Involve Asia’s Key Stats 2023 showcases the full-year trend and performance of Partners and Brands, compared with 2022.

We looked into the key stats followed by focusing on the four main countries based on conversions and sales across Southeast Asia, including the emphasis on verticals, type of Partners, and double-digit sales.

- Indonesia

- Malaysia

- Philippines

- Thailand

This report further explained with the following additional sections to support the performance growth in 2023:

- Involve marketing campaigns

- Type of Partner Channels

- Type of Content and Audience for Partner Channels

In 2023, the engaged Partner’s participation in promoting brands’ evergreen and exclusive deals to various audiences led to over 100 Million conversions and drove more than USD858 Million in total sales across Southeast Asia and global countries, including Malaysia, Indonesia, the Philippines, and Thailand.

The double-digit sales performed better between April 2023 and July 2023 due to increased Partners’ participation.

Health & Beauty, Home & Living, Fashion, and Electronics were the top-performing verticals that drove the most sales and conversions (made successful purchase through affiliates’ unique deeplink) during the peak 2023 double-digit sale seasons.

Ad Networks, Social, and Content were the dominant channels contributing high conversions and sales in 2023. They primarily promoted Marketplace, Travel, Fashion, and Home & Living.

View more of this report by clicking on the following sections below:

Full Year Key Stats

Total Conversions

Year | Q1 | Q2 | Q3 | Q4 |

2022 | 100 | 101 | 106 | 110 |

2023 | 106 | 106 | 112 | 133 |

Note: Numbers are indexed.

Quarterly Breakdown:

- 2022: The total conversions show a varying trend across the quarters, with a gradual increase of 10% from Q1 to Q4

- 2023: For 2023, there was a noticeable 25% increase in total conversions. It remained consistent in Q1 and Q2, further increased in Q3, and experienced a significant jump in Q4.

Year-over-Year (YoY) Comparison:

The total conversions in 2023 demonstrated a substantial 10% increase compared to the total conversions in 2022.

The overall result suggests a positive trend in sales performance, with Q4 of 2023 showing the highest total conversions.

Total Sales

Year | Q1 | Q2 | Q3 | Q4 |

2022 | 100 | 111 | 112 | 125 |

2023 | 125 | 122 | 127 | 158 |

Note: Numbers are indexed.

Quarterly Trends:

- 2022: There was a consistent 25% increase in total sales from Q1 to Q4.

- 2023: The total sales continued to increase throughout the year by 27%, peaking in Q4.

Yearly Comparison (Overall):

Overall, there is a growth in total sales from 2022 to 2023 with a 19% increase. The numbers for each corresponding quarter in 2023 were generally higher than those in 2022.

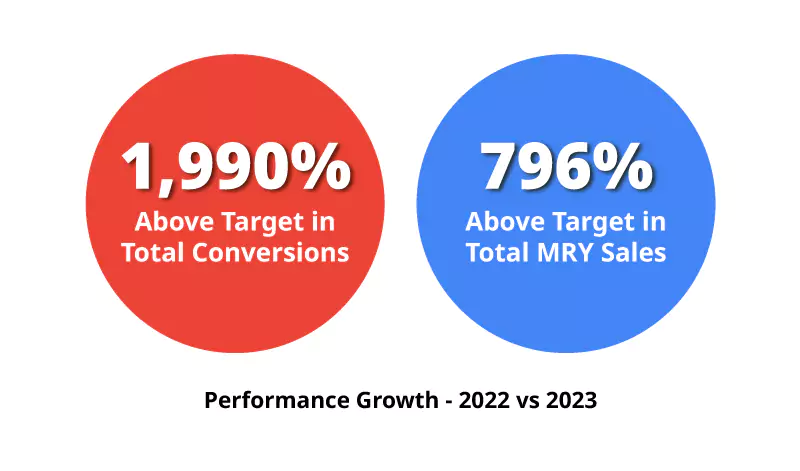

The improvements in 2023 sales and conversions were due to Involve campaigns and targeted evergreen campaigns catered to various type of Partner channels by verticals.

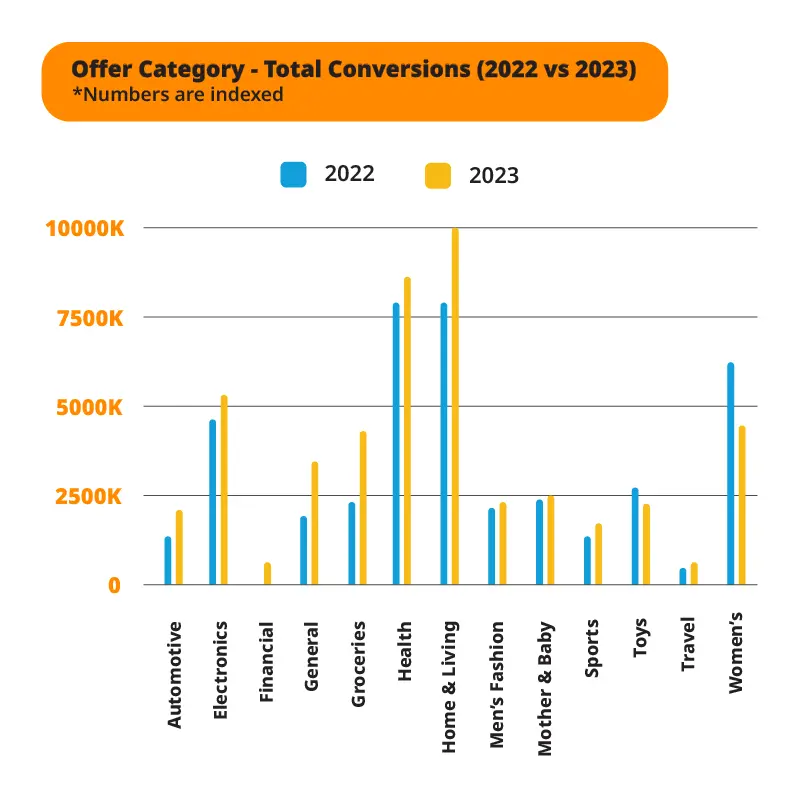

Category Performance

Total Conversions

Home & Living, Health & Beauty, and Electronics emerged as the top three categories, exhibiting the highest conversion rates through Involve Partners links. This indicates that these categories experienced significant success in converting user engagement into actual purchases.

Notably, there was a substantial increase in purchases within specific categories in 2023 compared to 2022. Financial Services witnessed an impressive growth of 1,562%, General Fashion saw a 74% increase, and Groceries & Pets experienced a 73% rise in conversions.

These percentages reflect a remarkable surge in user engagement and conversion rates for these categories, signifying a notable shift in consumer behaviour and preferences from 2022 to 2023.

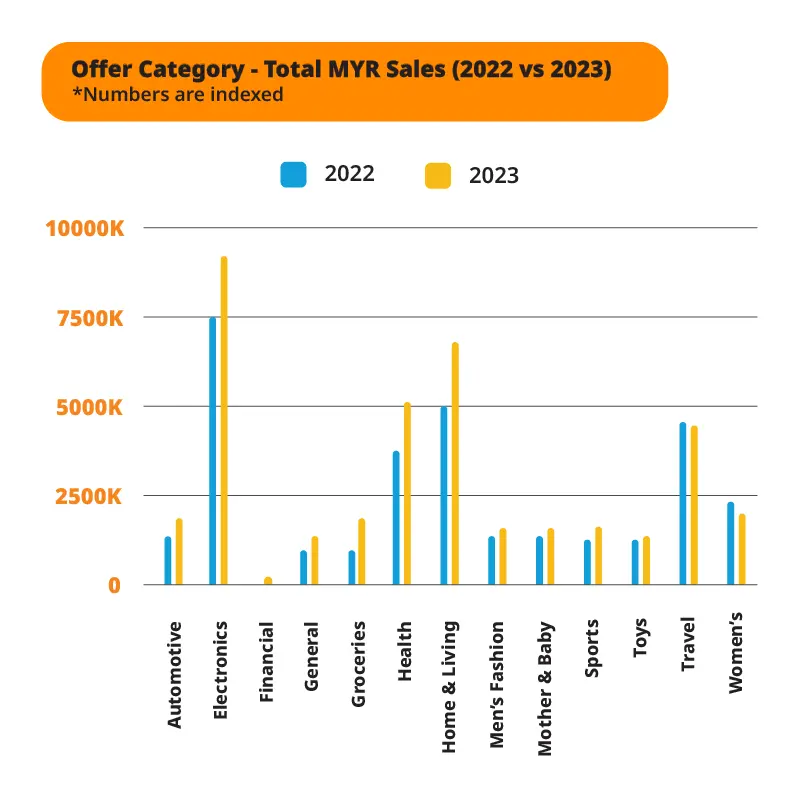

Total Sales

Electronics, Travel, and Home & Living were the top three categories with the highest sales made at e-commerce stores. This indicates that these categories experienced the most significant success in generating sales through partner promotions in 2023.

In 2023, there was a significant surge in purchases across specific categories compared to 2022. Financial Services exhibited an outstanding growth of 3,397%, Groceries & Pets recorded a 75% increase, and General Fashion observed a 38% rise in sales.

These percentages underline a substantial shift in consumer spending patterns, indicating a noteworthy sales increase for these categories between 2022 and 2023.

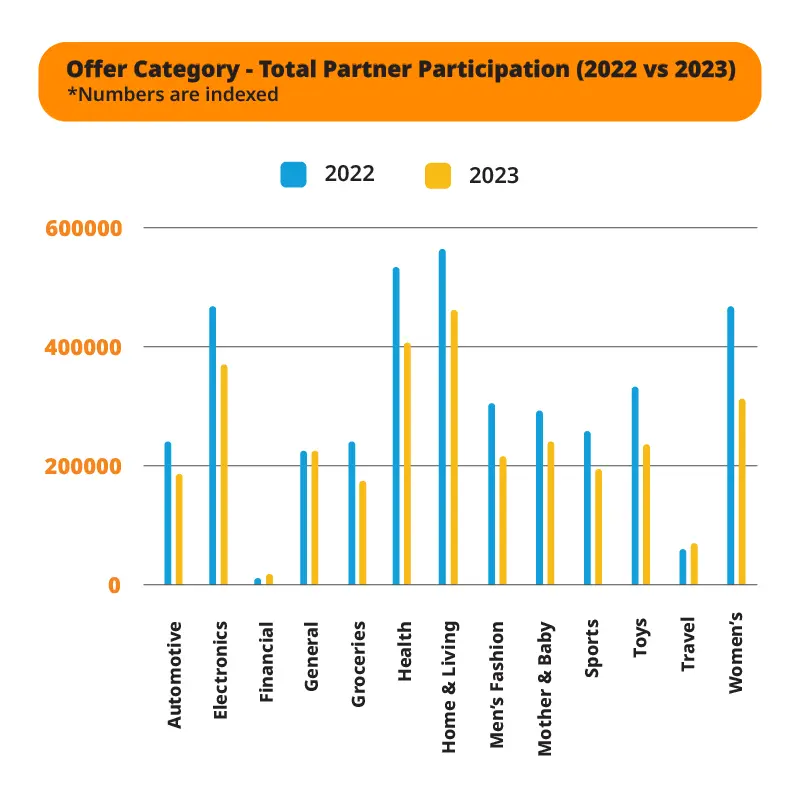

Total Partners Participation

Home & Living, Health & Beauty, and Women’s Fashion stood out as the top three categories where Involve Partners actively participated in promoting products.

Home & Living, Health & Beauty, and Women’s Fashion stood out as the top three categories where Involve Partners actively participated in promoting products.

This highlights their engagement in showcasing lifestyle items, health and beauty products, and women’s fashion trends to their audience during the year.

Compared with 2022, Partners were more participative in promoting products to followers in the categories of Financial Services (184%) and Travel (7%) during 2023.

Although there was a decreased Partner Participation in 2023 in other categories, most Partners continue to promote brands to drive consistent engagement and promotion levels.

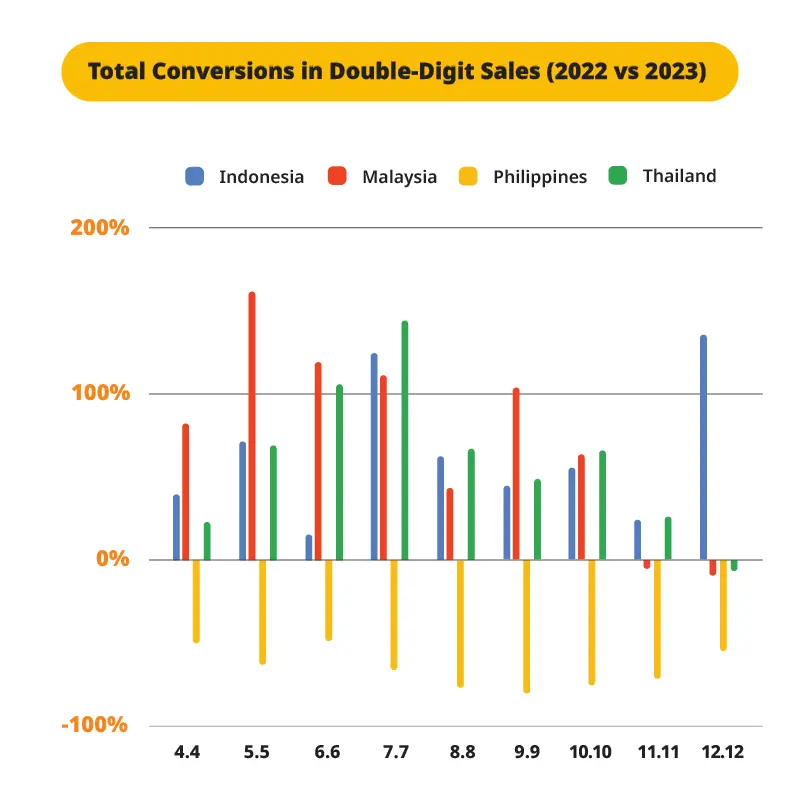

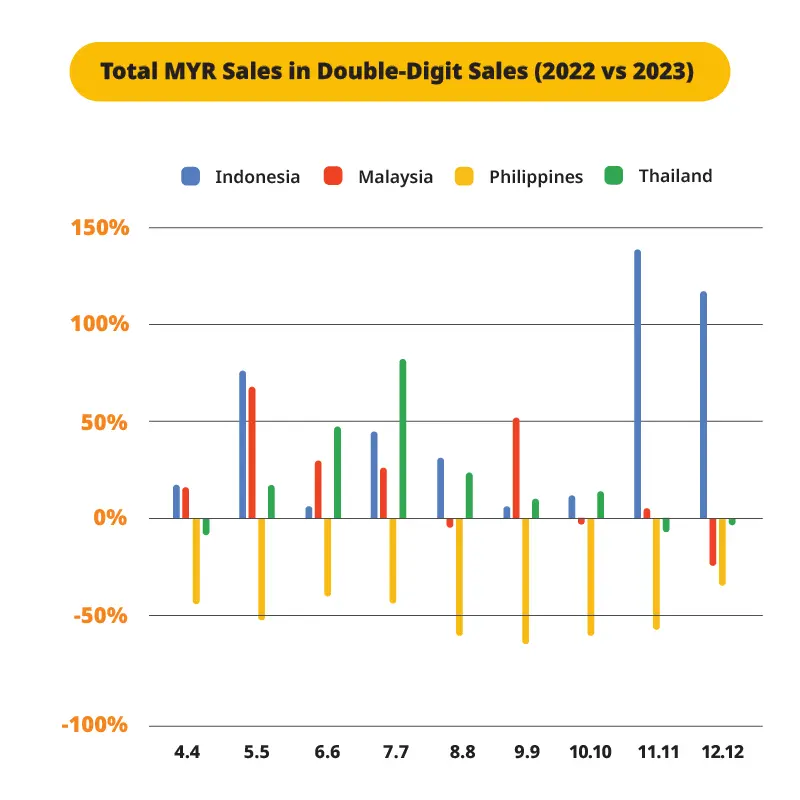

Double- Digit Sales Performance

- Malaysia – Significant growth between April and July year-on-year, with approximately 100% to 155% increase in total conversions due to the festive Raya season, limited-time voucher sales, and Mid-Year Sales. Popular marketplaces with Shopping Day and Mega Brand Sales contributed more growth in total conversions (a 105% increase) during the 9.9 Sales in 2023.

- Indonesia – In comparison between 2022 and 2023, 12.12 Year-End Sales contributed the highest growth of total conversions among other Southeast Asian countries with a 138% increase, followed by the 7.7 Mid-Year Sales that boosted a 127% increase in total conversions.

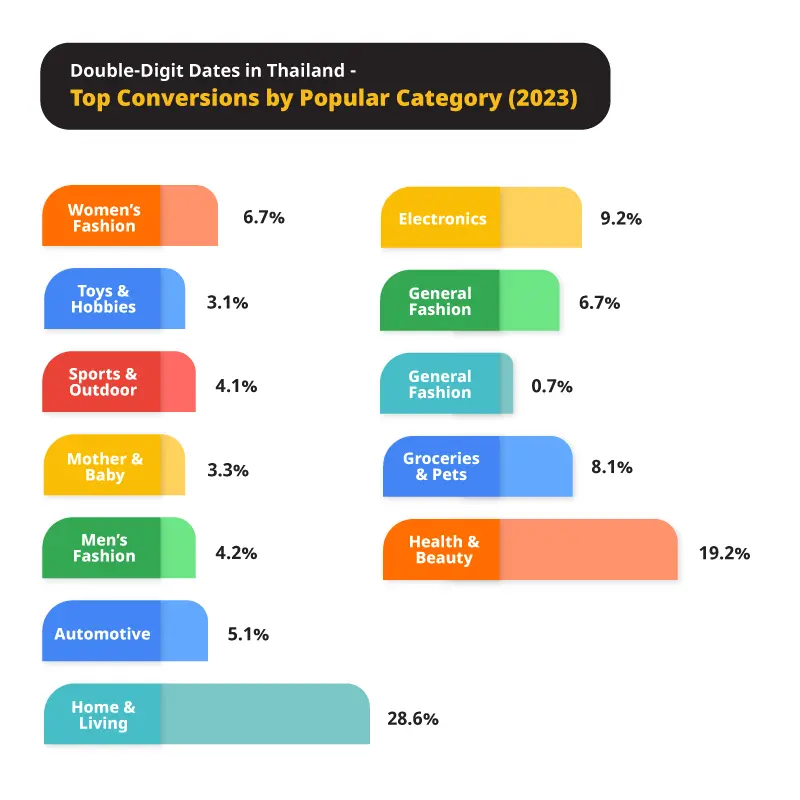

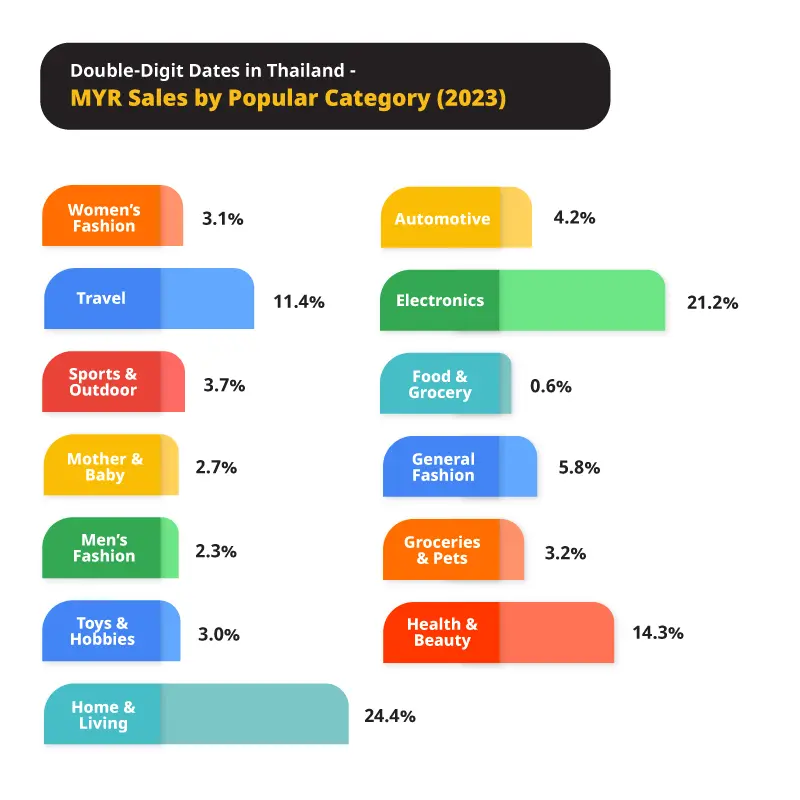

- Thailand – The growth of conversions gradually increased with an average of 32% in the second quarter of 2023, thanks to the consistent promotions encouraging customers to shop with attractive savings, especially during the Mid-Year Sales at popular e-commerce marketplaces.

- Philippines – The total number of conversions decreased in 2023 due to the increased inflation that impacted the pricing of products, which affected the customers’ decision-making for online shopping.

- Indonesia – Online shoppers made more purchases through Involve Partners’ recommendations during the 11.11 Sales (140% increase) and 12.12 Sales (117% increase), a few of the most popular double-digit sales across e-commerce platforms.

- Malaysia – 5.5 Raya Sales drove higher total sales with a 67% increase, followed by 9.9 Sales with a 52% increase due to Shopping Day and Mega Brand Sales at frequently visited e-commerce platforms.

- Thailand – Involve Partners consistently promoted more in the second quarter of 2023, which increased the growth of total sales with an average of 18% increase, as they suggested their followers enjoy enticing savings on recommended products during the Mid-Year Sales at popular marketplaces.

- Philippines – Increased inflation impacted customers’ purchasing decisions, which led to a huge decrease in total sales throughout the double-digit sales in 2023.

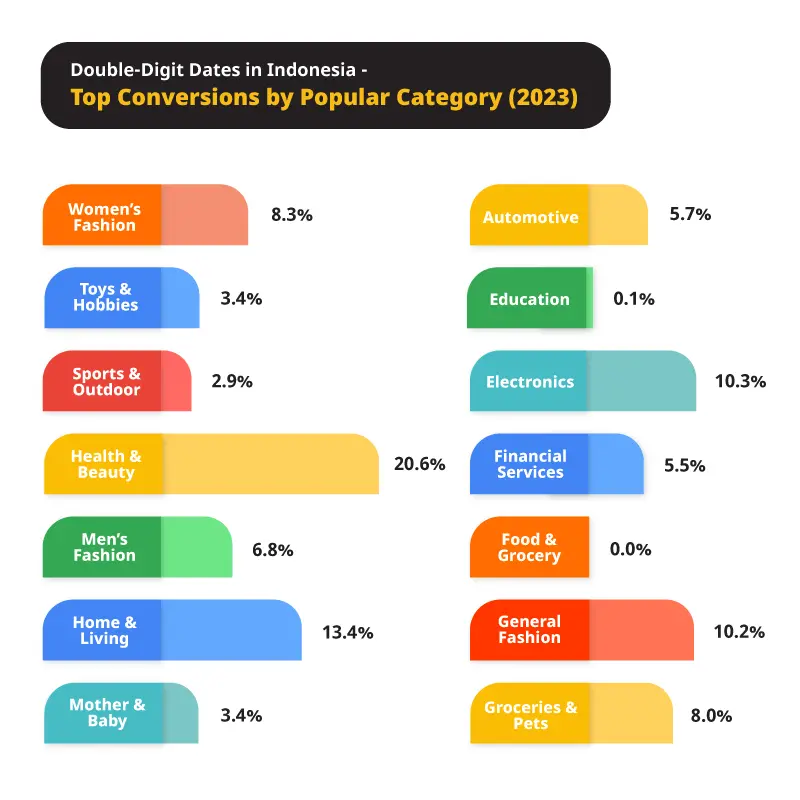

- Health & Beauty, Home & Living, and General Fashion were the top three categories frequently purchased by customers through Involve Partners’ affiliate links.

- In comparison to the double-digit sales in 2022, customers purchased more on Financial Services (13,358% increase), Travel (319%), Groceries & Pets (251% increase), Automotive (136% increase), and Men’s Fashion (85% increase).

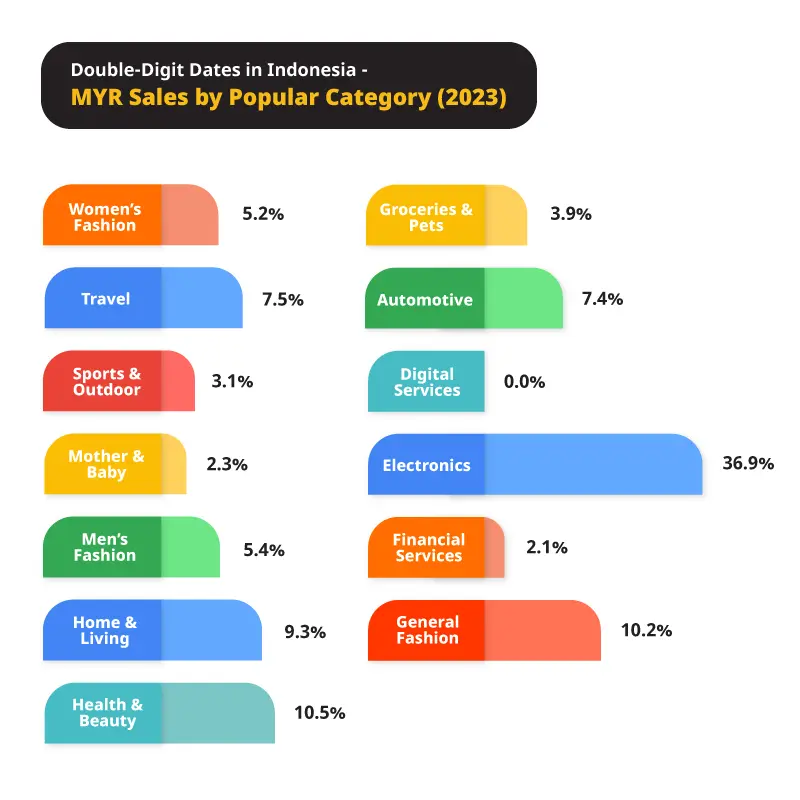

- Electronics drove the highest sales total throughout 2023, followed by Health & Beauty and Home & Living.

- Between 2022 and 2023, there were significant increases in total sales in Financial Services (3,313% increase), Travel (541% increase), General Fashion (217% increase), and Groceries & Pets (133% increase) at popular e-commerce platforms

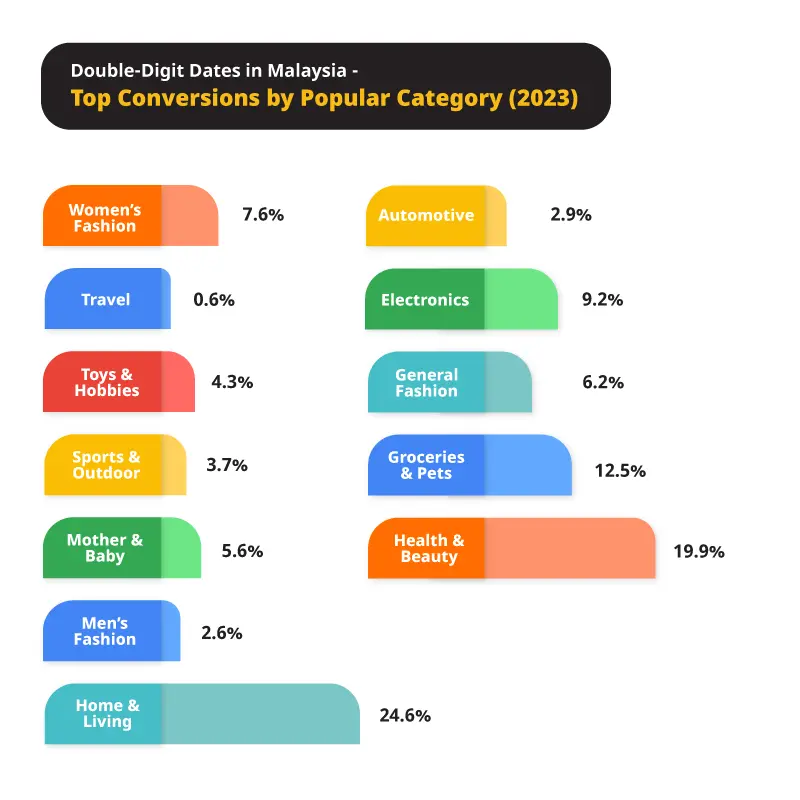

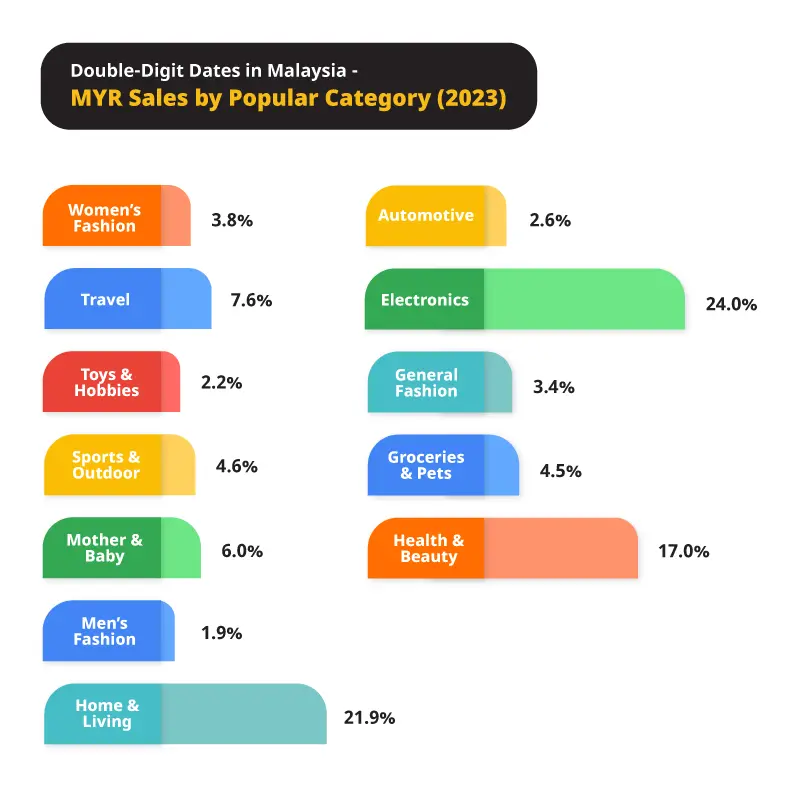

- Malaysian customers preferred to purchase online in the Home & Living, Health & Beauty, and Groceries & Pets verticals through the recommended products that Involve Partners suggested.

- The growth of total conversions between 2022 and 2023 gradually increased for General Fashion (384% increase), Electronics (85% increase), and Sports & Outdoor (61% increase).

- Electronics, Home & Living, and Health & Beauty contributed the highest sales total among other online verticals.

- Compared with 2022, Involve Partners promoted more products to their online followers, from General Fashion (86% increase) and Sports & Outdoor (77% increase), which drove a higher total of sales.

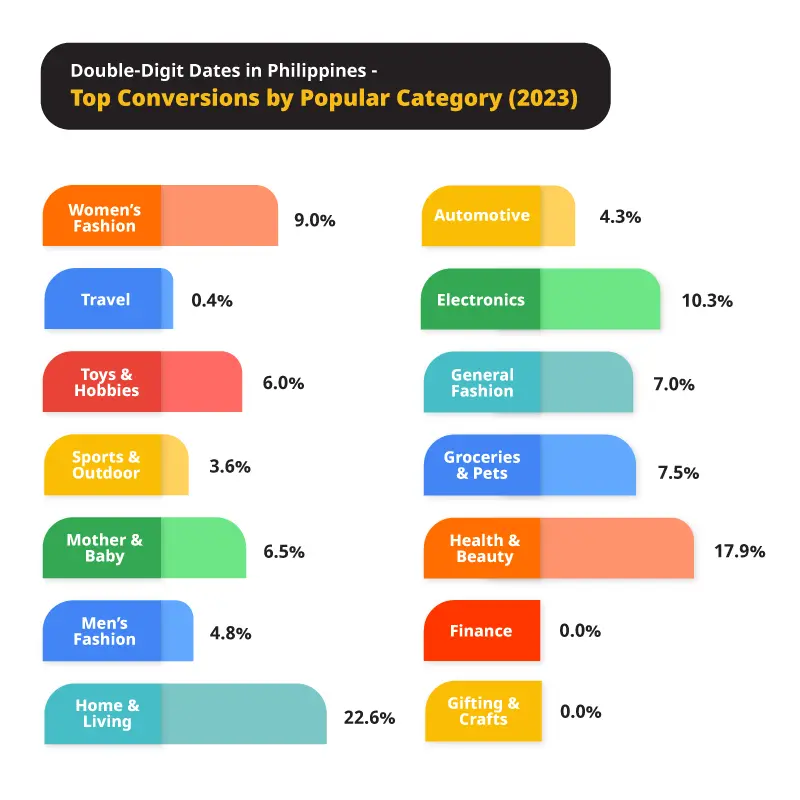

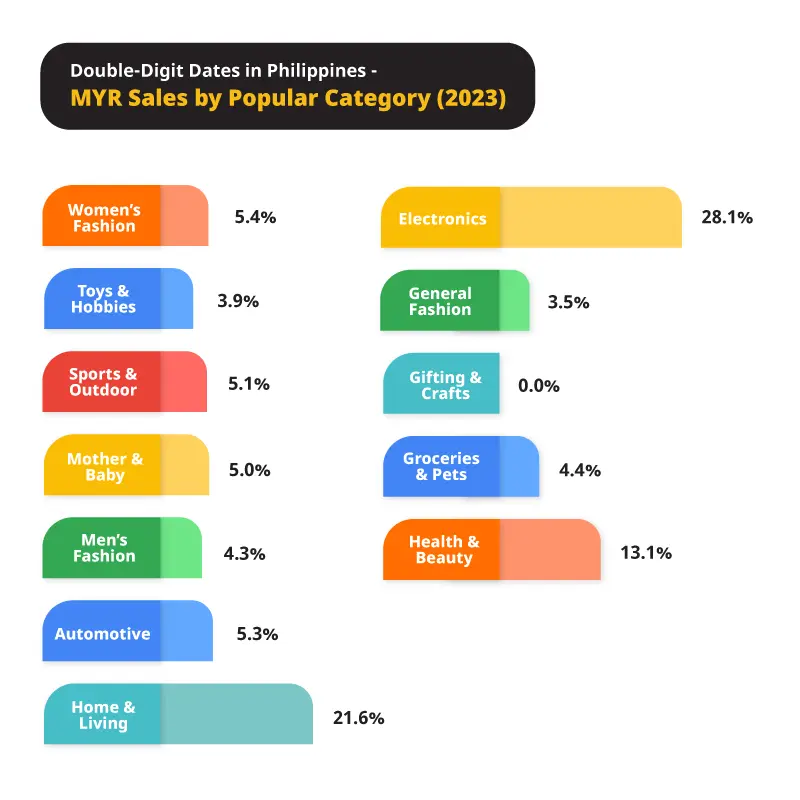

- In 2023, similar to 2022, Filipino customers purchased products online in the Home & Living, Health & Beauty, and Electronics verticals.

- Customers started applying for financial products & services with local brands, with a 92% increase in total conversions.

- Involve Partners’ promotions for Electronics, Home & Living, and Health & Beauty verticals led to the highest total of sales among others in the e-commerce platforms.

- Home & Living, Health & Beauty, and Electronics were the most popular verticals customers purchased online through Involve Partners’ promotions with affiliate links.

- Automotive (144% increase), Sports & Outdoor (140% increase), General Fashion (134% increase), Men’s Fashion (118% increase), Groceries & Pets (101% increase) had significantly grown in total conversions.

- Home & Living, Electronics, and Health & Beauty earned the highest sales among verticals on e-commerce platforms.

- From 2022 to 2023, the total sales massively increased in the Men’s Fashion (113% increase), Sports & Outdoor (108% increase), Automotive (76% increase), General Fashion (64% increase), Groceries & Pets (65% increase) verticals.

Popular Categories WIthout Double-Digit Sales

Total Conversions

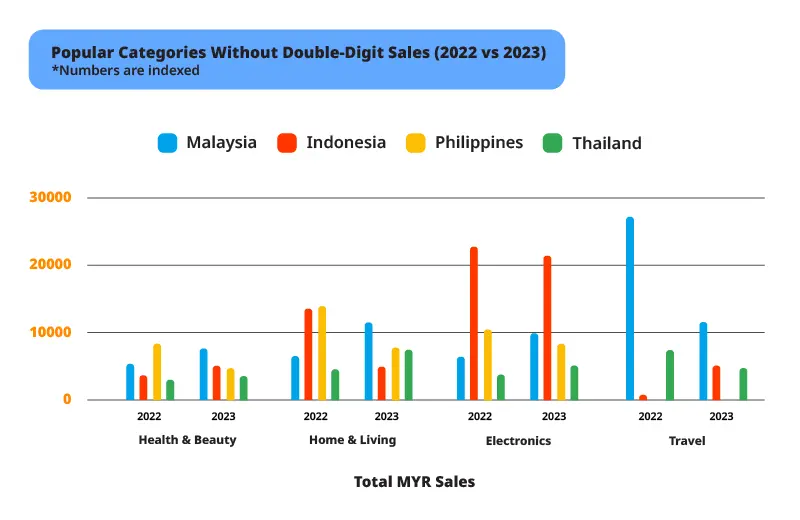

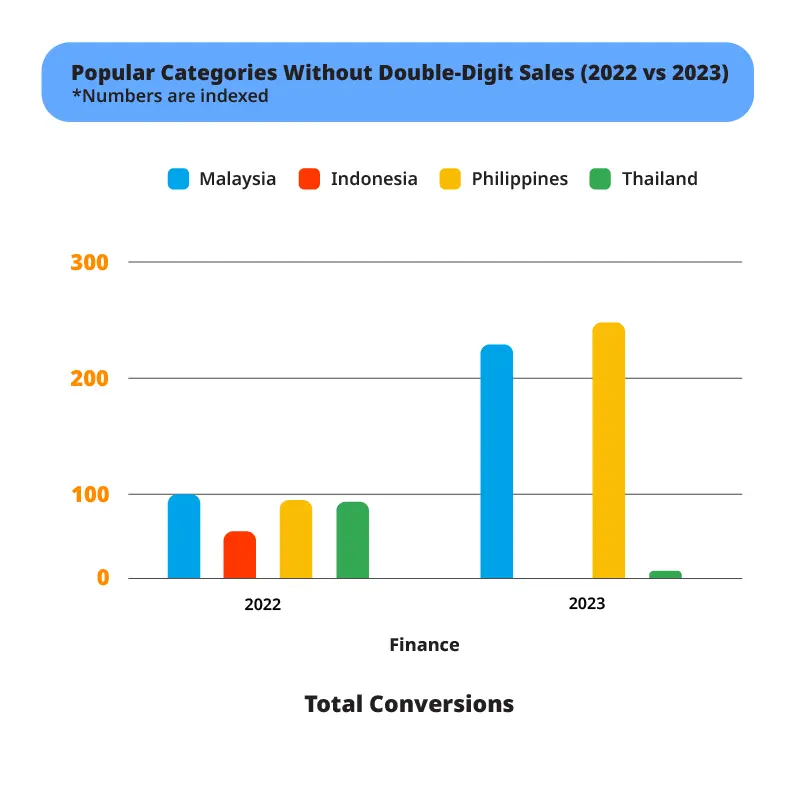

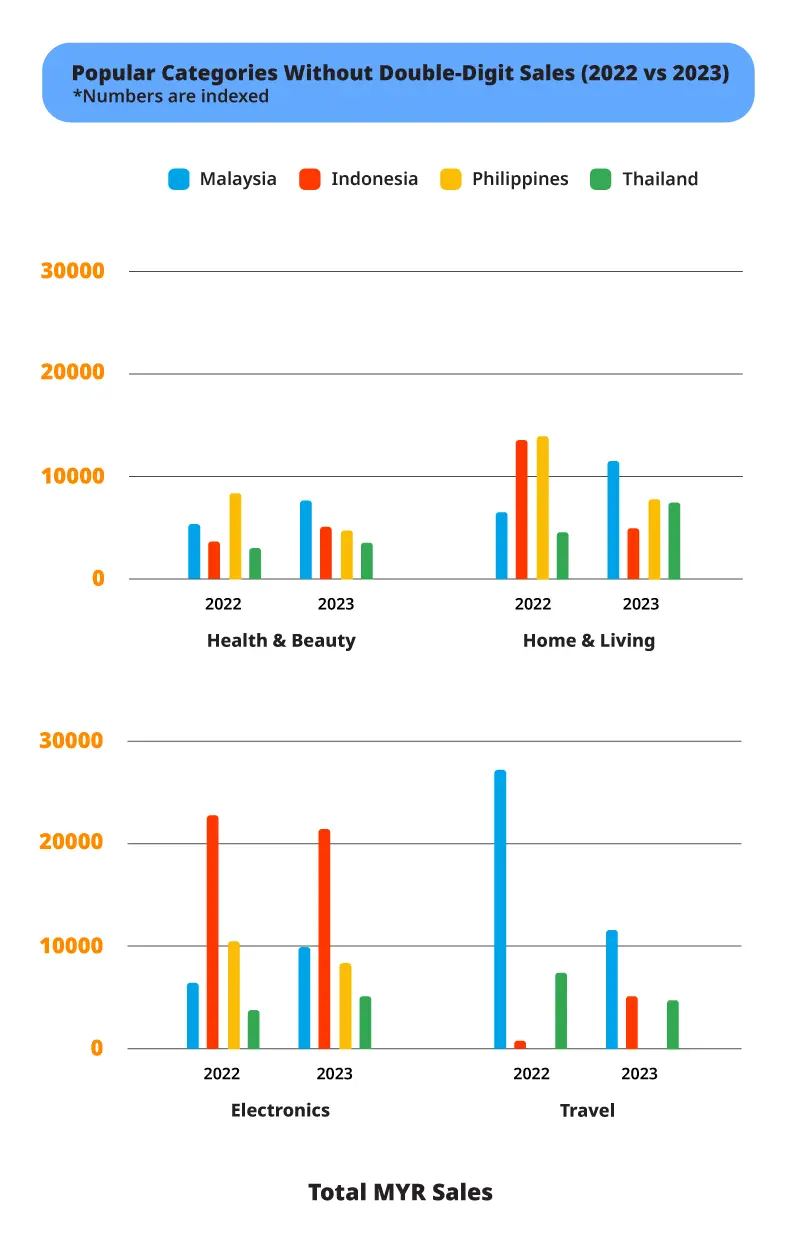

In 2023, Health & Beauty emerged as one of the top-selling categories with highest conversions while total conversions for Electronics had grown significantly across Southeast Asia.

Meanwhile, total conversions for Home & Living increased in Malaysia, Indonesia and Thailand.

Involve Partners focused on promoting products related to various aspects of lifestyle and creating memorable experiences with loved ones, leading to increased engagement with their online followers.

This trend highlighted a deliberate change in promotional strategies, likely influenced by evolving consumer preferences and market dynamics within these specific product categories.

In the Philippines, total conversions fell slightly between 2022 and 2023 due to economic uncertainties, especially the rise of inflation.

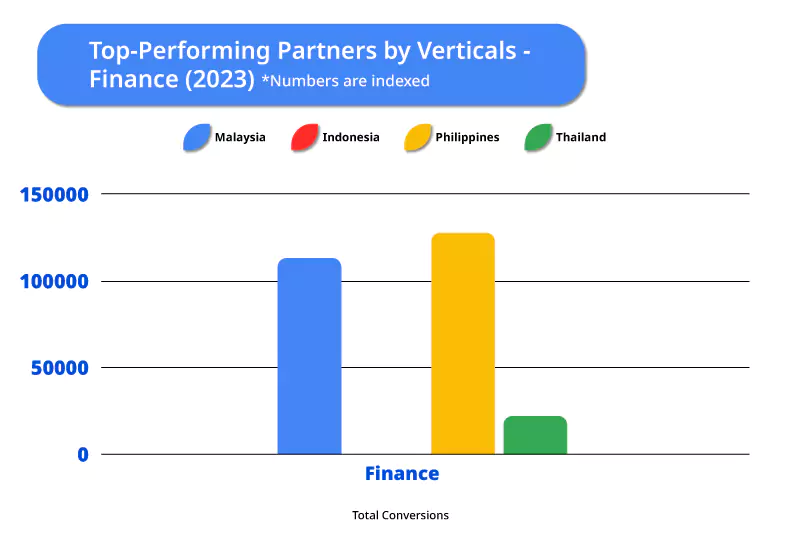

Philippines (166% increase) and Malaysia (139% increase) had the highest total conversions for promoting Finance, since the addition of new products and services at Involve and encouraged Partners to recommend alongside existing brands to their online followers.

In 2023, Partners noticed a trend where most customers were looking for effective and affordable products to manage their savings.

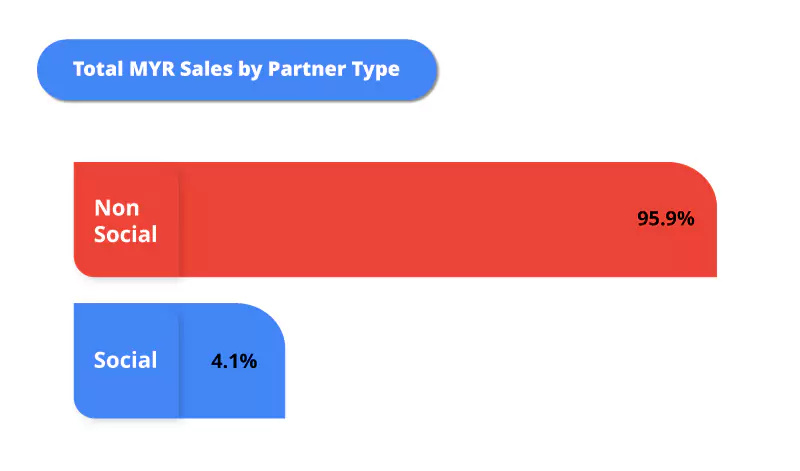

Total MYR Sales

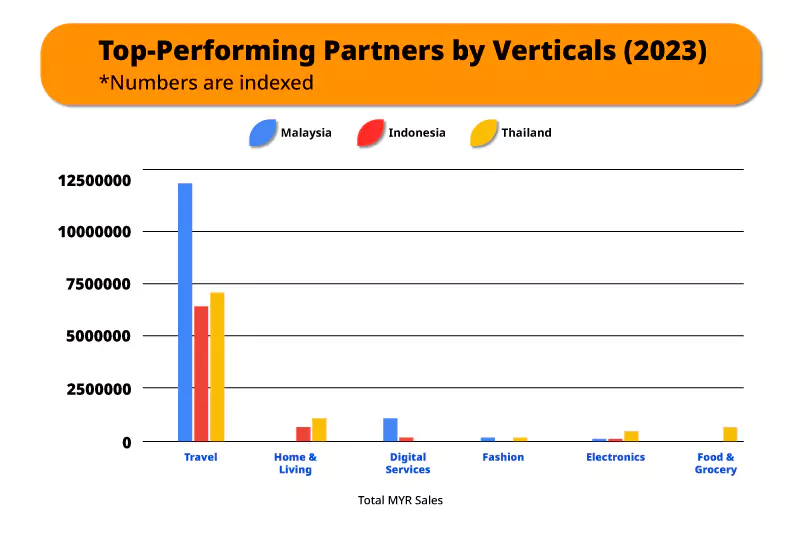

Although Travel is one of the top categories with the highest sales in Malaysia, the growth dropped by 57% due to the increased rates on flights and accommodations. However, customers in Indonesia had interest in domestic and international travels, leading to a 593% increase.

Between 2022 and 2023, Indonesia continued to purchase in the Electronics category online while there was increased growth in total sales for significant market interest and engagement with Electronics in Malaysia and Thailand.

Also, Partners based in and had traffic in Malaysia (53% increase) and Thailand (over 54% increase) drove growth in sales for Health & Beauty and Home & Living.

The increased growth was impacted by targeted promotions with top-selling products based on customers’ preferences which were pushed by Partners on various platforms.

Health & Beauty in Indonesia garnered a 37% increase for total sales due to active participation by global media buyers.

Marketing Campaign Analysis

The following campaigns by Involve ran to drive Partners’ participation, increase brand awareness, and increase the number of engagements.

Furthermore, these campaigns aimed to drive brand recall and loyalty among Partners who rely on Involve as a credible affiliate network.

Eligible Partners received additional bonuses based on the required number of clicks, conversions, and pending/approved payouts.

Kongsikan Rezeki Campaign

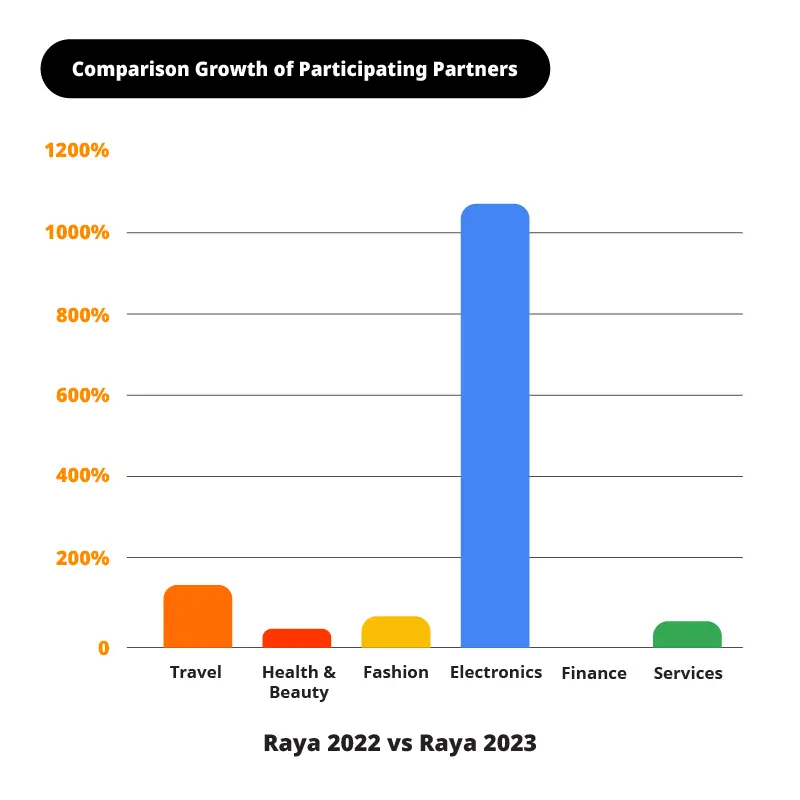

Between 4 April 2023 and 5 May 2023, Kongsi Rezeki campaign took place in Malaysia and Indonesia to celebrate Ramadan and Raya festival.

The Top 10 Partners from each country who earn a minimum payout will be eligible for additional bonuses.

Compared to the 2022 benchmark, Kongsi Rezeki campaign garnered a massive increase in both countries for total unique Partners who promoted and earned conversions.

Country | % Change |

Malaysia | +123% |

Indonesia | +36% |

These Partners primarily promoted household items and mobile gadgets under the Electronics vertical with a massive 1,078% increase, followed by Travel with a 127% increase.

In Malaysia, Involve Partners promoted more participating brands, which drove a 99% increase in total conversions and a 162% increase in total sales.

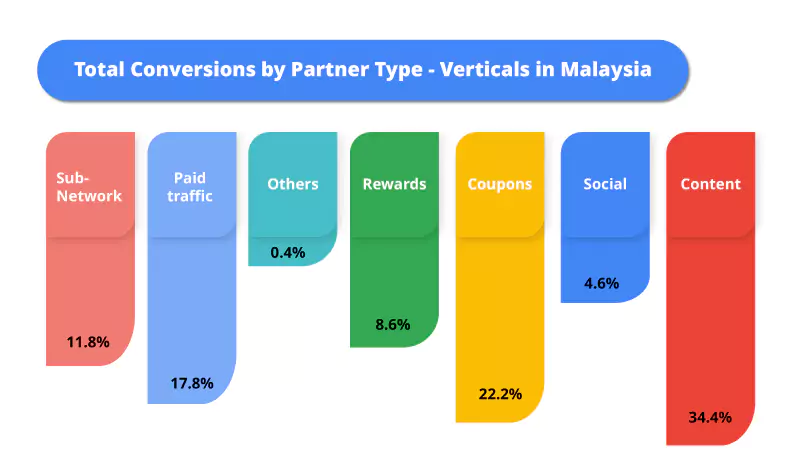

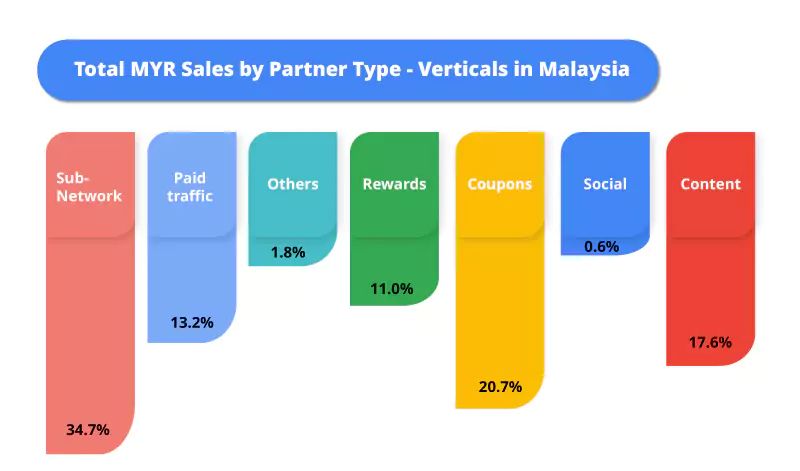

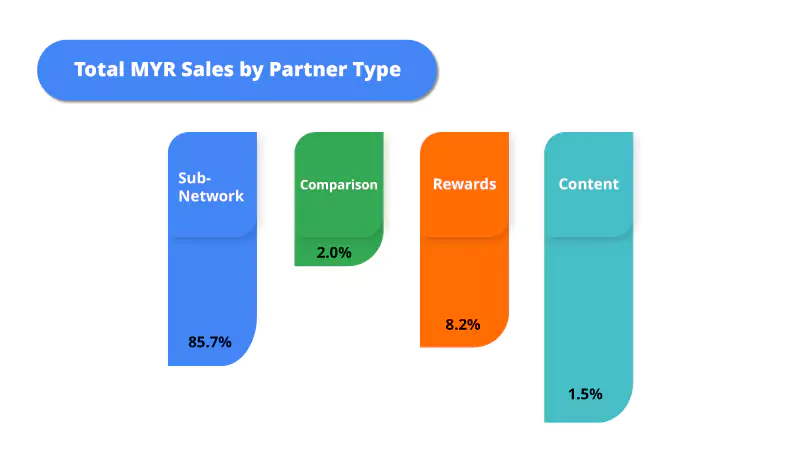

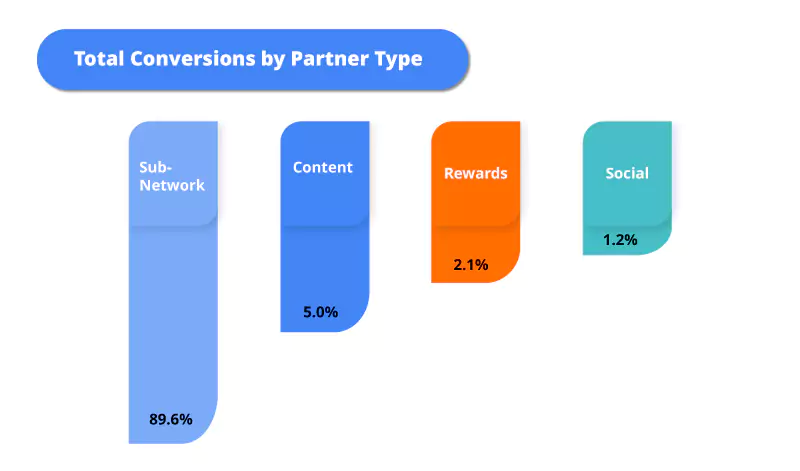

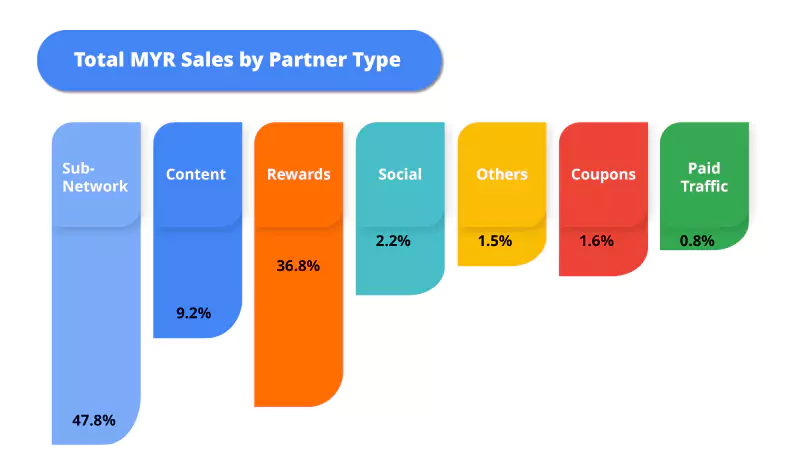

- Coupons drove equal contribution for total conversions and sales through promotions with exclusive discounts shared with online followers in Malaysia.

- Although Sub-Networks earned fewer conversions, they strategically promoted specific deals and products on their creative ads across platforms.

- Content had the highest total conversions among Partner Types but brought lesser sales for participating brands.

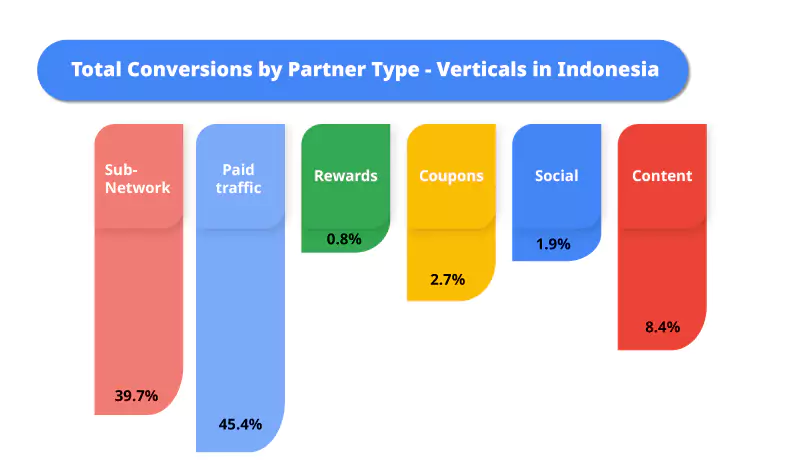

Most Partners running Sub-Network and Paid Traffic were based outside of Indonesia and promoted Ramadan and Raya deals to their target audience.

Involve Travel Fair

Involve Travel Fair was targeted to Involve Partners based in Indonesia and had traffic in that country, encouraging them to join the domestic and international travel brands’ affiliate programs and promote them to their online followers.

The campaign took place from 13 June 2023 to 21 July 2023 to build extra brand exposure during the school holiday season and activate churn Involve Partners through travel deals.

Selected Involve Partners by Silver Tier and Gold & Above Tier received additional bonuses based on payouts received from unique clicks and conversions.

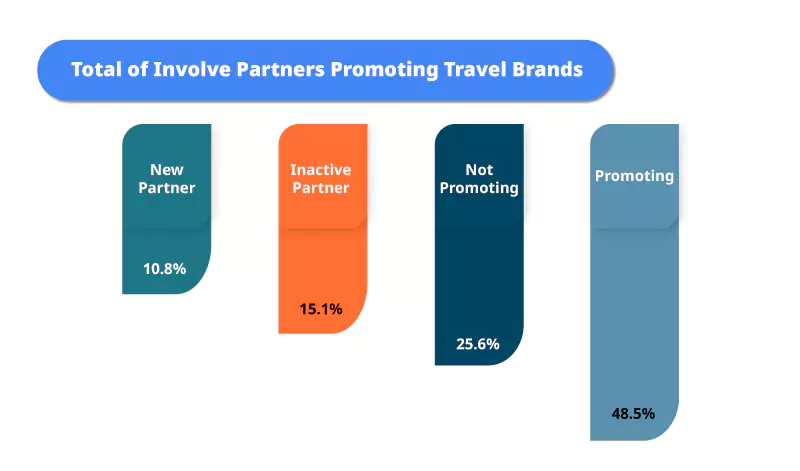

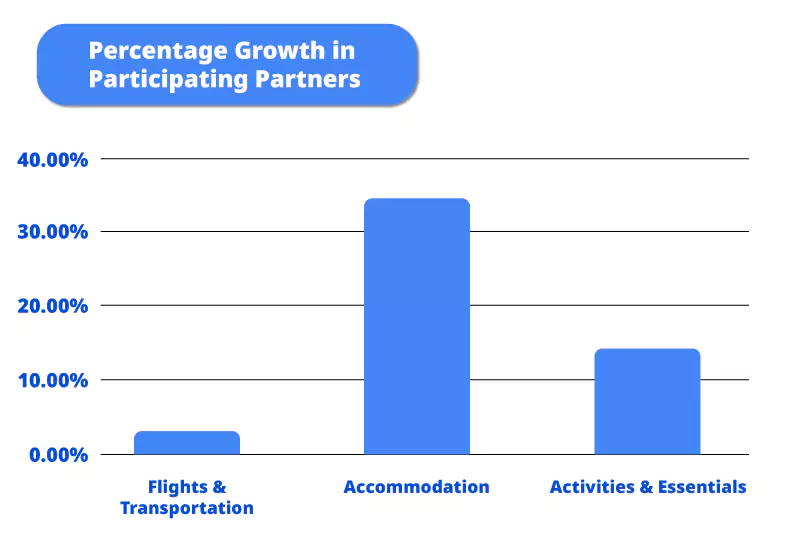

Compared with the benchmark period in 2022, there was a 78% increase in Partner participation in promoting travel brands, mainly contributed by booking accommodations and activities.

Involve Partners promoted travel brands before the Involve Travel Fair kicked off, driving higher performance, followed by those who had yet to promote travel brands and inactive Partners.

Read more about the performance of Involve Travel Fair in our detailed case study.

Involve Bonus Merdeka

In conjunction with Independence Day in Malaysia and Indonesia, we ran the Involve Bonus Merdeka campaign from 14 August 2023 to 16 September 2023.

The Top 50 Partners had traffic in Malaysia and Indonesia and, with approved payout, received bonuses by promoting participating brands on their platforms.

Partners were encouraged to participate in the social media contest and stand a chance to win exclusive prizes.

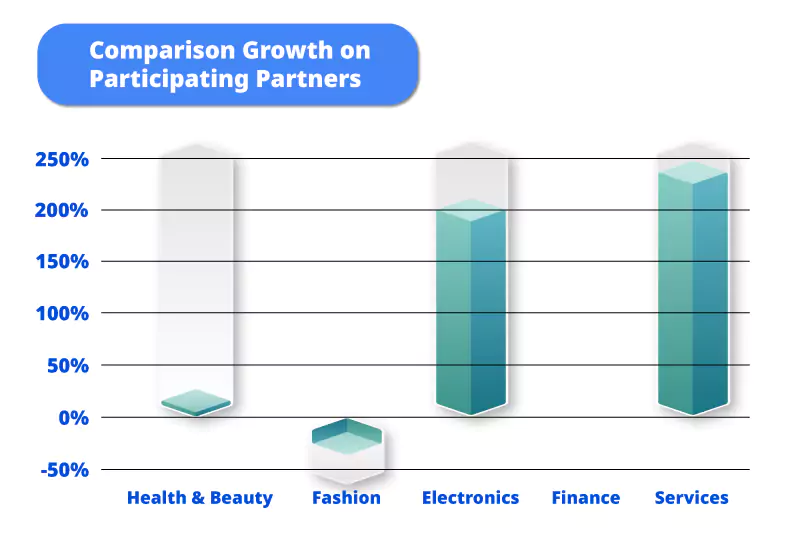

The Involve Bonus Merdeka campaign contributed to massive growth in total conversions and total sales in Malaysia and Indonesia due to consistent engagement with Partners’ promotions by verticals and extensive internal communications for participating brands.

- Total Participating Partners actively promoted Services (246% increase) and Electronics (200%) increase to their online followers.

- They highlighted recommended household items, mobile gadgets, gaming items, Wi-Fi subscriptions, and car accessories.

- Most Sub-Networks were based in Malaysia, and those outside Malaysia and Indonesia targeted personalised ads to various audiences, leading to the highest total conversions and sales.

- Rewards drove the second highest in total conversions and sales due to attractive discounts and cashback shared with their followers.

Passport to Paradise

The “Passport to Paradise” campaign ran from 2 October 2023 to 30 November 2023 to meet the trend of arranging travel plans for the year-end and festive holidays.

Involve Asia provided sponsored travel brands with dedicated marketing collateral to increase brand exposure and attract more Partners to participate in the campaign.

New and Existing Partners received bonus rewards by tier based on pending payouts and successful bookings of participating travel brands.

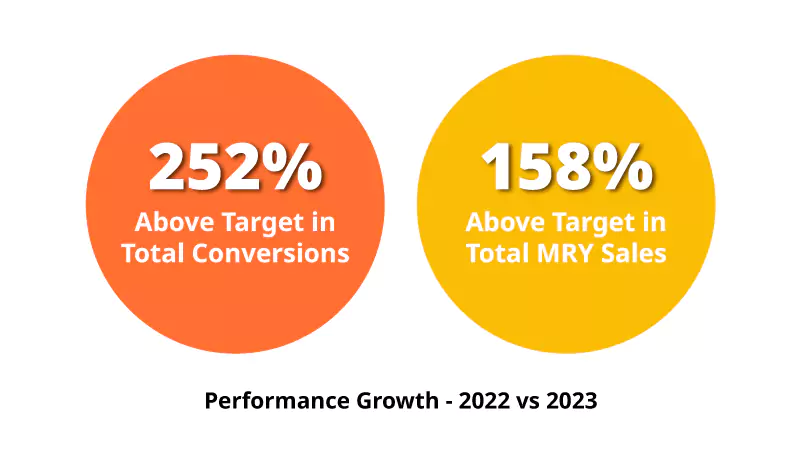

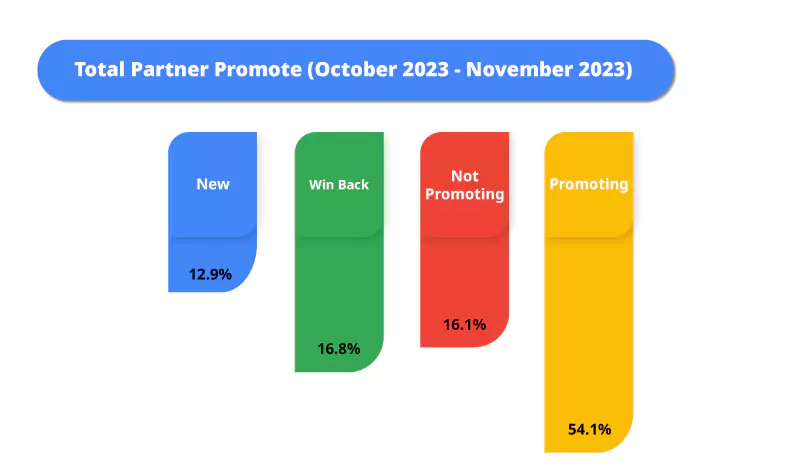

This campaign drove a 109% increase in the number of Partners earning conversions from promoting participating travel brands, with those who had promoted travel brands before the campaign winning back inactive Partners that contributed the most conversions.

Involve Partners promoted more accommodations, activities, and essentials to their followers, which led to a total increase of 49%.

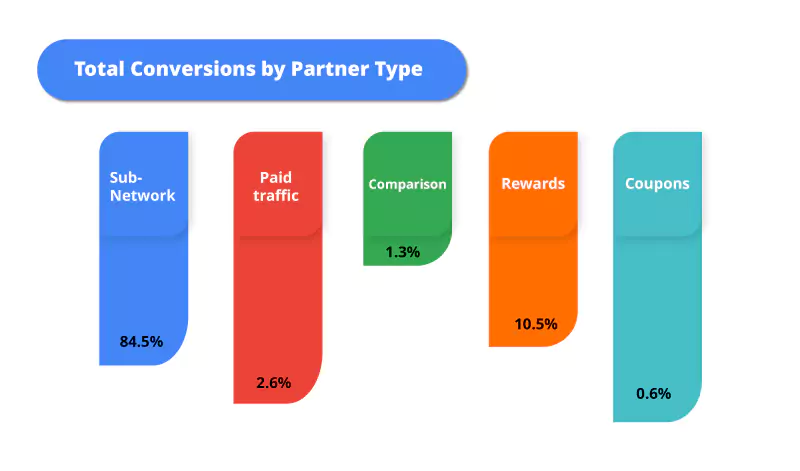

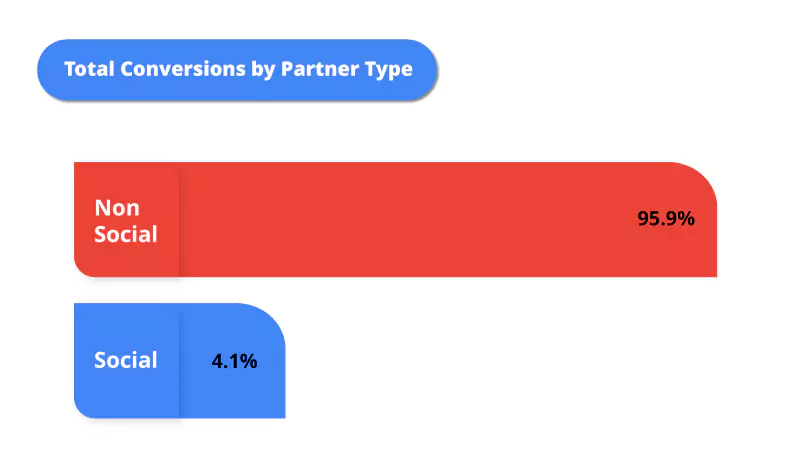

96% of Involve Partners promoting were Non-Social who contributed the highest conversions and sales, mainly by Paid Traffic and Sub-Network who ran targeted display ads across various platforms in regions.

Find out more details about the “Passport to Paradise” campaign, including the sponsored brands’ performance, in our case study.

Big Bang Sales

Involve Asia end 2023 with its year-end campaign, Big Bang Sales, which ran from 7 November 2023 to 31 December 2023 by giving bonus rewards to eligible Partners promoting participating brands from various verticals.

Involve Asia selected Partners based on the highest total number of Coins collected through successful payouts for promoting participating brands on their platforms.

Involve Asia provided sponsored brands with marketing collateral (based on selected tier package, worth up to USD 600) to build wider exposure and encourage Partners to participate in promoting their products and services.

Compared to other internal campaigns, Big Bang Sales drove the highest growth in the increase of conversions and sales across Southeast Asia. Partners with traffic in Southeast Asia were based in other countries such as India and Eastern Europe.

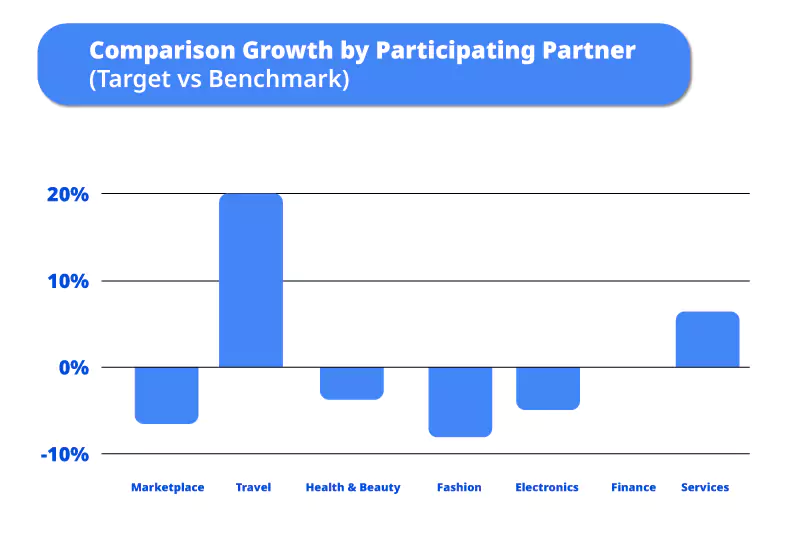

Partners promoted more Travel (20% increase) and Services (6% increase) verticals due to their target audience preferences. This also could be attributed to some Partners who have traffic in specific countries based on the brands’ target audiences.

- Sub-networks contributed the highest total conversions and sales due to the allocated target ads to various audiences. Most of the sub-networks were based in other countries with traffic in Southeast Asia.

- Although Rewards earned fewer conversions, these Partners were able to drive the second-highest sales for participating brands due to consistency in engaging their new & existing followers with attractive deals, including discount codes and cashback.

- Content provided engaging information related to the brands’ promotions with concise, unique selling points, promo codes, and creatives that drive their readers to make purchases on brands’ e-commerce sites, leading to an increase in sales during the year-end of 2023.

Learn more about how Involve Asia ran the “Big Bang Sales” campaign in our detailed case study.

Top-Performing Partners

Top-Performing Partners By Vertical

Total Conversions

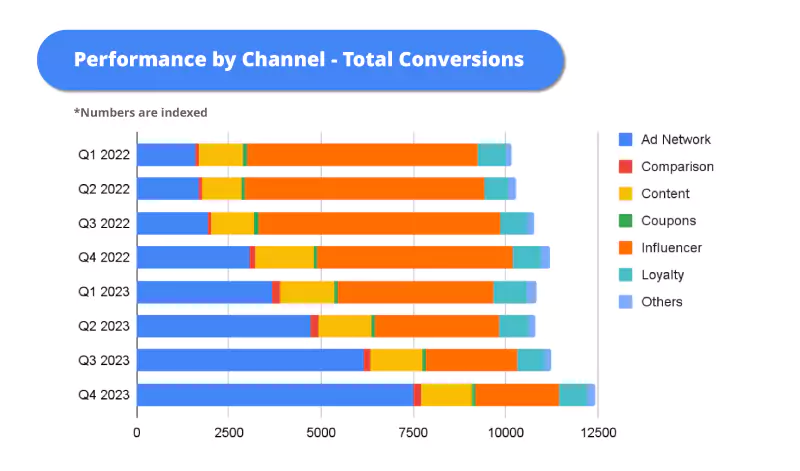

- Q1: In 2023, Influencers recorded the highest performance in generating conversions by promoting affiliate links to followers. Ad Network has a massive growth of 131% increase compared to the year 2022, followed by Content with a 21% increase.

- Q2: In 2023, Influencer and Ad Networks had proven an increase in conversions compared to Q1. Influencers continued contributing the highest total conversions by promoting the brands’ deals with their affiliate links on their platforms. Compared to 2022, Ad Network (181% increase) and Content (34% increase) had significant growth in 2023.

- Q3: In 2023, Ad Network recorded the highest performance with a 220% increase in generating conversions by promoting various creative ads with affiliate links, followed by Influencer and Content growth compared to 2022. These three Channels were steadily performing in terms of generating conversions despite their ups and downs.

- Q4: In 2023, Ad Network was still the top-performing channel in generating conversions, with a 147% increase compared with 2022. The conversion rate was high for the Ad Network channel despite the slow promotions approach by most Channel Partners during the year-end. Influencers and Content Creators were a few of the Channels contributing more conversions, among others.

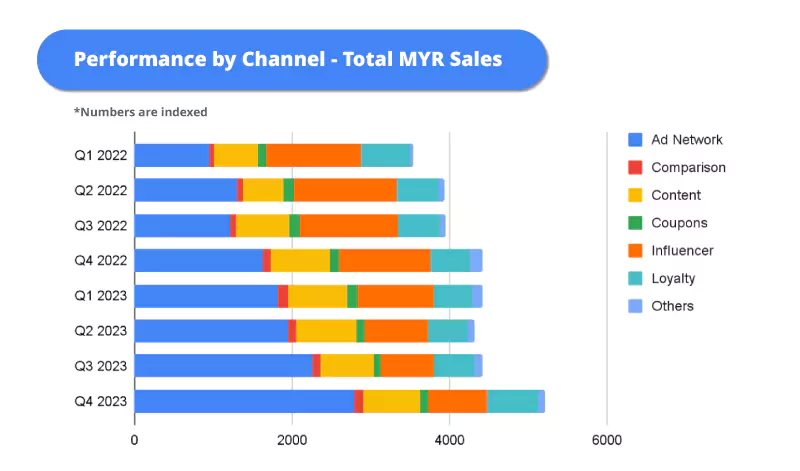

Total MYR Sales

- Q1: In 2023, Ad Network recorded the highest performance by a 92% increase in generating sales compared to 2022. Influencer and Content were among the top-performing channels that drove sales in 2023.

- Q2: In 2023, Ad Network recorded the highest performance with a 50% increase in contributing sales, followed by Influencer and Content, compared to 2022. Overall, Ad Network showed an outstanding performance by beating the numbers of Q1 growth compared to Influencer and Content.

- Q3: Compared between 2022 and 2023, Ad Network contributed the most sales with an 87% increase in growth, followed by Content and Influencer. Ad Network remained the leading channel in generating the most sales compared to the two other channels.

- Q4: Ad Network recorded the highest performance by a 71% increase in total sales from 2022 to 2023, followed by Influencer and Content. Influencer and Content showed a slight decrease in generating sales in Q4 since there were fewer promotional pushes during the last few months of the year 2023.

Top-Performing Partners By Vertical

Total Conversions

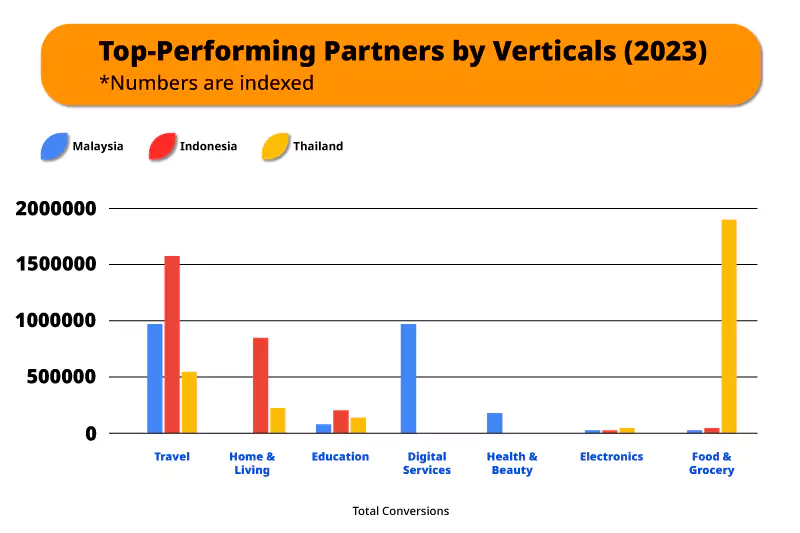

In 2023, Top-Performing Involve Partners in Indonesia were more enthusiastic in promoting Travel, Home & Living, and Education, leading to increased growths in conversions as most customers made purchases for their trips to favorite destinations, fulfilling their essential needs, and improving their skills by taking online courses.

Partners in Malaysia and those who had traffic in Malaysia drove higher conversions for Travel and Digital Services brands due to trending demand for lifestyle products through the use of technology, such as making travel bookings seamlessly, learning new skills online, and upgrading essentials for websites, gaming & home networks for work and home.

In Thailand, Food & Grocery, Travel and Home & Living were the leading categories with the highest conversions attributed to the Top-Performing Involve Partners, driven by prevailing trends and followers’ preferences on online purchases at affordable prices.

There were substantial surges in conversions for Finance in Malaysia and Philippines as most Partners actively promoted financial products & services as most online followers sought solutions to manage their finances.

Total Sales

Partners with interest for Travel contributed the highest sales in Malaysia, Indonesia and Thailand due to consistent engagement with online followers through video content featuring tactical and evergreen promotions with recommended flights, accommodations and activities.

There was a significant growth of 40% between 2022 and 2023 for Digital Services due to increased registrations for WiFi services and purchases for mobile gaming.

Global Partners and Partners based in Indonesia promoted Home & Living & Electronics products based on their online followers’ interests across various age groups, such as families, couples, and singles.

Sales grew with a 61% increase, including Home & Living, Electronics and Food & Grocery, compared to the rest of the categories, as there were fewer promotions made across platforms.

Type of Content by Top-Performing Partners

Year | Country | Type of Channel | Category |

| 2022 | Indonesia | Rewards | Marketplace, Fashion, Home & Living |

Malaysia | Social | Marketplace, Finance, Travel | |

Philippines | Social | Marketplace | |

Thailand | Rewards | Marketplace, Food & Grocery, Travel | |

| 2023 | Indonesia | Rewards | Marketplace, Home & Living, Fashion |

Malaysia | Social | Fashion, Digital Services, Health & Beauty | |

Philippines | Social | Marketplace | |

| Thailand | Rewards | Marketplace, Travel, Electronics |

- Marketplace, Travel, Fashion, and Home & Living remain the focus for Involve Partners (Social and Rewards) across Southeast Asia. The fact that there was a slight variation between 2022 and 2023 suggested a sustained interest and success in these verticals.

- Using Instagram, Facebook, TikTok, and websites as mediums for product reviews and promotions indicates that these platforms are effective channels for engaging with followers. Consistent use across both years suggested a successful strategy in building growth in revenue and engagement with their followers.

Target Audience

The below findings were broken down to how these categories relate to the target audience based on the Top-Performing Partners’ promotions:

Category | Target Audience | Promotion Type |

Marketplace | Interested in a wide range of products and services across verticals available in online marketplaces. | Partners promoted specific products & deals to their targeted audience. |

Travel | Interested in travel, vacation planning, and related services. | Partners promoted travel-related products and services such as flight bookings, hotel accommodations, travel accessories, and tour packages. |

Fashion | Fashion enthusiasts, shoppers, and individuals interested in the latest trends and styles. | Partners were most likely to promote clothing, accessories, footwear, and fashion-related items from specific brands or retailers. |

| Home & Living | Homeowners, interior design enthusiasts, and individuals interested in home decor and lifestyle products. | Partners promoted furniture, home decor items, kitchen appliances, and other products related to home and living. |

As Partners’ interest in promoting various verticals globally, especially in Southeast Asian markets, significantly shifted, Brands can consider taking action with the following solutions:

- Run attractive campaigns (for Partners) with higher commissions or bonus payouts based on the continued demand for lifestyle essentials like Travel, Home & Living and Health & Beauty.

- Provide a wide range of products for Partners that resonate with the followers’ preferences.

- Identify Partners’ capabilities (such as Ad Network, Social, Content and Rewards) in promoting campaigns that align with Brands’ objectives

- Initiate long-term collaborations with Partners based on research on Partners’ promotions and consumer demands & behaviour

- Track and monitor campaign performance to optimise ongoing and future campaigns with attractive rewards and promotional resources

Interested in building your growth with Involve in affiliate marketing? Contact your Account Manager to start your next steps for future campaigns.