The Loanonline affiliate program on Involve Asia gives finance publishers, comparison sites, and performance marketers a strong way to earn by promoting a digital lending platform built for fast and convenient online loan applications. As more users in Southeast Asia turn to mobile-first and digital-first financial services, Loanonline becomes increasingly relevant for audiences searching for quick loan information and applications.

For publishers, this means access to a high-intent audience actively looking for personal loans, emergency funding, and online approval options—ideal for performance-focused monetization.

Why Promote Loanonline on Involve Asia?

1. High-Intent Finance Audience

Users who visit loan platforms are usually close to taking action. They tend to need:

- Personal loans for planned expenses

- Emergency funds for unexpected situations

- Short-term financial support

- Fast and simple online approval processes

This high level of intent makes the Loanonline affiliate program on Involve Asia a strong performer for finance-focused publishers.

Read: 10 Best Affiliate Programs in Finance on Involve Asia

2. Digital-First, Fast, and Convenient

Loanonline is designed for modern users who prefer:

- Online applications instead of branch visits

- Quick eligibility checks

- Mobile-friendly interfaces

- Clear and simple application flows

User-friendly flows often translate into higher click-through and conversion rates for affiliates.

3. Perfect for Finance & General Audience Publishers

The Loanonline affiliate program on Involve Asia is a great fit for:

- Finance blogs and personal finance sites

- Loan and credit comparison platforms

- SEO publishers targeting money, loan, or budgeting keywords

- Cashback and rewards websites

- Influencers and content creators sharing financial education

- Subnetworks and performance marketers with SEA or international traffic

Loans are a natural extension of content about money management, budgeting, and financial planning.

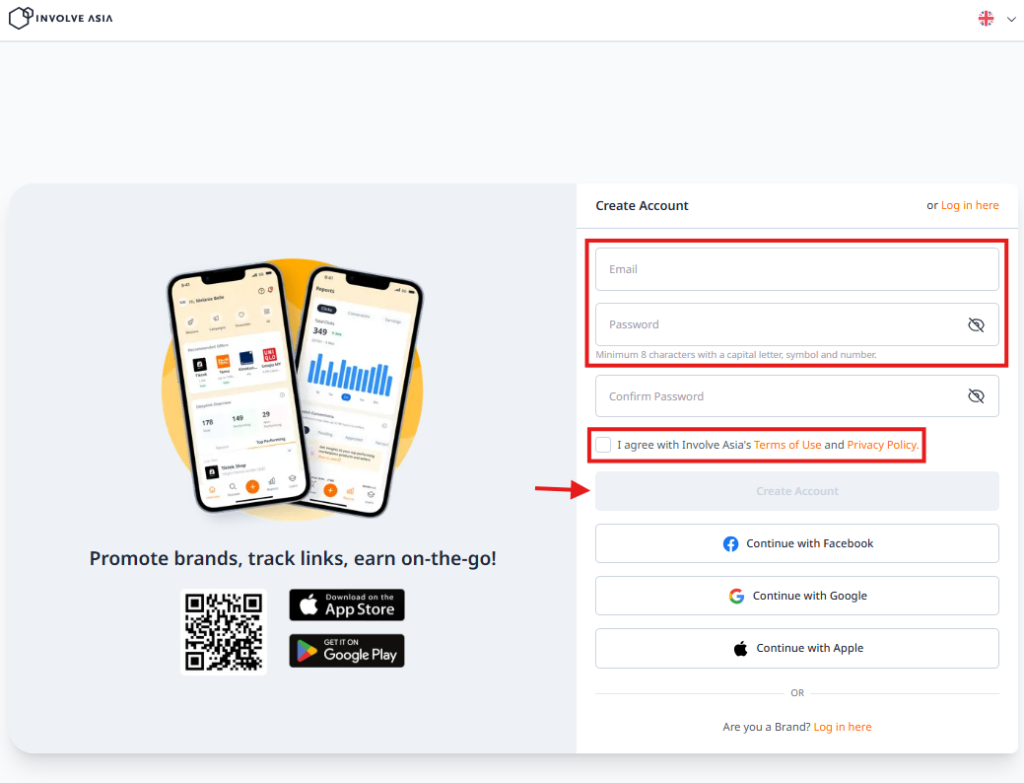

How to Join the Loanonline Affiliate Program on Involve Asia

You can start promoting Loanonline via your Involve Asia Publisher Dashboard in just a few steps.

Step 1 – Login to Your Publisher Dashboard

Login using Google, Facebook, Apple, or your email and password. If you click the Loanonline offer link while logged out, you’ll be prompted to log in and then automatically redirected back to the offer page.

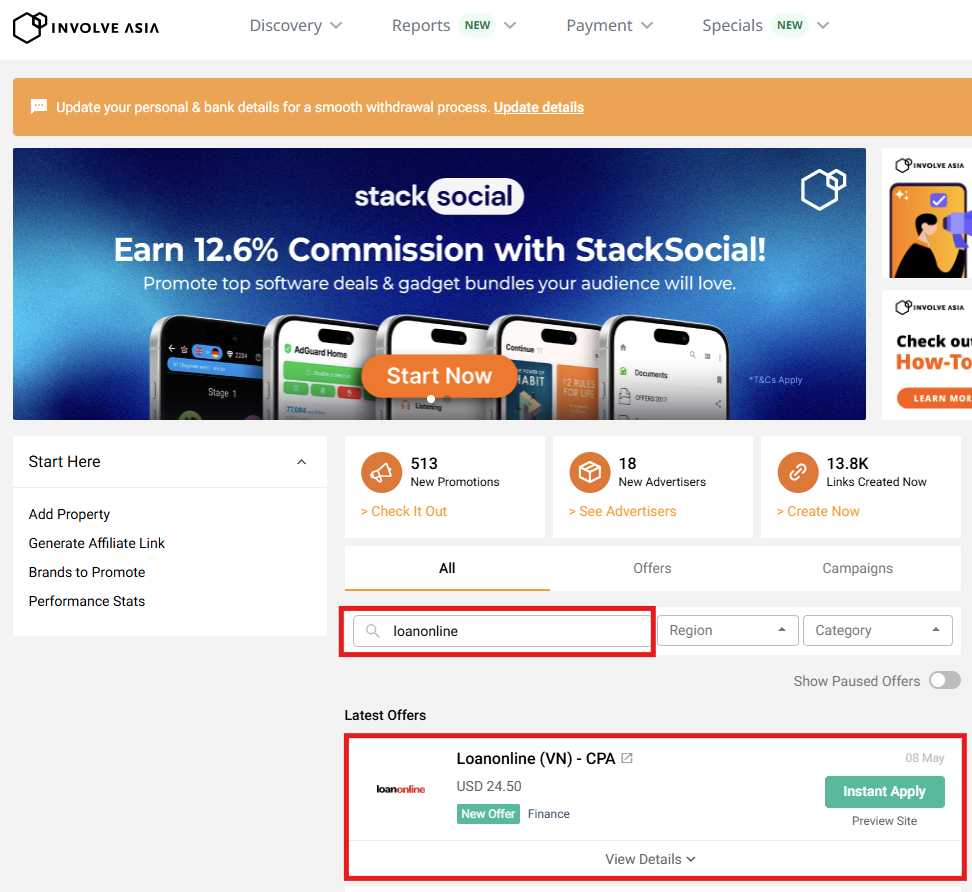

Step 2 – Go to the Advertiser Directory

From your dashboard, navigate to:

- Discovery > Advertiser Directory

Use the search bar and type Loanonline to find the offer.

Step 3 – Apply to the Offer

On the Loanonline offer page, you’ll see one of these buttons:

- Instant Apply – approval is automatic and you can start promoting immediately.

- Apply – your application will be reviewed, usually within 24–48 hours.

Once approved, the button will change to Promote.

Step 4 – Generate Your Tracking Link

Click Promote on the Loanonline offer page to get your main tracking link instantly.

If you want to send users to a specific Loanonline landing page, you can:

- Go to Create Deeplink in your dashboard.

- Paste the specific Loanonline URL you want to promote.

- Generate a targeted deeplink for that page.

Step 5 – Start Promoting Loanonline

Share your affiliate links through channels where your audience consumes financial content, such as:

- Loan comparison and review articles

- Personal finance and budgeting guides

- Short-form financial tips on TikTok, Reels, or YouTube Shorts

- Long-form YouTube explainers on loans and credit

- Email newsletters covering financial advice or offers

- Cashback or deal platforms with finance sections

Every qualified action or approved loan (depending on campaign rules) tracked through your link earns you a commission.

How to Maximize Your Loanonline Commissions

1. Target High-Intent Loan Keywords

Create content around searches where users are close to applying, such as:

- “Best personal loans in [country]”

- “How to get fast online loans”

- “Emergency loan options with quick approval”

- “Online loan comparison for beginners”

2. Build Financial Education & Guidance Content

Helpful, educational content builds trust and improves conversion rates. Ideas include:

- “When should you take a loan?”

- “How to budget your salary and repayments”

- “Understanding interest rates and loan terms”

- “How to avoid common loan mistakes”

3. Use Seasonal & Situational Angles

Loan demand can increase during:

- Festive and holiday seasons

- Back-to-school periods

- Big sale events and high-spend months

- Unexpected expense periods or emergencies

Aligning your content with these timing spikes can improve clicks and approvals.

4. Diversify Content Formats

To reach different audience segments, consider:

- Comparison lists (“Top online loan platforms in [country]”)

- FAQ-style posts about loan eligibility and requirements

- Short social content breaking down loan myths

- Email series on improving financial health

5. Optimise With Involve Asia Tools

Use the tools in your Publisher Dashboard to improve performance over time:

- Deeplinks to send users to the most relevant Loanonline pages

- SubIDs to track different traffic sources and campaigns

- Analytics to identify top-performing content and audiences

Conclusion

If your audience is interested in personal finance, budgeting, and loan solutions, the Loanonline affiliate program on Involve Asia is a strong monetization opportunity. You guide users towards convenient online loan options, while earning commissions for each successful action.

With Involve Asia, you also benefit from:

- Real-time tracking of clicks, conversions, and earnings

- Monthly payouts

- Access to hundreds of finance, travel, tech, and e-commerce offers

- A platform designed for publishers across Southeast Asia and beyond

Login to your Publisher Dashboard, search for Loanonline, apply, click Promote, and start earning today.

Frequently Asked Questions (FAQs)

Is the LoanOnline affiliate program free to join?

The LoanOnline affiliate program on Involve Asia is completely free to join. There are no registration fees or hidden charges, which makes it accessible for both new and experienced affiliates. Once your property is approved on Involve Asia, you can apply for the LoanOnline offer and begin promoting immediately. Because LoanOnline is a widely used platform for financial comparisons, affiliates can start earning without any upfront investment. The free entry and high-demand financial niche make this a strong opportunity for content creators, finance bloggers, and influencers who regularly discuss budgeting, loans, or financial tools.

What can I promote through the LoanOnline affiliate program?

Through the LoanOnline program, you can promote a variety of financial comparison services, including personal loan comparisons, short-term loan providers, credit-related tools, and financial assistance platforms depending on the country’s available product lineup. Your role as an affiliate is not to provide loans, but to direct users to LoanOnline’s comparison interface, where they can evaluate options that suit their financial needs. This makes it easier and safer for affiliates, as you are promoting an informational service rather than a financial product directly. This variety also allows for multiple content angles—budgeting, emergency funds, credit education, and more.

Who is the ideal target audience for LoanOnline promotions?

The LoanOnline program appeals to a broad audience including young adults, employed professionals, students, and individuals researching personal finance options. Users searching for loan comparisons, budgeting solutions, emergency cash alternatives, or financial planning tools are highly conversion-ready. If your content focuses on personal finance, savings advice, money management tips, or financial products, you already have the right audience. LoanOnline also suits creators whose followers frequently seek financial guidance, especially around topics like responsible borrowing, comparing lenders, or improving financial awareness. This makes the target audience wide and relatively easy to reach across multiple platforms.

Do I need a finance blog or financial expertise to promote LoanOnline?

You don’t need a finance blog or advanced financial expertise to promote LoanOnline effectively. While dedicated finance pages may convert well, you can also promote the offer through TikTok explainers, Instagram stories, YouTube videos, Facebook groups, email newsletters, or general lifestyle content. The key is to share simple, helpful insights—like how comparison tools help users make better financial decisions. As long as you avoid giving personal financial advice and instead focus on explaining how LoanOnline simplifies comparison, you can succeed without being a finance professional.

How can I maximize conversions for the LoanOnline affiliate program?

To increase conversions, focus on educational content that highlights the benefits of comparison tools—transparency, convenience, and the ability to make informed financial decisions. Create content such as “How to compare loans safely,” “Why loan comparison websites matter,” or “Smart ways to plan your monthly budget.” Use product-specific deeplinks to drive users directly to the comparison page. Promote during moments when financial interest spikes—like back-to-school season, year-end expenses, or after major sales periods. Clear CTAs such as “Compare options before applying” or “Check your eligibility instantly” also help boost click-through and conversion rates.