The COVID Pandemic accelerated the demand for digital banking products such as credit card applications.

RinggitPlus noticed 2 things:

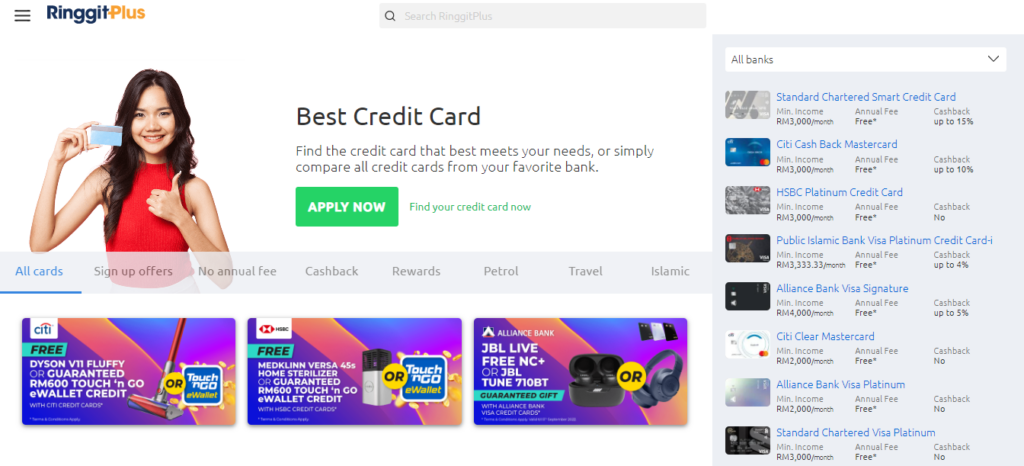

- Most online shoppers are looking for different credit card benefits for their shopping spree.

- People often refer to the opinions of personal finance content creators to help them pick a credit card.

RinggitPlus upgraded its affiliate program to lead generation so it can allocate the budget strategically and convert those leads into potential customers making purchases.

This case study will show how RinggitPlus increased its credit card applications by a whopping 96x within 12 months with a strategic affiliate Partnership with Involve Asia.

The Secret: Switching Affiliate Commission Payout

Previously, RinggitPlus ran on a Cost-Per-Action (CPA) affiliate commissions structure. Partners will only get paid when the bank approves the customer’s credit card applications.

Despite the high commission payout of RM140+ for each successful credit card application, the banks rejected most applicants and took a longer time to approve their applications. So affiliate Partners find the Offer unattractive.

RinggitPlus’s Account Manager at Involve recommended making their commission structure more attractive by changing it to Cost-Per-Lead (CPL).

Affiliate Partners are now paid RM14 for each application sign-up, regardless if their credit card application is approved or not.

Both RinggitPlus & Involve Partners benefited from this new change:

| Benefit to Advertiser | Benefit to Involve Partners |

| They pay lower commissions per conversion. | Higher conversion rate to earn affiliate income. |

| They get more potential lead sign-ups. |

Making the Offer Attractive to Consumers

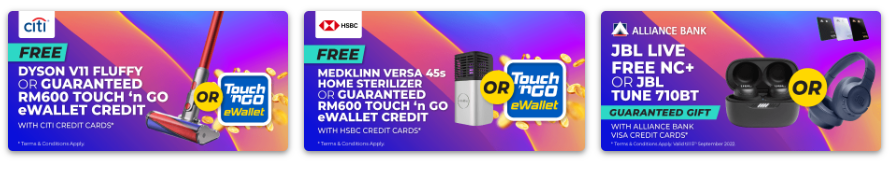

Highly desirable gifts (iPads, wireless headphones & speakers) for successful credit card applications make it irresistible for the customers.

On the other hand, RinggitPlus provides upsized commissions when applicants (earn more than RM3,000 a month) apply through Partners’ affiliate links to increase the quality of credit card applications.

This helps Partners to fine-tune their marketing within their audience.

Content Creators Working Their Magic

(Source: KiaEatPlay & DiscoverJB Facebook Posts)

Influential content creators created bite-sized content educating their audience about the credit cards listed on RinggitPlus website.

They shared their experiences and credit card benefits of online shopping.

Comparison websites also picked up RinggitPlus credit card applications & potential customers can compare each credit card’s pros & cons to suit their individual needs.

The Result: 96x Increase in Credit Card Applications

The significant changes made to the RinggitPlus affiliate program brought immense growth, especially the credit card application sign-ups:

Within 12 months, Involve Partners’ promotions drove a whopping 96x increase in credit card applications on Advertiser’s website.

RinggitPlus commission payout to Partners increased 40x, which built strong trust & partnerships between the Partner community.

Partners received 3x more earnings through Advertiser’s Cost-Per-Lead (CPL) commission structure for successful credit card sign-ups without required bank application approvals.

Boost Your Online Conversions with Involve

Want similar extensive growth in sales?

Register as an Advertiser with Involve Asia & a dedicated Manager will be in touch with you to set your business in affiliate marketing.

Sign up below: