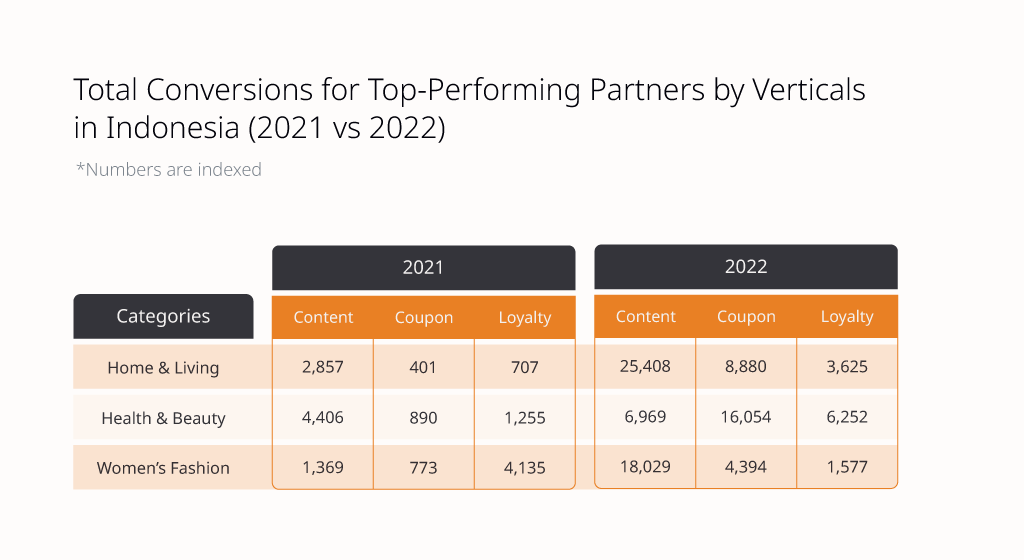

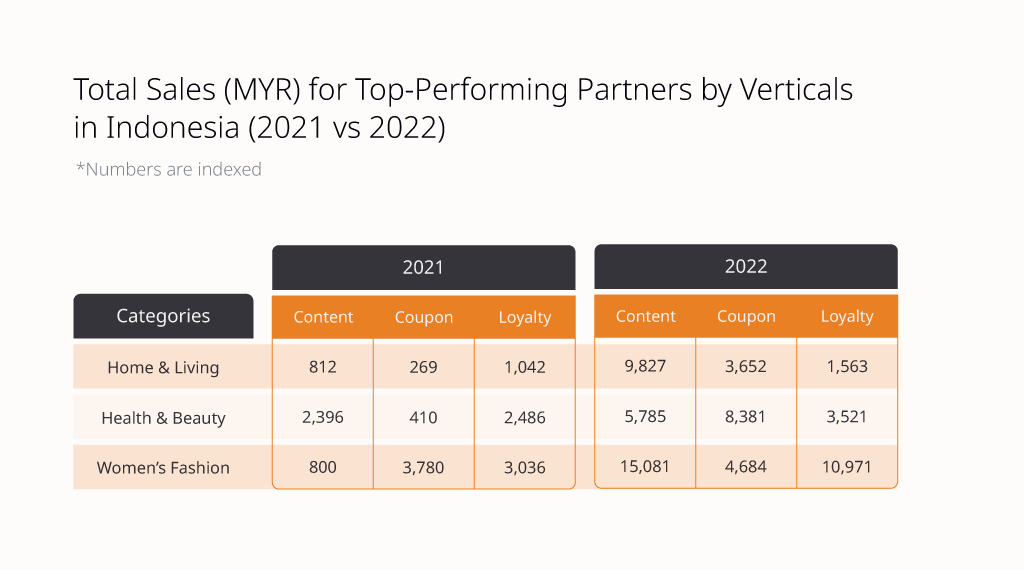

Indonesia

- Home & Living: Content creators & Coupons contributed 8X more conversions compared to 2021. Loyalty networks increased 4X more conversions within a year.

- Health & Beauty: Coupons generated the most conversions when compared to content creators and loyalty.

- Women’s Fashion: For Coupons, the total number of conversions to the Women’s Fashion category increased 3X. The total number of conversions went up slightly by the Content Creators in 2021, whilst total conversions for Loyalty increased in 2022

- Home & Living: In 2022, compared to 2021 total sales by Content Creators, Coupons, and Loyalty

- Health & Beauty: The three verticals of top-performing Partners showed significant growth in total sales in 2022, showing that Indonesians enjoyed purchasing these goods online.

- Women’s Fashion: The total number of sales for Coupons in the Women’s Fashion category was the highest followed by Loyalty and Content with significant increases in sales.

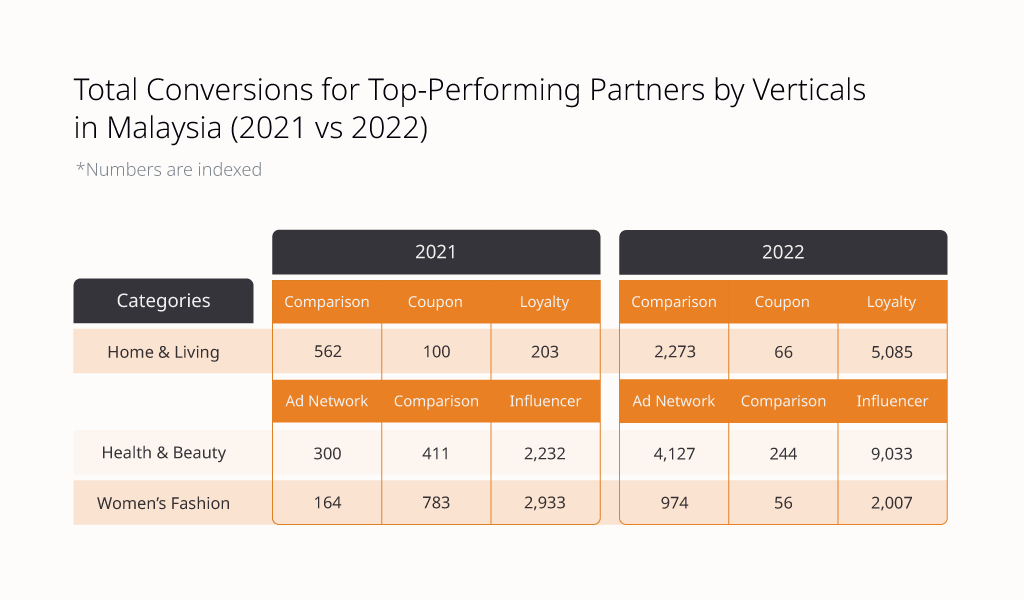

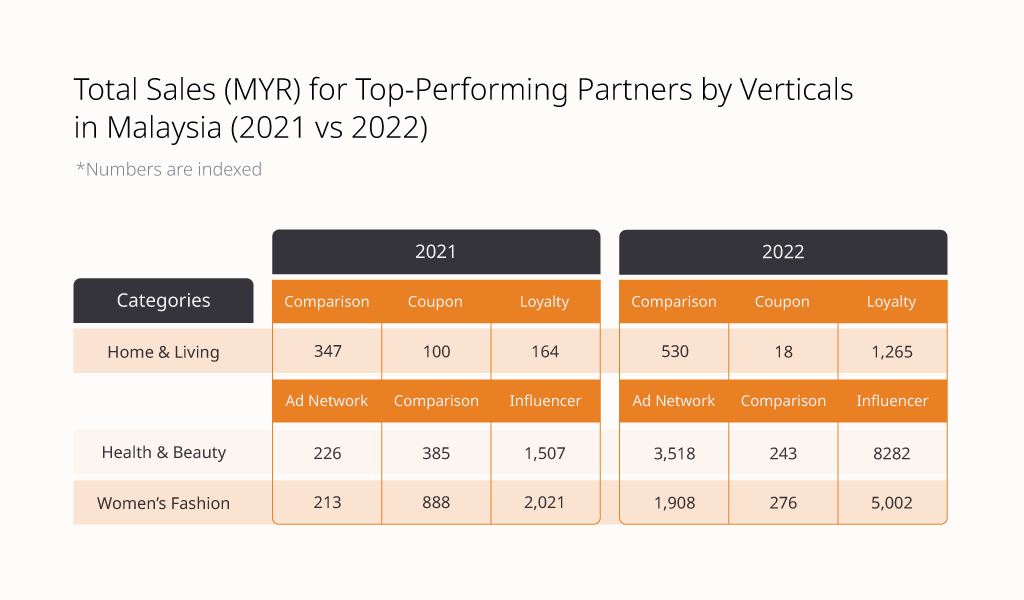

Malaysia

- Home and Living: The total sales and conversions for the Loyalty network increased by 2X. Comparison websites recorded slightly higher numbers in 2021.

- Health & Beauty: Influencers generated the highest number of sales. Meanwhile, Ad Networks saw a 2X increase in sales and conversions in 2022, while Comparison websites saw a slight decrease

- Groceries & Pets: Influencers and Ad Networks effectively drove conversions and sales. Ad Networks saw a significant increase in total conversions in 2022.

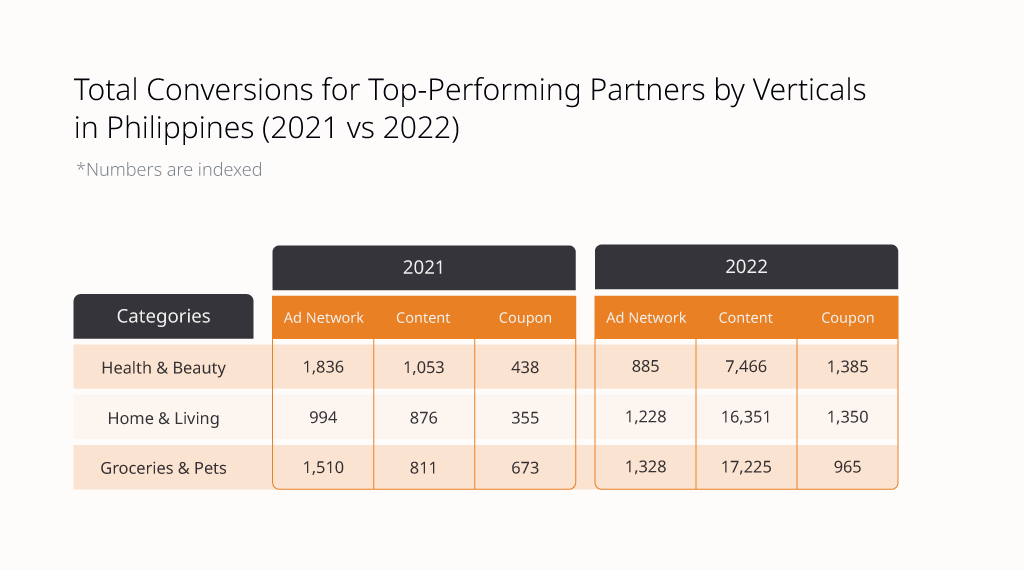

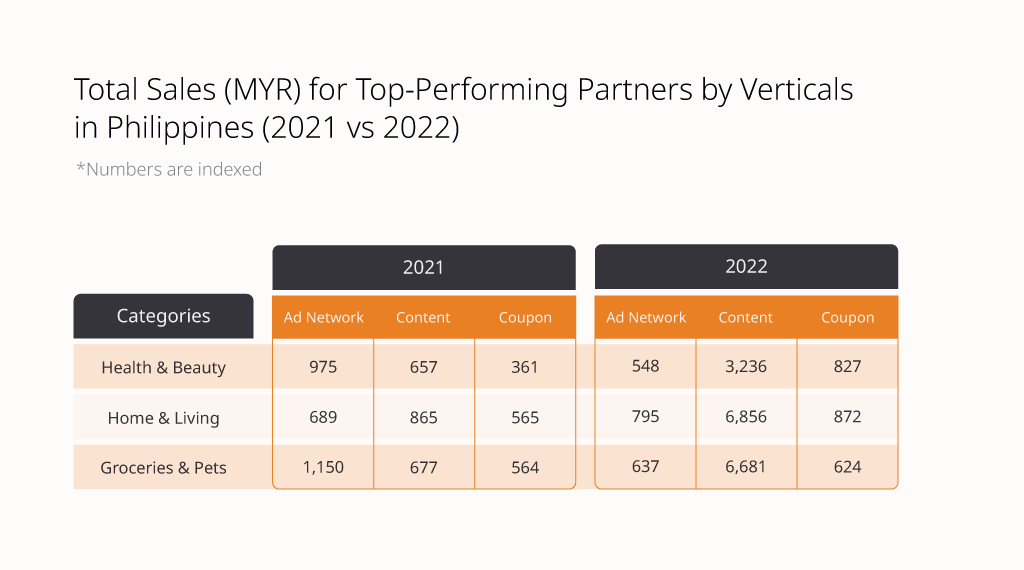

Philippines

- Health & Beauty: In 2022, Content Creators brought in the highest number of conversions and sales. Meanwhile, Coupon recorded steady growth & Ad Networks showed a slight increase in total sales and conversions

- Home & Living: Content created by Involve Partners tripled the number of total conversions and sales in 2022. In contrast, Ad Network and Coupon were slightly higher in both total conversions and sales than in 2021.

- Influencers drove the most conversions & sales by promoting Women’s Fashion, Home & Living, Health & Beauty, Electronics, and Groceries & Pets.

- Small participation by Partners who run Ad Networks, Content, Coupon, and Loyalty for Women’s Fashion, Home & Living, Electronics, and Groceries & Pets.

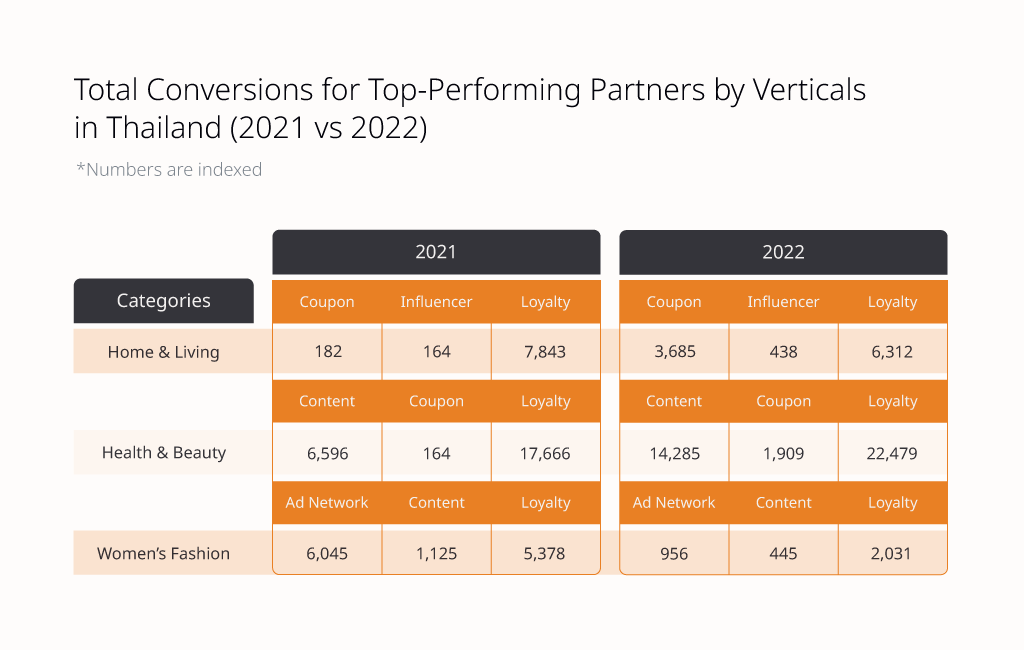

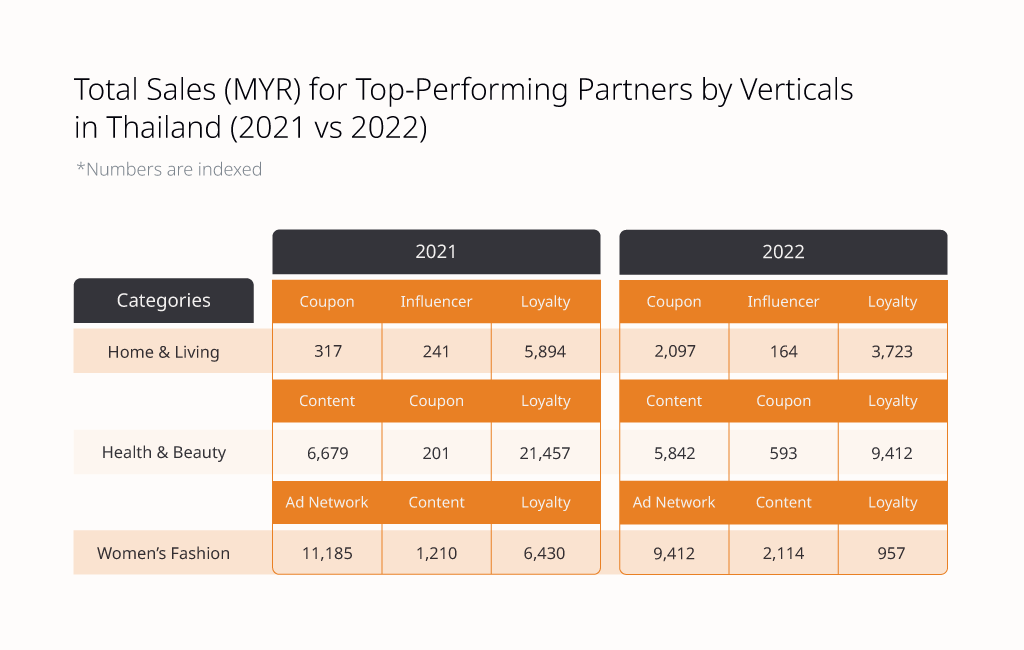

Thailand

- Home & Living: Coupons recorded a steady increase in the total sales and conversions. Influencers showed a slight increase in total conversions, and the sales for Loyalty dropped in 2022

- Health & Beauty: Loyalty drove the most conversions and sales, followed by Content and Coupon

- Toys & Hobbies: This category has recorded lower total conversions and sales in 2022 compared to the previous year due to a decrease in Partners’ participation for promoting this category

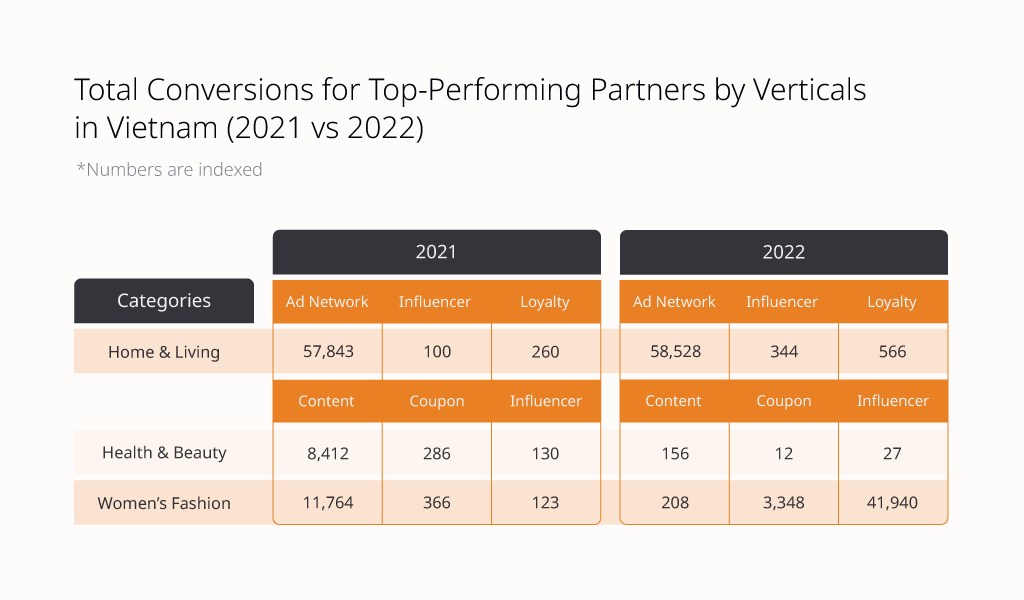

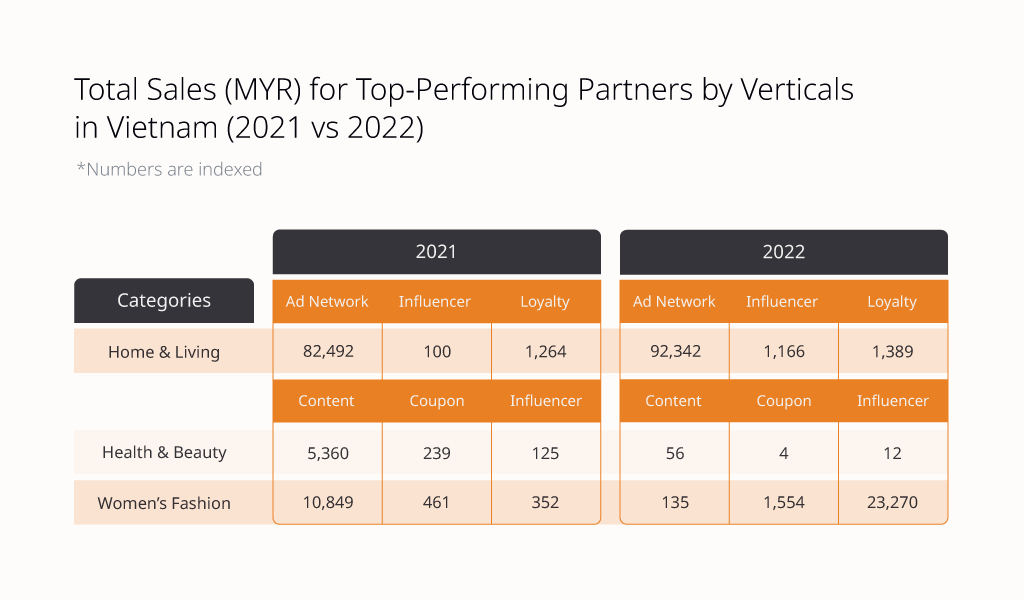

Vietnam

- Home & Living: Ad Network and drives the most conversions & sales through promoting recommended essentials for living spaces.

- Health & Beauty: Involve Partners promoted less for this category in 2022.

- Women’s Fashion: Influencers contributed to driving sales by 4X while Coupon recorded a slight increase in total sales compared to 2021

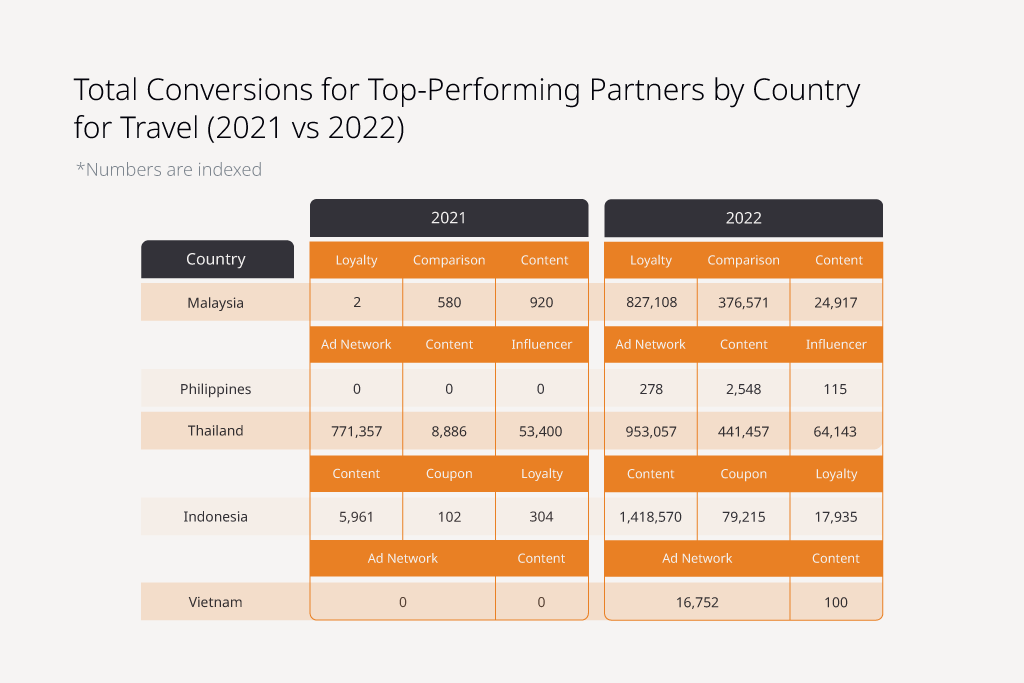

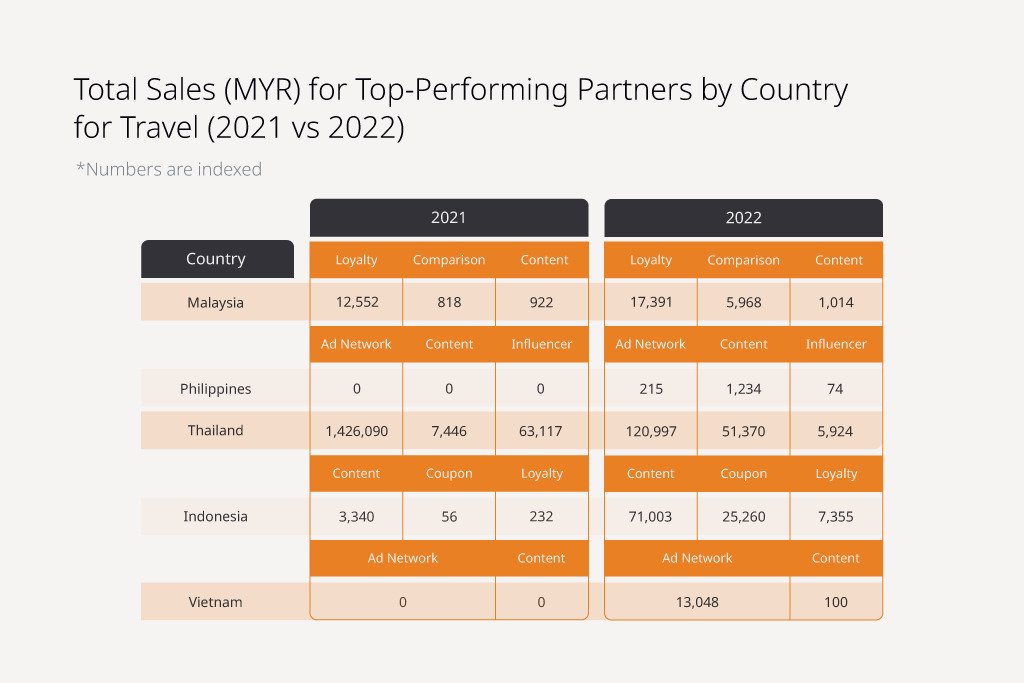

Travel

The removal of COVID-19 border restrictions has motivated people worldwide to pack their belongings and travel.

The travel category had the highest sales and conversions as advertisers used various campaigns to encourage more people to travel while also restoring losses affected by the COVID-19 lockdown.

Let’s look at the performance of the Travel category for Indonesia, Malaysia, Philippines, Thailand & Vietnam below:

- Malaysia: Loyalty and Comparison drove a 4X increase, followed by Content creators drove a slight increase for conversions & sales in 2022.

- Indonesia: Content drove the most conversions & sales, almost 4X compared to 2021. Meanwhile, Coupon & Loyalty recorded a steady increase in total conversions and sales.

- Philippines: Content creators drove the most conversions and sales in 2022. Meanwhile, the Ad Network and influencers contributed decent numbers in total conversions and sales compared to 2021.

- Thailand: Content creators drove the most conversions and sales for travel, followed by Ad Networks and Influencers.

- Vietnam: Ad Network received the most conversions and sales, with a nearly 3x increase from 2021

2023 Predictions in Affiliate Marketing

Based on the above key stats & insights (comparison between 2021 and 2022), we break down the following predictions for affiliate marketing trends of 2023:

The rise of collaborative ‘content-focus’ campaigns between Advertisers and Partners

With consumers becoming more selective about making purchases, Advertisers are constantly looking for new ways to reach their target audience with relevant offers by collaborating with affiliate Partners while also building relationships with them.

Therefore, the rise of content-focused campaigns between Advertisers and Partners has opened up new opportunities for both parties.

Content-focused campaigns will continue to help Advertisers shift their focus from revenue generation to customer lifetime value (CLV). By understanding the lifetime value of each customer and how much effort it takes to convert them into customers, Advertisers can create more effective campaigns that give Partners greater incentives for each conversion generated.

Brand’s exposure through video content

Affiliate Partners are starting to focus more on creating video-focused content where they show the products in action, which entices their audiences to purchase the products via their affiliate links.

Product reviews are one of the most effective ways to create brand awareness while driving sales and increasing engagement with existing customers. Collaborating with online video creators is a great way to increase content reach. It’s also helpful to exchange ideas with collaborators to create high-quality videos.

Videos in a story-telling format captivate the viewer and make them want more. This is why it’s important to create entertaining, educational, and engaging video-focused content that appeals to all senses instead of focusing on one thing at a time.

Usage of AI & machine learning

AI & machine learning with automation would be useful to streamline and optimise affiliate programs, campaigns & products for Advertisers based on the customers’ online shopping behaviour.

Drawing out the real-time and historical data through tracking and monitoring various touchpoints help provide detailed insights based on the relationship between content-focused campaigns for products & services.

At the same time, running the A/B tests for affiliate programs and campaigns help brands determine which brings better conversion rates, sales, and revenue.

Cookieless future

Brands will start relying less on third-party cookies due to Tracking IDs restriction, which will be difficult to determine the customers’ journey through browsers (such as Google Chrome and Firefox), despite ensuring security and privacy are well-protected.

Therefore, brands are considering having alternative tracking methods such as server tracking and bounce-less tracking to pinpoint the customers’ behaviour online.

While approaching to go cookieless in the coming years, brands need to ensure privacy by seeking consent from related parties, including those on behalf of the consumers.

Shorter payment cycles

Affiliate Partners seek faster payment of bonuses & commissions based on their overall monthly performance and/or specific campaigns they promote.

Therefore, affiliate marketing networks are looking for ways to improve the cash flow by having better tracking for validation and payment process.

Having budgets and commissions transferred smoothly would encourage Advertisers and Partners to collaborate in promoting campaigns, products & services to their target audiences.

Learn more about the affiliate marketing trends in 2023 here.

The overall performance of Involve’s Top-Performing Partners for each country differs with categories (Home & Living, Health & Beauty, Women’s Fashion, Electronics, Toys & Hobbies, and Groceries & Pets) and Partners’ strategies of promoting the Advertisers’ promotion.

As we can see from the graphs reported above, Indonesia, Malaysia & Philippines performed very well compared to Thailand and Vietnam in 2022.

The Travel category has been booming in popularity since travel restrictions were lifted in 2022 compared to the previous year.

The Partners’ performance in each country has been outstanding, contributing to an increase in total conversions and sales.

Involve is constantly looking for new ways to encourage our Partners to promote our Advertisers’ products by developing new campaigns and rewards to assist Partners in their affiliate journey with us.

Looking for a great opportunity to connect with Partners and drive sales? Contact your Account Manager to plan your next campaigns.